2nd block: introducing Debitum Loyalty program

After months of development, we are eager to launch Debitum Loyalty program – the second block in our journey to build real value for our community. This program rewards consistency and engagement, giving you more ways to earn from the same smart investing decisions you already make.

Why did we make the Loyalty program?

Our investors are the foundation of Debitum. You trust the platform, support real businesses and help our community grow.

The Loyalty program rewards our investors for their consistency, trust and commitment.

We have created a flexible system where everyone can progress – whether through investing or inviting others to join and start earning.

Two ways to reach loyalty tiers

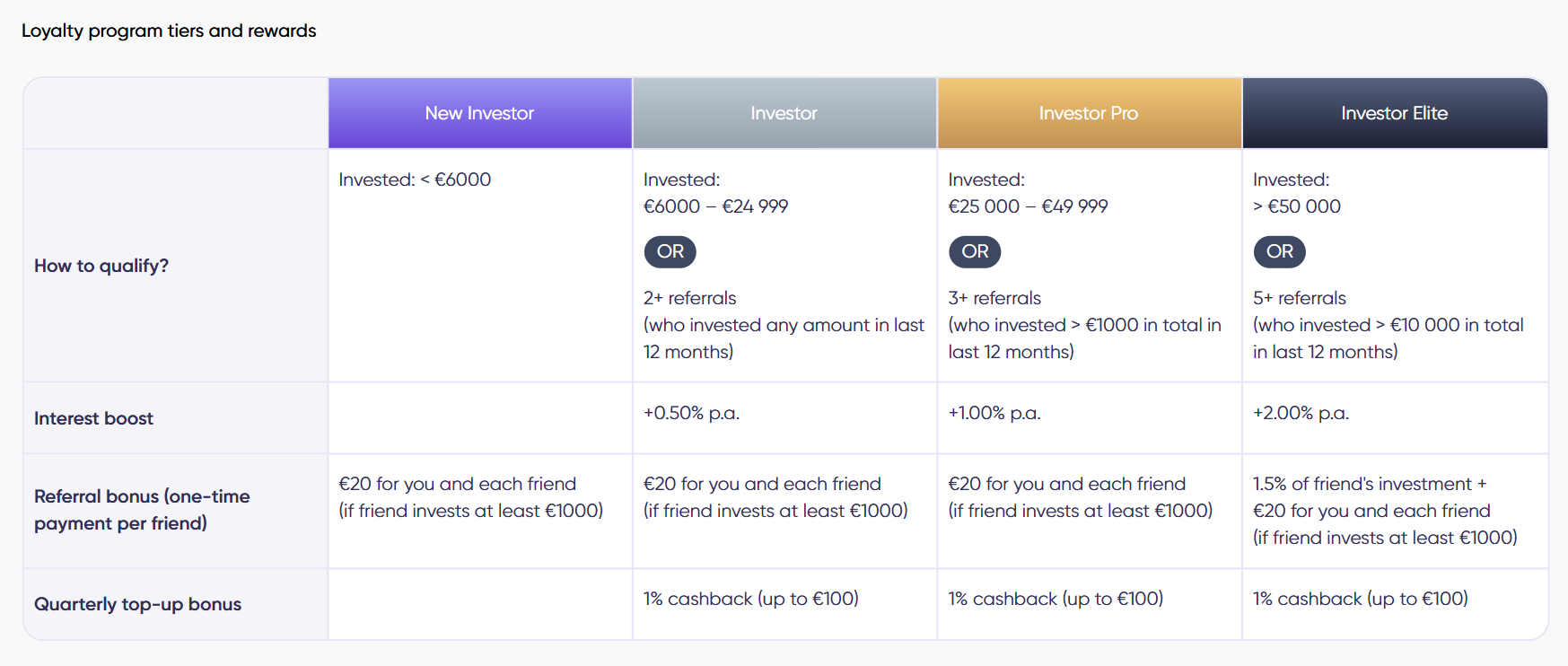

Climb to higher loyalty tiers through two paths, designed to benefit both new investors and our long-term Debitum community members.

1. Grow your portfolio. The more you invest, the closer you move to the next loyalty level and the greater your potential returns from your investments or deposits.

