Category: Partnerships

Latvian Forest Development Fund: A New Note Issuer Coming Soon to Debitum Investments

Debitum Investments is expanding its range of investment opportunities for our investors. On February 14, 2025, we are introducing the Latvian Forest Development Fund (LFDF)—a strategic player in Latvia’s forestry sector. LFDF bridges the gap between independent forest owners and major institutional buyers like SODRA and IKEA, creating value at both ends of the market.

Forestry investments offer strong returns with relatively low risk, and LFDF plays a key role in transforming smaller forest properties into institutional-grade assets. The fund acquires land from owners typically holding 10 to 50 hectares and manages every stage—timber harvesting, exports, land optimization, and finally, legal preparation for resale. By the time institutional investors step in, LFDF has consolidated these assets into a structured portfolio, allowing the former to acquire large-scale forestry investments in a single transaction. This streamlines the process for both small landowners seeking efficient sales and institutional buyers looking for scalable, high-value opportunities.

A High-Growth Sector with Strong Returns

LFDF operates in one of Latvia’s most promising investment sectors—forestry. The fund focuses on strategic acquisitions, sustainable management, and optimized exits, ensuring maximum land value appreciation.

Latvia’s forestry sector is positioned for long-term growth, driven by several key factors:

- Undervalued land prices compared to Western Europe, providing strong capital appreciation potential.

- Rising timber demand, with global consumption increasing in construction, energy, and manufacturing.

- Consistent land value appreciation, with Latvian forestland prices steadily rising between 2016 and 2024.

LFDF has already acquired 2,600 hectares of forestland and successfully sold 800 hectares, achieving an average margin per transaction of 35%. By 2026, the fund aims to expand its portfolio to €40 million, capitalizing on a growing market with strong institutional demand.

Security and Stability in Forestry Investments

Forestry is recognized as a low-volatility asset class, offering intrinsic stability and long-term appreciation. Unlike financial markets, forestland remains a tangible, income-generating resource that continues to grow regardless of economic cycles.

LFDF minimizes risk through:

- A structured, long-term investment strategy focused on sustainable land appreciation.

- A strong legal framework in Latvia, ensuring investor protection and regulatory oversight.

- An experienced leadership team, led by Janis Upenieks and Gatis Melderis, with extensive expertise in forestry investment, land valuation, and financial structuring.

LFDF’s financial discipline is also well-established. The fund successfully secured and repaid €7 million to Mundus Bridge Finance, managed by INVL, one of the Baltics’ leading investment management firms.

Liquidity and Market Accessibility

Forestry investments are often perceived as illiquid, but Latvia’s forestry market is active and integrated into international trade. Latvian timber is exported worldwide, with strong demand from Scandinavian countries and China.

- Forestry represents 20% of Latvia’s total export value, generating over €4 billion annually.

- Major buyers, including IKEA, SCA, and SODRA, acquire significant volumes of Latvian forestland.

- Over 54% of Latvia’s forests are privately owned, creating ongoing investment and acquisition opportunities.

This steady demand for timber and land ensures that forestry remains a highly liquid and accessible investment sector.

Investing in LFDF Through Debitum Investments

Traditional bank financing can be slow and restrictive, limiting the ability of funds to act on high-value opportunities. LFDF’s partnership with Debitum Investments provides investors with faster, more efficient access to forestry investments.

Investors benefit from:

- Collateral-backed investments, ensuring security.

- Regular financial reporting for full transparency.

- Access to a proven investment model without the delays of traditional financing.

With its established track record, stable asset base, and structured investment strategy, LFDF offers a combination of high returns and low risk for investors looking to diversify into the forestry sector.

LFDF Trust Score: A

LFDF has been assigned a Trust Score of A, reflecting its strong financial standing and operational transparency.

- Legal Factors (B): While LFDF meets high standards across most criteria, the highest possible ranking is not assigned due to its collateral structure, which does not include real estate. Instead, a commercial pledge is in place over all shares and assets of the issuer, allowing enforcement against receivables, timber products, and other assets.

- Financial Factors (A+): LFDF maintains a strong financial position, supported by its structured approach to land acquisition and value appreciation. The company consistently generates high margins from strategic forestry management and has demonstrated financial discipline, having successfully secured and repaid €7 million in previous financing.

- Other Factors (A+): LFDF has been highly cooperative, maintaining open and transparent communication. The company provides regular financial reporting, ensuring investors have full insight into performance metrics. Its leadership team brings extensive industry expertise, further strengthening operational execution and investor confidence.

LFDF Launching Soon on Debitum Investments

Forestry investments offer strong returns, low volatility, and long-term capital appreciation. LFDF’s business model, market positioning, and transparent approach make it a compelling opportunity for investors seeking exposure to Latvia’s expanding forestry sector.

LFDF will be available soon on Debitum Investments—stay tuned for more details.

This is a marketing communication and should not be interpreted as investment research, advice, or an endorsement to invest. The historical performance of financial instruments is not indicative of future outcomes. Investing involves risks; the value of investments may fall as well as rise. Be sure to assess your knowledge, experience, financial situation, and investment goals before investing.

Partner Stories: Meet Sandbox Funding, Our Key Loan Originator

“Why is Sandbox Funding everywhere on the Debitum Investments platform?”

This is a fair question we hear often. It’s true that Sandbox Funding has a significant presence on our platform. The “why” behind this reveals much about how Debitum Investments operates and serves its investors.

So, it‘s time we unwrap everything you’ve wanted to know about Sandbox Funding: its business model, recent financial performance, and collaboration with Debitum Investments.

Quick Facts

0%. 100%. 1843%.

These are the real numbers showing the percentage of defaults, repayments made on time, and the increase in Sandbox Funding’s equity since it was established 1.5 years ago.

But it’s more than impressive stats.

In practice, it shows how accountable and efficient Sandbox Funding is: loans are issued to vetted borrowers only (1 in 10 companies make it through the screening process), repayments are collected as scheduled, and the funds are promptly returned to investors along with earned interest—every time.

Even when something goes wrong (e.g., an underlying borrower, SIA Power Capital, reg. nr. 40203444130, faced repayment challenges), it’s not just the numbers that demonstrate Sandbox Funding’s commitment to its promise to investors. The borrower is undergoing loan restructuring, while Sandbox Funding fulfilled its buyback obligation on behalf of the borrower and ensured full principal and interest payments to investors on time—using its own capital (despite a late repayment of €1.785M on a €2.225M loan.)

The Origin Story

In 2023, we at Debitum Investments asked ourselves:

How can our investors gain access to more investment opportunities, faster?

The answer was simple. We needed a solution to streamline partner evaluation and loan origination.

This required a vehicle that could speed up the process of evaluating and onboarding potential partners through a synergy of an automated loan management system, extensive risk evaluation, thorough financial assessment, and an intentionally rigorous borrower vetting approach.

