7th block: new Note issuer – Baltic Terra

As we conclude our blockbuilding series, we are ending it with great news for our investors.

We are expanding the Debitum platform with a new financing partner and note issuer – Baltic Terra. It is a new diversification opportunity based on a real asset: agricultural land. This addition strengthens Debitum goal to connect investors with real-economy assets that generate long-term and sustainable returns.

What is Baltic Terra?

Baltic Terra is an agricultural land investment fund focused on Latvian farmland, one of the most undervalued agricultural land markets in the European Union.The fund acquires agricultural land, improves its productivity and structure, and manages it professionally to generate income and long-term appreciation.

Baltic Terra business model

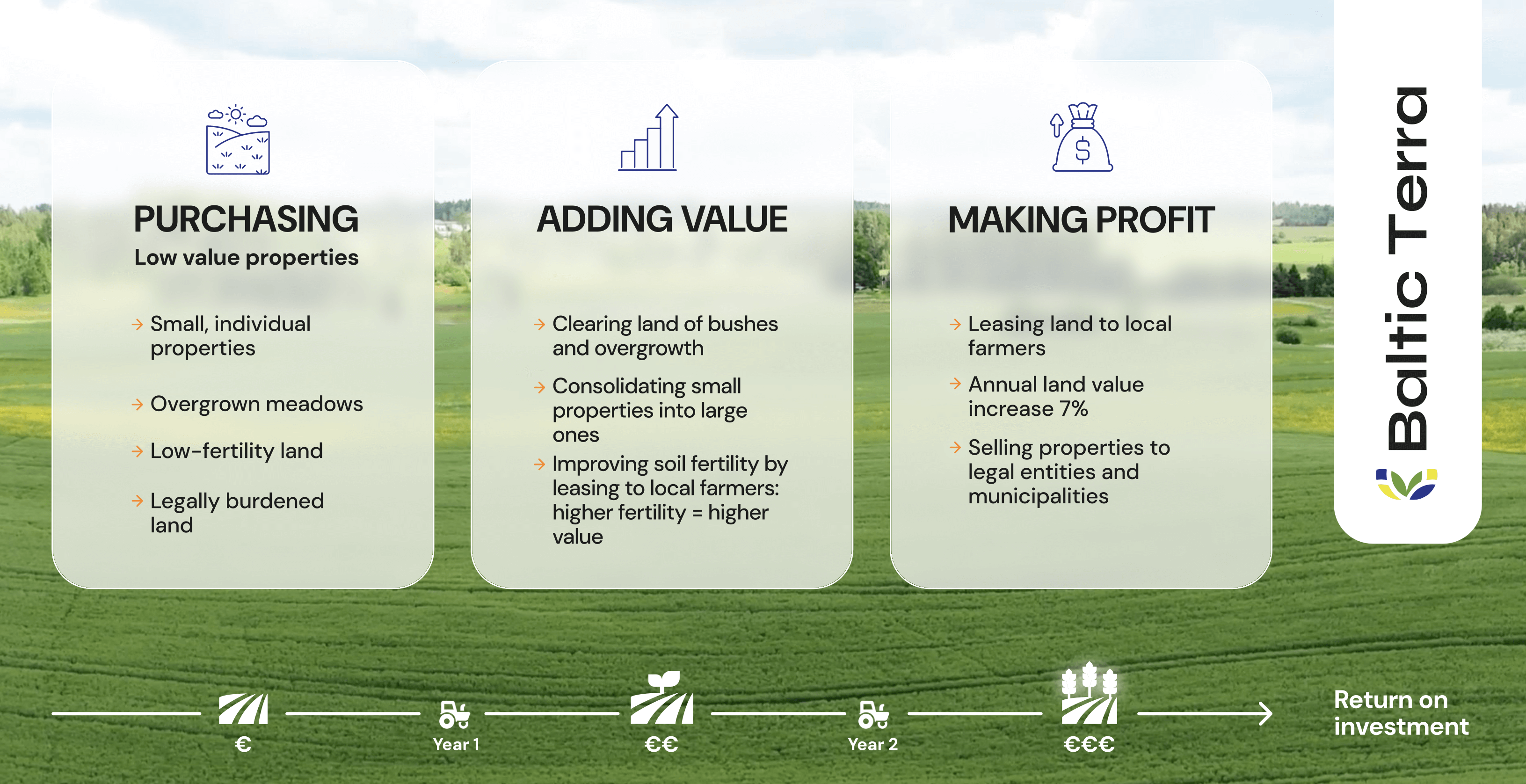

Baltic Terra operates through a clear three-stage value creation model, designed to perform consistently across market cycles.