2. Invite friends. You can also progress through loyalty tiers by inviting friends to join Debitum. Referred friends are counted once they complete the KYC process. However, to qualify for loyalty tier progression, referred friends must also meet specific investment requirements that vary by tier (see the reward table). For example, to qualify for the Investor Pro tier, you need at least three referred friends whose combined investments reach €1000. That means all three must complete KYC, but if only two of them together invest €1000 or more, the condition is still met and you qualify.

By combining both paths – growing your own investments and inviting friends – you can unlock even more rewards, move faster through the loyalty tiers and enjoy higher returns on your portfolio.

How do rewards work?

Once you reach a specific tier, your future activity – new investments, deposits or referred friends – determines rewards.

Interest boost up to +2.00% p.a.

Earn an additional annual return on all new investments made after you reach your tier.

Referral bonus for both you and your friends.

When you refer a friend to our platform, both of you can earn a referral bonus once your friend invests at least €1000. This bonus is a one-time payment per referred friend, rewarding both of you for participating and growing the community.

Our Elite Tier members enjoy even greater benefits. In addition to the standard one-time referral bonus of €20, Elite members receive an extra one-time payment equal to 1.5% p.a. of the referred friend’s total cumulative investments made within the first 30 days after completing KYC verification.

Quarterly top-up bonus – 1% cashback (up to €100).

Every quarter investor (except New Investors) receives cashback based on new net deposits made after the tier is reached.

Examples of how investors qualify and earn rewards

To make it easier to understand how the Debitum Loyalty program works, here are a few practical examples that show how investors can reach different tiers and what rewards they receive.

These examples show how every investor – regardless of their approach – can grow within the Loyalty program, combining steady investing and community growth through referrals.

Case 1: reaching Investor tier through referrals

An investor has referred two friends but has not made any personal investments yet.

Both friends have passed KYC, and one of them invests €1200.

Result: The investor qualifies for the Investor tier.

Rewards: Both the investor and the friend who invested receive a €20 referral bonus.

Case 2: reaching Investor Pro through investment

An investor has personally invested €25 000, qualifying for the Investor Pro tier.

After qualifying, the investor makes an additional deposit and investment of €1000 during the first quarter.

Result: The investor remains in the Investor Pro tier.

Rewards: receives a +1.00% p.a. interest boost and quarterly top-up bonus on the new €1000 investment.

Case 3: combining investing and referrals

An investor invested €6000, and during the first quarter invited two friends.

Both friends invest €1000 each (a total of €2000 combined).

Additionally, the investor deposits and invests €2000 and deposits another €1000 to the platform in the same quarter.

Result: The investor qualifies for the Investor tier after making €6000 investment.

Rewards: Both the investor and the two referred friends receive €20 referral bonuses each as both invested €1000. Investor gets an interest boost of +0.50% p.a. on the new €2000 investment. Investor receives a 1% cashback top-up bonus for the €3000 deposit made in that quarter.

Case 4: maintaining your tier after repayment

An investor has reached the Investor Pro tier by investing €25 000.

During the first quarter, one loan matures and the full amount is repaid, reducing their outstanding investments to €23 000, which is below the tier threshold.

Result: The investor uses the 10-day grace period to deposit and invest €3000 and maintain the Investor Pro tier.

Rewards: Receives a +1.00% p.a. interest boost and quarterly top-up bonus on the newly invested €3000.

Track your loyalty progress easily

To make the experience even smoother, we have introduced a dedicated Loyalty progress page, where you can:

- follow your loyalty progress and see your current tier;

- monitor how close you are to reaching the next tier;

- track your friends’ activity and referral progress;

- access your referral link instantly;

- everything you need to understand your rewards and plan your next steps is now in one place.

What’s next?

The Loyalty program is just the second block in a series of updates that make Debitum more transparent, engaging and rewarding.

More blocks are already on the way, all helping you achieve stronger and more rewarding returns. But for now, go ahead and enjoy your rewards or explore more about the new program.

This is a marketing communication and should not be interpreted as investment research, advice, or an endorsement to invest. The historical performance of financial instruments is not indicative of future outcomes. Investing involves risks; the value of investments may fall as well as rise. Be sure to assess your knowledge, experience, financial situation, and investment goals before investing.