Putting it into action, however, was another story (and this is the story of how Sandbox Funding was established.)

Sandbox Funding’s Model

The collaboration between Sandbox Funding and Debitum Investments is elegantly simple.

Sandbox Funding carefully evaluates businesses, secures appropriate collateral, and issues loans using its own capital. When a loan is securitized, our investors gain access to these thoroughly vetted opportunities, backed by stable performance indicators.

Additionally, Sandbox Funding secures collateral from borrowers while maintaining a 10% “skin in the game” (meaning Sandbox Funding retains a 10% stake in every loan they issue), ensuring an added layer of protection for investors.

“Sounds good, but where’s the proof?” Well, the proof is in the numbers:

Now, with a current loan portfolio of €18M, Sandbox Funding has become our largest loan originator, serving sectors like forestry, energy production, construction, and finance, with:

- Total investments of €28.5M

- €18M in outstanding investments

- €1.2M in paid interest and €10.5M in repaid principal

- Average ABS returns equal to 13.21% per annum

It works that well because Sandbox Funding’s model has created a win-win scenario.

For investors, it provides access to highly vetted borrowers with stable performance indicators, faster.

For SMEs, it addresses a critical gap in Latvia’s financing sector, offering quicker and more accessible funding solutions than traditional banks.

For us, it solves a classic industry challenge: onboarding new partners to the platform more efficiently.

And Finally, The Most Frequent Question, Answered

“Isn’t Sandbox Funding owned by the same people as Debitum Investments?” Many investors ask this, and the answer is yes—with strategic intent.

It’s true that Sandbox Funding is our fully controlled ally company, and we aren’t hiding it. Quite the opposite: it’s how we ensure the highest quality of investment opportunities for our investors and we’re proud of that.

But our caution, due diligence, and transparency-driven approach remain the same when it comes to Sandbox Funding’s operations.

How?

We regularly publish quarterly Sandbox Funding financial reports to provide investors with a clear view of its performance (check the latest reports). This obligation is outlined in the Partnership Agreement between Sandbox Funding and Debitum Investments.

By sharing financial data regularly, we’re putting transparency front and center—keeping investors and stakeholders in the loop with clear, consistent updates on the company’s financial health and performance.

Closing Thoughts

The Sandbox Funding story is about building a bridge between ambitious SMEs and savvy investors. It‘s about creating a financing model that works for everyone. Most importantly, it’s about doing things right and transparently, one carefully vetted loan at a time.

Explore current investment opportunities by Sandbox Funding.

This is a marketing communication and should not be interpreted as investment research, advice, or an endorsement to invest. The historical performance of financial instruments is not indicative of future outcomes. Investing involves risks; the value of investments may fall as well as rise. Be sure to assess your knowledge, experience, financial situation, and investment goals before investing.

Short-term financial instruments as a solution in nowadays world

For more than a year we are living in a world that is affected by pandemic and the “New Normal” has become a usual life rhythm. However, a lot of us still live under unpredictable conditions and do not know how to plan future actions, especially related to finances.

Investors who are investing their savings now find themselves in a situation where they need to maximize their return while keeping the risk at a minimum. Therefore, investors need to ask – what is the most prudent way to manage my funds? As a result, a lot of investors with low-risk tolerance think about high liquidity and low return. Such investors want to have access to their funds as soon as possible even though investors need to sacrifice some of their interest returns.

However, Debitum and one of its partners, Flexidea, can offer an answer for the investors’ headache – short-term financial instruments. Due to the unique Flexidea business model (read more in Blog), Debitum can offer short-term investment opportunities that generate an attractive return while keeping the risk low. Most of Flexidea’s clients are sustainable and experienced businesses that offer safe and timely returns and with an average term of only 39 days, these short-term investment opportunities allow you to receive the returns quickly without freezing your funds for a long time period.

Flexidea assets are a great choice if you are trying out the Debitum platform or looking for a high turnover of your investments. Unlike other loan originators on the platform, Flexidea has become an integral part of the Debitum platform, serving short-term investors at an increasing pace. Despite the pandemic, Flexidea showed great results in 2020 and continues to maintain this momentum with more loans coming on the platform at the beginning of 2021.

Whether you are a new or experienced investor, Flexidea assets with an average loan term of 39 days and an interest rate of 8% are a great way to speed up your portfolio and we believe that this term and interest rate combination is great. Therefore, check out Flexidea assets on the Debitum platform and make your financial planning much easier!

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

New partnership with loan originator CubeFunder from the United Kingdom

We are happy to announce another new partner from the UK – CubeFunder, an alternative lender for the UK small businesses since 2017.

About CubeFunder

CubeFunder is a company that has been successfully disbursing loans to small and medium businesses for over 3 years and managed to grow its portfolio to almost 10 million Euro.

The team at CubeFunder has focused on both state of the art solutions like Open Banking and the personal touch that small and medium business require.

Business model

Clients of CubeFunder are small and medium businesses ranging from trading and service providers to artisanal food making with various companies in between. CubeFunder uses a human-centric approach to their client onboarding procedure, always visiting their clients on-site. Many borrowers stay with CubeFunder and keep coming back if they need quick and efficient financing. As a result, CubeFunder is financially stable and profitable for the past 2 years.

Risk model

CubeFunder has a robust technical side as they use one of the largest risk assessors in the world, Equifax, to score its clients and CubeFunder has its own custom build IT systems with information on all of their clients and their payments – which can happen daily, weekly or monthly. All loans are backed by underlying like owners’ personal guarantee, stock of the borrower, cross-company guarantee, and other.

CubeFunder works with slightly riskier SME’s than most other SME financiers. The uniqueness of CubeFunder is how they mitigate the credit risk of the portfolio. CubeFunder has regular monthly repayment schedules. Moreover, the originator can directly debit the bank account or payment card of the borrower on a daily, weekly, or monthly repayment basis. Every schedule is tailored to the needs of a borrower. This ensures that the borrower repays the loan by very small but frequent payments. That allows identifying potential problems within the company at the earliest stage.

The average interest for loans of CubeFunder is around 10%. So, go to Debitum platform, check the assets, and start investing!

Bonus campaign for our investors!

All investors who invest more than 500 EUR into the new CubeFunder assets will receive an additional 1% cashback. Therefore, do not hesitate and check out the assets on the platform! We believe that an additional 1% is a great opportunity to increase your return on these investments to a significant 11%!

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Triple Dragon assets are more secure now: a new SPV structure is in place

Earlier this year, in February 2020, we have onboarded UK loan originator Triple Dragon to the Debitum platform. As a quick reminder: The London based company, that is in business since 2016, offers flexible funding and working capital solutions for developers and publishers of video games and mobile apps.

The demand and popularity of Triple Dragon loans didn’t take us by surprise, as those assets have been backed by receivables from major tech enterprises such as Google, Apple, Amazon or Facebook. But not only the underlying collateral has been a huge benefit for guaranteeing the safety of Triple Dragon assets, also the buyback guarantee ensured an additional layer of security for our investors.