- Acquiring undervalued land.

The fund focuses on land that is often overlooked by the market:

- small or fragmented plots;

- overgrown or underused agricultural land;

- land with legal or structural inefficiencies.

These characteristics allow Baltic Terra to acquire land below market value.

- Adding value through active management

After acquisition, the fund increases land value by:

- clearing and restoring neglected land;

- consolidating fragmented parcels into efficient agricultural blocks;

- leasing land to professional local farmers, improving soil fertility and productivity.

This step transforms neglected land into productive farmland.

- Monetisation and long-term use

Once improved, land is monetised through leasing or strategic exits,

depending on market conditions and portfolio needs.

How does Baltic Terra generate profit?

Baltic Terra generates returns through three complementary profit streams:

- Leasing land to local farmers.

Long-term lease agreements provide recurring, predictable income. - Capital appreciation of agricultural land.

Latvian farmland has historically shown steady price growth,

supported by limited supply, rising demand and EU agricultural policies. - Selling properties to legal entities and municipalities.

Improved and consolidated land parcels are selectively sold at a premium,

generating realised profits alongside recurring income.

Why is it worth investing in agricultural land?

Agricultural land is widely regarded as one of the most resilient real assets available to investors.

Key characteristics include:

- lower volatility compared to financial markets;

- natural inflation protection;

- real-world collateral;

- returns driven by food production and land scarcity.

In Latvia land prices are still significantly lower than in Western Europe. This creates meaningful long-term growth potential as the market matures.

Trust score and investor protection

Baltic Terra has been assigned a Trust Score of A,

reflecting a strong foundation for growth and investor protection.

Legal factors (B)

Baltic Terra payment obligations under the Notes are secured by Latvian law–governed commercial pledges over the company’s assets and all shares in the company. These pledges do not directly cover certain registerable assets, such as land, vehicles, livestock or ships. However, the pledge over all company assets allows enforcement against receivables, inventory, intangible assets and fixed assets that are not subject to separate registration. In addition, the pledge over all shares provides the right to enforce by selling the shares of the company if needed.

Financial factors (A+)

Although recently established, the Baltic Terra fund has demonstrated strong initial financial results,

fulfilling all payment and operational obligations.

This confirms that land acquisition, improvement and appreciation can be a sustainable

driver of returns.

Other factors (A)

The fund maintains open and transparent communication with Debitum, providing financial data,

reports and operational insights without hesitation

and is committed to the same transparency toward investors.

The team behind Baltic Terra

Baltic Terra is managed by a team with deep local expertise in land acquisition,

agriculture and real estate.

Janis Lezdins, Founder and Managing Partner, with over 15 years of experience in large-scale land and forest acquisitions.

Anete Zilvere, Strategic Partnerships Lead, managing a 200-hectare farm with more than a decade of leasing experience.

Linda Revele, Head of Operations, ensuring legal, operational and strategic execution.

The team is supported by a strong local network of farmers, landowners and institutional partners.

Watch our CEO, Anatolijs Putna, in conversation with Baltic Terra founder, Jānis Lezdiņš.

Investment targets and growth plan

Baltic Terra operates with clear, measurable long-term objectives, giving investors transparency on both scale and ambitions.

The fund’s strategy is structured around the following targets:

- capital target by 2027: €35 million;

- land acquisition goal: approximately 10 000 hectares of agricultural land.

These targets reflect Baltic Terra’s focus on building a diversified and scalable agricultural

land portfolio across Latvia,

while maintaining disciplined acquisition standards and operational efficiency.

By consolidating fragmented and underused farmland into professionally managed assets,

the fund aims to benefit from stable leasing income and long-term land value appreciation as the Latvian farmland market continues to mature.

A new diversification layer on Debitum

With Baltic Terra joining the platform, investors gain access to a land-backed assets that strengthens portfolio diversification.

This addition reinforces Debitum principle: invest in real-economy assets that create long-term value.

Baltic Terra notes are now available on Debitum platform, offering investors the opportunity

to gain exposure to agricultural land

through a structured, professionally managed fund.

Explore Baltic Terra notes here.

Read more about Baltic Terra here.

This is a marketing communication and should not be interpreted as investment research, advice, or an endorsement to invest. The historical performance of financial instruments is not indicative of future outcomes. Investing involves risks; the value of investments may fall as well as rise. Be sure to assess your knowledge, experience, financial situation, and investment goals before investing.