After having successfully funded nearly 1.5 million Euro with an average interest rate of 8.61%, we are happy to announce that Triple Dragon assets are now coming back to the platform. If that wouldn’t be enough, this time Triple Dragon assets are coming along with yet another layer of safety, for which we have installed an SPV structure.

In this post, we will share with you what an SPV is, how it works, why we have installed it and how you can ultimately benefit from it.

What is an SPV?

SPV is short for special purpose vehicle but can also be called a special purpose entity (SPE). In its essence, an SPV is a subsidiary created by a parent company, mainly to isolate financial risk. This means that even if the parent company goes bankrupt, its legal status as a separate company makes its obligations secure.

In case of Triple Dragon, it means that another LLC entity has been registered under UK law. Although this SPV is 100% owned by Triple Dragon, Debitum co-founder Martins Liberts is one of its directors and therefore has access and control over the subsidiary.

How an SPV structure works

How does it work?

In order to further increase the volume and exposure of Triple Dragon assets on the Debitum platform, we have proposed to establish a special purpose vehicle in the UK, that will act as a dedicated origination entity.

This means that from now on, loans are exclusively originated for Debitum investors and we will obtain extensive monitoring access. As a consequence, we will have full and real-time visibility on the loan book, collateral pool, bank accounts and accounting.

Why we have decided to establish an SPV with Triple Dragon

After we have observed a big interest in Triple Dragon assets by our investors and seeing a flawless loan performance throughout this time, it was clear to us that we wanted to continue this business collaboration and even further increase the exposure on the Debitum platform.

But increasing exposure while maintaining an appropriate level of security, only comes along with more control from our side. That’s why we put the new SPV structure in place, in order to balance better on the risk-return scale.

What are the benefits for investors?

Through this new established SPV entity, Debitum is now in better control over funds that are provided by our investors. In case we observe or notice any issues, we can immediately pause and stop the offer of new loans on the platform.

As the new SPV is fully dedicated to Debitum investors, this means not only further control but an improved mitigation of risks as well. For example, no other debts will appear in this SPV, such as operational costs or salaries. While in some cases there could be a different order of priorities for how liabilities would be paid back, in this case Debitum is the senior debtor and therefore has ultimate pledge on the SPV.

With the new setup being in place, which we for instance also have with assets from Flexidea, we forecast to upload up to 4 million Euro of new Triple Dragon assets in the next weeks and months.

You in?

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

New partnership with loan originator Evergreen Capital from Estonia

We are happy to announce a new partnership! Our new partner Evergreen Capital is a non-bank lender providing financing to Estonian small businesses since 2017.

About Evergreen Capital

Evergreen Capital has been disbursing loans within Estonia for over 3 years. They have already successfully distributed over 4 million in loans to various Estonian small businesses. The team at Evergreen Capital is focused on having a profitable business that can grow slowly but efficiently. Now Evergreen Capital is ramping up to go to the next level and increase its portfolio with the help of Debitum.

Regular clients of Evergreen Capital are micro and small businesses like IT companies, retail companies, industrial companies, and many other industries. Evergreen performs a credit check of the clients, assesses their financial state and solvency, underwriting model takes into account the applicant’s sector, prior experience, business volume and diversification, tax history, and other public and proprietary information. Additionally, Evergreen uses Creditinfo and Inforegister.ee for their credit evaluations. All the loans up to 10,000 Euro are backed by a personal guarantee of either the manager or the owner of the company, or both, after carefully examining their credit history. Loans over 10,000 Euro are also backed by a pledge – real estate.

Evergreen Capital is a bit higher risk loan originator on the Debitum platform, the loans that they provide are for clients at a higher risk category when compared to our previous loan originators, but the pricing model and the overall attitude of Evergreen Capital ensures that it is a financially stable company that is growing every year. Debitum will monitor company’s financials so they always have enough funds to cover buyback and meet all other covenants.

Average interest for loans of Evergreen are to be around 10%. So, go to Debitum platform, check the assets and start investing!

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

New partnership with loan originator FLEXIDEA from Latvia

New partnership with loan originator FLEXIDEA from Latvia:

Did you miss short term assets on Debitum Network lately? Invoice-financing assets from FLEXIDEA are here for you!

About the company

FLEXIDEA is an innovative invoice financing solution established in 2017 out of Riga, Latvia.

Their clients are SME from Latvia with high business field diversity (fast-moving consumer goods manufacturers and traders, other manufacturers and traders, logistic service providers, wood and metal traders, and more). The payers of invoices are local and multinational companies of medium and large size like chains of supermarkets, multinational manufacturers, and service providers.

How it works

The founders of FLEXIDEA believe that invoice financing (invoice discounting) should be fast, online, and require minimum human participation. They developed an in-house IT solution that allows their customers to upload all required information online and get automated answers along the way.

FLEXIDEA uses several score providers (Coface, KIB) to get the probability of default for both – the client (seller of goods) and the debtor (the payor of invoice). The scoring model includes 3rd party scoring, credit history, open-source information, analysis of client financials, and bank statements.

About assets

Firstly, both parties (client and debtor) verifies and approves each invoice. Secondly, all invoices are paid directly to the FLEXIDEA bank account. It makes the financing deal safer, and there is a lower risk for invoice default.

The average asset term for FLEXIDEA is 36 days, while the average amount is about 6K euro making FLEXIDEA assets very attractive for your investment strategy. Just don’t forget to adjust your auto-invest plan.

Check out the assets that are already on the platform. If you like what you see, do not hesitate to add them to your portfolio.

Discussion with the co-founder of Triple Dragon Pieter van der Pijl

Discussion with the co-founder of Triple Dragon Pieter van der Pijl:

We are glad to present our newest discussion online with one of the co-founders of Triple Dragon Pieter van der Pijl. We believe that this interview will help you to have a better picture of how this loan originator is working and why you should invest in their assets.

Martins: Firstly maybe you can tell something about yourself? About your background and role in Triple Dragon?

Pieter: My background was always been in finance, I am also really passionate about video games and investing in them for a long time. The co-founders of Triple Dragon are also Charlie and Diederik, so we combined mutual interest and passion in gaming industry and experience in finance and that’s how Triple Dragon was created.

Martins: So, there are three guys doing it, right?

Pieter: Three founders, but our team is currently 6 people.

Martins: Can you tell a bit about Triple Dragon? What exactly do you do?

Pieter: We finance video game companies, and we finance them on the stage when they have products, which are life and generating revenue, so we could reduce the risk by taking security over the store receivables. So video games or all companies especially mobile games are usually making their revenue trough app store, especially companies like Google that are collecting all the revenue from consumers and then paying to video games companies. It obviously takes time before revenue which is being generated, and then it takes time and it also takes like 30-45 days before the app store payout to these video games companies. So, they have receivables, the cash which they can’t use, and we are lending against those receivables. Its Apple, Google for mobile, Microsoft Nintendo for console gaming and Steam and Epic for PC.

Martins: As I understand you mentioned that approximately term is when collected plus 30-45 days but at the same time you manage to do loans that are around one year and even longer? How is that structured?

Pieter: Yes, so the payment terms what the app stores are usually from 30 to 45 days, but what we would like to do is, we are financing video games companies that are really at the growth stage so that the product is live. What they need is advertising and marketing for, their games. And if we can finance those companies, we would rather finance them for a longer period of time than just one kind of invoice discounting of the app store receivables. It’s a lot more trusting for video gaming companies to have access to financing, to grow their business, over the next 6-12 months, that it is currently like for 2-3 months. And the same thing for us, if we can finance company for 12 months, and the cost of doing this is the same, and it means the return that we are able to make is higher if we lend for a longer period, and that means a better return for our investors.

Martins: Structure means that. Throughout all that period your financing amount is less than receivables, or how does it work?

Pieter: Yes, we always want to be very conservative and make sure that we are fully secured, so as a requirement for a borrower is that there should be store receivables over at least 120 % of the amount we are lending. So, we are always overcolletarized.

Martins: Okay, it sounds great, but everyone is interested in what happens if your borrower, the game developer goes bankrupt? How do you ensure that your fund is getting back?

Pieter: Well, we are in so-called fairly fortune position that in most cases we are collecting the app store receivables, either ourselves or in the accounts of the major banks. So, the store payments are going directly to those accounts, if borrow would get into trouble financially, we basically are able to collect those funds. So, bankruptcy is not going to affect us, because we are overcollertarized, we are secured, and we have control of cash flows. So even in those scenarios, we are getting fully repaid including interest and penalty.

Martins: So, in essence, it means that even if everything goes bad, everyone who has invested in the loans you are providing, you believe that in any way they will be able to get all the funds back.

Pieter: The only scenario we would potentially occur a loss if the underlying payer of those receivables would go out of business, so for example if Apple or Google would go bankrupt, then yes, there would be a problem, but if the borrower goes out of business, it is not going to affect us or investors because of overcolletarizatin. So, we really look at how secure is our collateral, are we sufficiently overcolletarized, and do we have control over those cash flows, and if that is the case, we feel super comfortable lending to a particular borrower.

Martins: But if Google and Apple go out of business and most likely there is no business at all on theirs?

Pieter: Yes, then it would be out of things, more worrying going on in the world I would say.

Martins: Okay, it sounds very good, as I said it is the very beginning what you are doing in the niche of lending for the game industry, which is booming at the moment, as I understand many countries are quarantined I would assume that there are more and more users of those games, right?

Pieter: Yes, I mean it’s not a secret, that people are forced to stay at home, so they need to find indoor entertainment. Yes, we see the spike in demand for mobile games. That has been mentioned in the press of Microsoft Xbox live service going down because of a sudden so many people because so many people are tuning in Steam, which runs the biggest PC store have the biggest ever occurring a number of users, a lot of players at the same time, so yes, clearly there is an increase in demand. The thing that we sort of looking at coronavirus aspect, for us it’s not so much increase in demand, which is a fortune for the gaming sector which is not going to directly affect us, but we like about it that we are not exposed to supply chain risk, I mean video games are transmitted digitally to Apple and Google app stores, that will keep continuing running, that’s not going to destroy the business. So, yes, in this perspective we are in a fortunate position.

Martins: I believe that’s it for this quick Q&A I think it gave a lot of insights for everyone who will watch. Thank you, Pieter, for that, see you another time!

Pieter: You are welcome, it is a pleasure working with you guys!

Go the platform and add Triple Dragon assets to your investment portfolio by clicking here!

New partnership with loan originator Noviti Finance-Lithuania

New partnership with loan originator Noviti Finance-Lithuania:

We are happy to announce a new partnership! Our new partner Noviti Finance is non-bank lender that provides business loans up to 25 thousand euros in Lithuania since 2016.

About Noviti Finance

Noviti Finance has been successfully disbursing loans to Lithuanian business since 2016. They already funded over 1000 small-medium businesses and lent over 10 million euros since they started to grow their business. The team of Noviti Finance is focusing on good customer experience, transparent pricing, flexible risk scoring and fast financing.

On Feb 20, 2020 Noviti Finance signed the agreement with European Investment Fund (EIF). The EIF will guarantee a portfolio of up to €10 million in new loans issued by Noviti Finance. More information on that is in the press release: https://ec.europa.eu/commission/presscorner/detail/en/IP_20_250

Noviti evaluates both company and business owners who are surety providers. In order to ensure independent opinion on scoring rating and credit history of borrowers Noviti uses scoring from Creditinfo – very reputable score provider that evaluates many factors like profitability, equity level, payable and receivable amount ratios. Noviti checks business owner assets, historical income, personal credit history and existing level of obligations. In order to get a positive decision a company and guarantor should meet Noviti requirements, if at least one is missing, – the decision is negative.

So go and check the Noviti assets available on the platform and include them in your investment plan!

New partnership with loan originator Triple Dragon from the UK

New partnership with loan originator Triple Dragon from the UK

Would you buy assets backed by Apple and Google receivables? We are happy to offer it to you!

We are pleased to announce our new partnership with UK based specialist games financing company Triple Dragon Limited.

Triple Dragon will provide new investment opportunities with attractive interest rates, exceptional underlying collateral, and a buyback guarantee.

About the company

Triple Dragon Limited is a London based company that is specialized in the financing and publishing of video games (PC and console), mobile games and mobile applications (apps).

Triple Dragon was founded in December 2016 by its three founders (Charles Brooke, Pieter van der Pijl and Diederik van Lede) who have a background and track-record in finance and law and are above all passionate gamers. The mission of Triple Dragon is to become a leading ‘merchant bank’ for the video games and mobile app industry.

The founders of Triple Dragon saw a huge opportunity in the mobile app and video games industry by providing developers and publishers of mobile apps and video games with flexible funding and working capital solutions that help them to grow their business.

All of these apps and video game developers and publishers share a common characteristic, they receive their revenue through major technology companies such as Google, Apple, Amazon and Twitter and the receivables on these major technology companies form the security that Triple Dragon (and Debitum Network investors) receives from its borrowers.

How it works – receivables from Apple or Google

Triple Dragon provides a variety of financing products to its borrowers, most often these are receivable backed loans which have some similar characteristics to invoice financing (a well-known asset type on the Debitum Network) because these loans are secured by receivables for app and video game revenue that has already been generated.

These are receivables on the major app stores (such as the Google Play Store or Apple App Store) or advertising networks (such as AdMob (Google) or Twitter). These loans are provided and administered by Triple Dragon and are uploaded onto the Debitum Network only if specific loan-to-value and collateralization criteria are met.

Tripe Dragon also provides user acquisition (UA) loans, which are secured and documented in the same way as receivable backed secured loans but that have different conditions and features. UA loans are flexible growth financing solutions for video games and app companies that have games or apps that can be profitably scaled up through performance marketing. UA loans usually start at lower amounts and then scale up when the game or app meets the performance benchmarks set by Triple Dragon. The experienced Triple Dragon team evaluates the key performance indicators and all analytical data of the apps and games and will then increase the loan size if the loans are significantly over-collateralized (125% or more).

All Triple Dragon loans are over-collateralized and have collateral that consists of receivables of well-known technology companies such as Apple and Google and these receivables can be easily realized. This results in a robust lending structure that is enhanced further by the buyback guarantee. Having in mind risk and return, you now have an excellent opportunity to invest in the assets of our new partner Triple Dragon which offers a very attractive return on investment with a very low-risk profile thanks to the underlying security in the form of receivables on companies such as Google and Apple.

All the loans are over-collateralized, and the collateral can be easily realized. This establishes the strong ground for the buyback guarantee. Having in mind risk and return, you have an excellent opportunity to invest in the assets of our new partner Triple Dragon. The risk is very low in comparison to the return that you get.

Check out the assets that are already on the platform. If you like what you see, do not hesitate to add them to your portfolio.

Debitum Network partners with a loan originator “Cardec Factoring”

Debitum Network partners with a loan originator “Cardec Factoring”:

We are happy to announce that today we have formed a new partnership with a loan originator from the Netherlands – “Cardec Factoring”. This is great news for our investors as they will be getting new assets to invest in with attractive interest rates and a buyback guarantee.

Through the partnership with Debitum Network, “Cardec Factoring” will offer invoice factoring assets from lawyers that offer their legal services to their customers and get promissory notes from “Raad voor Rechtsbijstand” RvR (Legal Aid Board) that are fully backed by the government of the Netherlands. We hope for a long term partnership with the loan originator after the first batch of assets has been funded. The Head of Operations of Debitum Network – Eimantas Valancius visited the headquarters of “Cardec Financing” in the Netherlands to sign the agreement and perform on-site due diligence.

Eimantas Valancius (The Head of Onboarding and Operations on Debitum Network) with Pieter de Loos (The CEO of Cardec Factoring)

About “Cardec Factoring”

“Cardec Factoring ” is a dynamic and legal organization that offers invoice financing services for their customers (in the form of promissory notes). The final payer of the invoices (promissory notes) is a state-owned agency RvR (Legal Aid Board). Therefore, all of the assets that we are going to upload on Debitum Network platform from “Cardec Factoring” will have a credit score of A+. This means they are some of the safest to invest in and could be compared to investing in government bonds of the Netherlands.

The good news is that interest rates for them will be much better than the government bonds of the Netherlands. For the sake of comparison, 2-Year Bond Yield for those bonds is – 0.60%, which means you will have to pay the government of the Netherlands for the possibility to buy and hold their bonds. The same is true with 3, 4, 5, 10, and 15 Year Bond Yields. They all have negative interest rates. Yet, the assets from “Cardec Factoring” will give an investor a return of 7%-8% per year.

Check out the assets

Having in mind risk and return, you have an excellent opportunity to invest in the assets of our new partner. The risk is very low in comparison to the return that you get. Whether you are a long term or short term investor, the investment option is good for diversification too. Check out the 69 assets that are already on the platform. If you like what you see, do not hesitate to add them to your portfolio.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Debitum Network partners with a loan originator Mikro Kapital

Debitum Network partners with a loan originator Mikro Kapital:

We are happy to announce that we have a new partnership with a loan originator from Romania “Mikro Kapital” onboarded Debitum Network platform. Mikro Kapital IFN SA (Romania) is a non-banking financial institution. It is part of a Mirko Kapital group that uses microfinance techniques for lending/investing in SMEs around the world with a special focus on emerging markets through their 2 securitization funds: Mikro and Alternative.

Debitum Network partnership with a loan originator Mikro Kapital Romania will offer the first assets on our platform. We hope for a successful continuation in the partnership after the first assets have been funded.

About Mikro Kapital group

Mikro Kapital group is a securitization fund management company. It was established under Luxembourg law in 2008. It is regulated by the European Union and controlled by Luxemburg authorities. Mikro Kapital group focuses on investing in small businesses across emerging areas of the world, especially in Russia, also Central and East Asia, Latin America and Europe.

The group invests in the real economy, stimulates the growth of small companies by providing financing to creditworthy micro and small businesses, and gives investors an opportunity to diversify their funds/investments by investing in industrial, agricultural, and service segments of the global economy. All loans issued by Mikro Kapital are fully collateralized. Mikro Kapital do not do any consumer lending.

Some stats about Mikro Kapital group

In ten years, the company created a global team of 1746 employees with 134 offices in 19 countries. The Mikro Kapital group operates in: Luxemburg, Italy, Russia, Belarus, Moldova, Romania, Tajikistan, Armenia, Kyrgyzstan, Honduras, Indonesia, Kazakhstan, Poland, Uzbekistan, the Czech Republic, Switzerland, Nicaragua, and Hong Kong.

The total amount of investments made through their Mikro Fund and Alternative Fund exceeds 600 million EUR.

During 10 years of activity, the default rate on the credit awarded has been below 1%.

About Mikro Kapital Romania

Mikro Kapital IFN SA (Romania) was established in 2016 and it has focused on achieving a positive impact especially in the emerging markets. It is the Romanian subsidiary of Mikro Kapital group. The company is a non-banking financial institution with a focus on very small, small and medium-sized enterprises, agro loans and a small portfolio of private loans issued to Romanian citizens.

Some stats about Mikro Kapital Romania

- Total loans originated: 20,874,441 EUR (1607 loans)

- Outstanding loan portfolio: 15,348,198 EUR (1332 loans)

- Average financing term: 3.28 years

The first assets on Debitum Network from Mikro Kapital

The first assets from Mikro Kapital have already been uploaded on Debitum Network platform. They are short term in duration with annual interest rates from 9% to 11%. All of them have a buyback guarantee. Are you interested? Be the first one to invest in the assets and earn attractive interest.

Top asset of the week from Mikro Kapital

We have handpicked the top asset of the week from our newest partner. The borrowing company has a family business, which provides transportation services by buses, and has been in business for more than 15 years. It has a great credit score, excellent interest rate, and you can earn more than that as the penalty rate (in case the borrower is late with the repayment) is 10%. Do not hesitate to put the asset into your portfolio as the assets on our platform are funded really fast.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

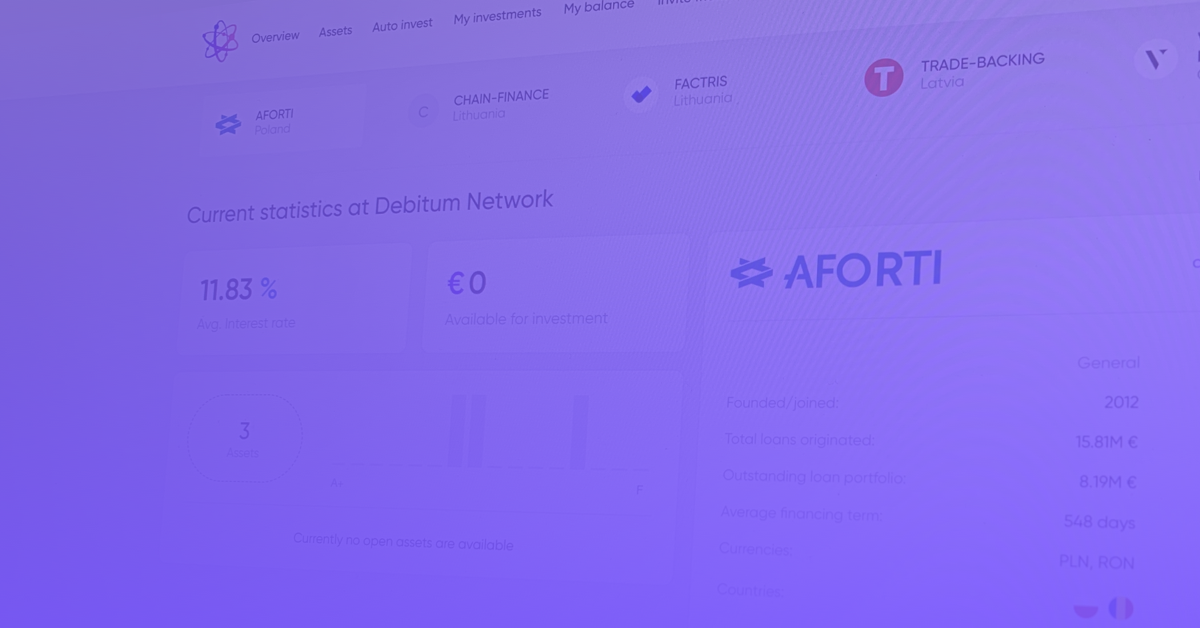

Regarding Aforti Finance assets on Debitum Network

Regarding Aforti Finance assets on Debitum Network:

Please be aware that on the 25th of July, all Aforti Finance assets were removed from Debitum Network and the entire invested amount plus due interest were bought back. We have come to this decision as a result of a thorough investigation of Aforti Finance financial situation while doing the 1st and 2nd quarter follow-up due diligence process. We didn’t wait until investors possibly got stuck with unpaid repayments and nervously wait for the situation to resolve itself. We wanted to protect investors’ funds and decided to act proactively.

Our risk management team did a thorough analysis of the financial data provided by Aforti Finance and had a number of important questions to ask. Correspondence between teams lasted more than a month and as some of the important questions were not answered or were answered vaguely, we decided to suspend offering Aforti assets for investment.

Our collaboration and partnership agreement with Aforti Finance still stand. We are going to review their data for the next quarter, and if the previous worrying questions are solved we will resume accepting their assets on our platform. For the time being, no more assets from Aforti Finance will be uploaded on Debitum Network until our risk management team ensures us otherwise.

We, at Debitum Network, always look ahead and try to avoid the risks before they arise or worse, get out of control. We have a very strong risk management team and a thorough due diligence process, which should help you stay calm with your investments and security of funds. We might be too cautious, but better safe than sorry. Thank you for your trust in Debitum Network.

Best regards,

Debitum Network team

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Debitum Network partners with a loan originator VIHOREV INVESTMENTS from the Czech Republic

Debitum Network partners with a loan originator:

Debitum Network keeps on growing and we onboard more new parties on our platform every month. Today, we are proud to announce a new partnership with a loan originator from the Czech Republic – Vihorev Investments

Debitum Network partners with a loan originator:

Debitum Network keeps on growing and we onboard more new parties on our platform every month. Today, we are proud to announce a new partnership with a loan originator from the Czech Republic – Vihorev Investments

. Vihorev Investments is a prominent real estate developer with years of experience in the market. The company focuses on developing real estate projects in Prague, the Czech Republic.

Through the partnership with Debitum Network, Vihorev Investments will offer the first test assets in the industry of real estate. These would be the first assets of a real estate industry on the Debitum Network platform and we hope for a successful continuation in the partnership after the first assets have been funded.

About Vihorev Investments

Vihorev Investments has been active in the real estate market for many years, building or managing assets worth EUR 20 million. In 2018 alone, it sold real estate worth approximately EUR 8 million. At present, it actively operates 4 projects with 177 residential or commercial units and is preparing to launch other projects.

A real estate project ‘STRAKONICKÁ’

Vihorev Investments has just successfully finished a residence project ‘STRAKONICKÁ’. The project has been developed in the heart of Prague and consists of 28 apartments and 4 studios. The total area of the residence is 1650 m2. The apartments are suitable for housing, business or can be used as an investment. 100% of the apartments have already been sold.

Test assets on Debitum Network (STRAKONICKÁ project) from Vihorev Investments

Debitum Network is going to refinance the equity of the project “STRAKONICKÁ”. This will be done via Vihorev Investments’ local SPV (Special Purpose Vehicle). The refinancing sum is spread over 15 ‘test assets’ that are uploaded on Debitum Network platform and are available for investing. We hope that the first mutual project between Debitum Network and Vihorev Investments will be successful and this will grow into a further fruitful partnership and more assets from the loan originator will be offered on Debitum Network platform.

A selected asset from the project STRAKONICKÁ

We encourage everybody (register on our platform, if you haven’t done it yet) to look at the newly uploaded assets from our new partner and possibly adding some of them to their portfolio (if you can’t see the loan originator, be sure to check the filter and adjust it accordingly). We have selected the top asset from the batch of assets (STRAKONICKÁ project) for you. It is expected that over the upcoming 5 years the project will generate a 148% return on equity from renting the apartments and have an average occupancy rate of over 75%. Furthermore, 100% of the borrower shares are provided as collateral. The asset also has a buyback guarantee. Does it sound good enough? If yes, be sure to add it to your portfolio. Do not hesitate as the assets on the platform are funded really fast. Check out the asset.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Aforti Finance, the leading non-bank lender joins Debitum Network

Aforti Finance, the leading non-bank lender joins Debitum Network platform

Debitum Network keeps on growing and new parties onboard our platform each month. Today, we are happy to announce a new partnership as we onboard a new loan originator from Poland Aforti Finance. Aforti Finance is one of the leading non-bank lenders in the Polish market, which is one of the largest in the Central and Eastern European region. It is part of Aforti Holding, which is listed on the Warsaw Stock Exchange. We sat down to talk about the company with Tomasz Kaźmierski – the Chief Sales Officer (CSO) and the Vice President of Aforti Finance S.A. Get acquainted with our new partner!

How would you introduce Aforti to our community?

We are part of Aforti Holding – a company listed on the New Connect market being side market of the Warsaw Stock Exchange. We have been operating on the Polish market since 2014, is currently the largest non-banking financial institution providing financing to business clients, mainly small and medium enterprises. The Board of Directors team consists of experienced managers with a strong background in financial institutions as well as in non-banking companies. Therefore, in the credit assessment of customers, we implement procedures and rules similar to banking ones, which allows for skipping too risky customers. Also, we focus on process automation – which makes our offer really competitive in comparison to other market players in Poland. We offer our products through our own outlets and through dedicated Call Centers. At the same time, we work with brokers, however closing the deal is being done by Aforti Finance employees, what allows us to properly check the customer and greatly limit the number of bad loans and subsequent NPL (Non-Performing Loans).

Can you describe how your lending process works? How is it different from getting a loan in a bank?

Our process is pretty simple but precise and accurate. Also, what is important for our clients, it is really fast. As soon as we receive a client’s documents, we begin the analysis involving an automatic check of the client in external scoring databases (including bank databases), where our potential client shall be verified. In addition, we automatically process bank statements using specially designed software that ensures their authenticity. We can close the entire decision process in 4 hours – we meet the expectations of the client who expects decisions as soon as possible. If the amount of the loan granted meets the client’s expectations – we arrange a meeting with our verifier, who meets with the client in the place of his business to verify and confirm originals of all previously provided documents, including bank statements. Also, we visually verify client’s business activity, which allows us to eliminate almost any potential frauds and extortions in this area. No bank on the Polish market operates so fast while maintaining such high-security standards in parallel.

Which markets do you operate in and what are your plans for future expansion?

At the moment, we run our business in Poland, where we have over 70% market share. At the end of October 2017, we were officially licensed by the National Bank of Romania to operate in Romania and we want to start our operations there in max a few weeks. Our plans are not limited to Romania – we want to expand soon our presence to other countries in the region.

What distinguishes Aforti from other loan originators in the region?

We operate very quickly, much faster than our competition. We are in a position to do that without losing the quality of loans cause we implemented a significant number of automated processes in the area of assessing the customer’s creditworthiness using internally prepared scoring. Also, we are in a position to grant a loan needed to pay off the client’s liabilities in ZUS (Social Insurance Institution) or unpaid taxes. Such purposes of the loan are unacceptable for most of our competition. Allowing that we help entrepreneurs to improve their financials and at the end to enable cooperation with banks. For us, it translates into a growing number of satisfied customers, more recommendations of our services, and finally into better financial results and bigger dividend for our shareholders.

Who is a typical customer of Aforti?

Almost 80% of our clients run their business for more than 24 months, and more than half of them – over 48 months. We do not offer our services to newly established entrepreneurs. The average age of our entrepreneur exceeds 40 years. These people – before starting their own business – have gained experience in other companies. A typical client runs its business as a sole proprietorship, focusing its activity on trade (wholesale and retail), transport, storage or construction.

What are the products presented in your offer?

We offer unsecured loans to the sole proprietorships and limited liability companies. In both cases, the maximum loan value is 150k PLN, and the maximum loan maturity is 36 months. In our product portfolio, there is also mortgage loan and in this case, it is possible to obtain financing up to 500k PLN, LTV up to 70%, for a period of up to 60 months. The average value of granted loans amounts to 86k PLN, and the average maturity is 18 months.

How was 2018 for Aforti and what are your plans for 2019?

2018 was another year of strengthening of Aforti Finance position in the area of B2B loans for small and medium enterprises.

In 2018, over 3,820 loan applications were submitted for an amount of PLN 479 million, which means over 50% growth comparing to the previous year. In terms of sales numbers, we granted loans worth over PLN 59 million, beating last year record in terms of volumes and the number of loans.

Currently, we are the leader on the Polish B2B loan market (loans granted by non-banking financial institutions) and we intend to maintain this position in the coming years. Talking about further expansion and business development – in November 2018 we’ve obtained a license granted by the National Bank of Romania allowing us to start our operations in this country. Likewise, as soon as possible we want to start our operations in other “low entrance costs” countries in the region.

What are the benefits for investors to invest in loans issued by Aforti?

From the 3 most important features of every investment (profitability, liquidity, risk level), we put all our efforts on the last one: lowering risk. As described on previous pages, before we grant a loan – we thoroughly verify involved risks including the activities carried out by the customer. Our target is limiting to the minimum or even eliminating the risk of frauds. Nevertheless, we understand that running a business always involves risk – so even the best scoring systems will not provide a 100% loan repayment guarantee. Therefore, regardless of the period for which we provide financing, we give to the investor a guarantee of buying back loans offered on the Debitum platform in case, when a borrower is more than 60 days late with the payment of their obligations to Aforti Finance. As a result, investors limit their risk level to the risk related to Aforti Finance, not to the borrower.

What are your expectations for cooperation with Debitum Network?

The most important for Aforti Finance is to build long-lasting and fruitful cooperation. As we plan to significantly extend the size of our operations, we need to be supported by a partner, who understands our needs, is technically and operationally advanced, and also has the scale of the business big enough to secure our financing needs. We believe Debitum Network can become such a partner.

The first assets from Aforti Finance are coming soon

The first assets from Aforti Finance will soon be uploaded on Debitum Network platform and investors can start investing in them. The assets will be short term with an annual interest of 11%-12%. All of them have a buyback guarantee. Got interested? Be the first one to invest in the assets and earn attractive interest.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Creditinfo Estonia – credit information and risk management solutions

Creditinfo Estonia, a leading service provider for credit information and risk management solutions:

We are proud to announce the expansion of our network. Last week Estonian leading service provider for credit information and risk management solutions Creditinfo Estonia joined Debitum Network platform. This is the third credit risk rating agency onboarded on our platform, and it will help us to provide an accurate risk rating for business loans uploaded on the platform from Estonian SMEs. The credit rating provided by Creditinfo Estonia will help our users to better understand the creditworthiness and risk category of companies whose assets are available for investment on our platform.

Debitum Network is a decentralized marketplace that connects various parties in the lending process from local markets. With the expansion of our platform to other markets within the EU, we expect to onboard a lot more counterparties to facilitate the lending process. Creditinfo Estonia is a valuable partner that has extensive experience in risk rating and will help us to deliver a more qualitative lending service by providing a more precise and up-to-date credit risk assessment for the assets uploaded on our platform.

About Creditinfo Estonia

Creditinfo Estonia (AS Creditinfo Eesti) is a subsidiary company of a leading service provider of credit information and risk management solutions worldwide Creditinfo Group and it aims to decrease financial risks of companies and private persons.

Over 25 years of experience has made Creditinfo Estonia a market leader making it the largest and the most professional provider of credit information. They have a variety of reports on Estonian companies to choose from: Credit Report, Credit Opinion Report, Annual Accounts, Beneficial Owners, Group Reports, Company Valuation, Commercial Registry Report and International Reports.

Creditinfo Estonia also administers Estonian Credit Register which was established by Estonian banks in 2001 with the purpose of protecting companies from repeated debtors and to improve people’s payment discipline.

Creditinfo rating

Creditinfo rating is a summary grade given to companies by Creditinfo Estonia based on the company’s economic and financial situation and payment behavior. It helps other businesses to assess both general and the financial situation of a current or a prospective partner/ client and compare it with other companies. Creditinfo Rating is trusted by the largest Estonian companies and banks.

Every year, Creditinfo Estonia gives an automated rating to all companies, which have submitted an annual statement.

More partnerships coming

We are happy about the great partnerships that we have. More preliminary agreements are being prepared and we are going to see new partnerships develop, which will further improve the quality of the lending and investing process on Debitum Network platform. Partnership with Creditinfo Estonia helps Debitum Network to function more effectively in financing SMEs around the world. Stay tuned for more news from Debitum Network!

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Risk rating company CrediWeb joins Debitum Network platform

Risk rating company CrediWeb joins Debitum Network platform

It is great to announce the expansion of our network. We are very excited as a new credit rating company CrediWeb from Latvia has joined Debitum Network platform. This is the second credit risk rating agency cooperating with us to provide accurate risk rating for business loans uploaded on the platform. We believe this partnership will help us provide our users with an even better product. From now on, CrediWeb will provide a risk rating for assets from Latvian loan originators.

Debitum Network aims to be a decentralized marketplace connecting additional parties in the lending process. With the expansion of our platform to other markets within the EU, we expect to onboard a lot more counterparties to facilitate the process. CrediWeb is a valuable partner that has extensive experience in risk rating and will help us to deliver a more qualitative lending service by providing a more precise credit risk assessment for the assets uploaded on our platform.

About CrediWeb

CrediWeb, in cooperation with licenced re-user SIA Crefo Rating, provides online access to information from the Register of Enterprises of the Republic of Latvia, providing clients with the most actual information and changes, which are updated along with changes registered in the Register of Enterprises.

CrefoScore for risk rating

Latvian largest companies trust and use CrediWeb solvency index CrefoScore to assess the financial position of potential or existing business partners or clients. Index accurately and clearly shows the probability of default. CrefoScore is their unique solvency rating and one of the most important components of the report – showing the probability, at which the company will be unable to pay its debts in the next 12 months. CrefoScore is calculated on a daily basis for every Latvian company, taking into account various factors, such as financial data, credit history, and other economic and financial components.

We understand the importance of versatility and, therefore, we are working to bring in more partners on our platform: loan originators, risk assessors, and debt collectors. Partnership with CrediWeb brings us closer to an effective financing ecosystem for the financing of SMEs. Stay tuned for more upcoming updates!

Ready to invest in low-risk loans for SMEs?

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Meet Debitum Network partner Debifo

Meet Debitum Network partner Debifo

Debitum Network pursues the goal to have a decentralized lending marketplace platform, which would involve as many professional businesses, institutional and private investors, as well as qualitative third parties providing services such as risk assessment, insurance, and debt collection. One of the parties is loan originators that put invoices or business loans for investors to invest in on the platform. Debifo is one of our partners and loan originators. Get acquainted with them!

Brief history and achievements

Debifo was established in 2015 and since then, it has been providing smart working capital solutions (short term loans) for small and medium-sized businesses (SMEs) in Lithuania. In 2016, Forbes singled out the company as top five European fintech Startups to watch in 2016. And they have justified the image of a firm to be watched. Since the inception, Debifo has financed over 20 million EUR worth of invoices. Companies working with them are happy with the provided service and 97% would recommend their invoice financing service to others. In 2016 it was nominated the financial service of the year in Lithuania.

The company uploads assets on the platform of a well established P2P lending platform of Mintos. Here is some statistics on Debifo involvement on Mintos platform:

- Total amount of loans originated: 53 million Euros

- Loan portfolio: 6.5 million Euros

- Loans outstanding on Mintos: 0.53 million Euros

- Net annualized return: 11.2%

- Skin in the game: 5% (percentage of the originated loans that they have stake in)

Common business vision – SMEs remain underfinanced

In Lithuania, small and medium-sized (SMEs) comprise 99.6% of all entities. SMEs are the heart of the economy and only a small part of them have sufficient funding. The same is true for SMEs around the world. In EU, the number is 99.8% of all firms. Unfortunately, they lack access to funding and as a result, their growth is capped.

Debifo is offering an alternative financing product for the Lithuanian market – invoice financing. The mission of the company is to help SMEs expand their businesses and manage their cash flows. Debitum Network has the same vision. It serves as a marketplace connecting SMEs, investors and third parties around the world to fill the gap of underfunded small and medium-sized businesses. Debitum Network and Debifo work in unison to make borderless financing of SMEs possible, not just locally, but also, globally.

Advantages over traditional banking factoring

The Debifo system gives clients the opportunity to free up vital working capital that is ‘frozen’ in long payment terms. Small business owners can take advantage of Debifo’s financing services to turn a payment term of 30–120 days into just a few days.

Debifo invoice financing has numerous advantages over the factoring services provided by banks. Debifo does not require long-term contracts or collateral and has no hidden fees. After completing a short registration form, clients can raise invoices for financing and receive the funds they need within a few days. The same procedure with the banks would take businesses 1-2 weeks. If young businesses can prove sales revenues exceeding 30 000 Euros, provide services and goods to other businesses and have been in business at least 6 months, they would not have problems with getting funds. On the other hand, banks would not finance companies that have short business history, lack of real estate collateral or personal guarantee.

Amount of value of invoices on the platform and the benefits of it

At any given time, the total amount value of invoices Debifo provides is around 0.5 million Euros. As invoices are repaid, new ones are uploaded and so the possibilities for businesses to be financed never ends. Everybody participating in financing can benefit greatly. Other benefits include:

- SMEs can get funding faster

- Investors and companies from around the world can participate in the financing process of local and global SMEs

- Investors/companies that fund SMEs earn higher returns (annual interest of 7-11%)

- Investors/companies contribute to the growth of SMEs around the world

- Investing in short term loans is a good way to diversify

- Investment amounts are flexible as no one must cover the entire loan

- Third parties can get attractive compensation for their services

- Flexible choice of portfolios: conservative, moderate, aggressive

- No collateral for SMEs necessary

Types of assets

At any time, Debifo has around 30 assets on our platform. As they are repaid, new ones are uploaded. At the time of writing there are 23 assets and the industries that dominate in those loans are: Logistics, Wholesale, Services and Manufacturing. Repayment periods vary from 1 to 130 days. The range of amounts are from 4000 Euros to 46 000 Euros. Investors can pick any asset and invest a flexible amount. The minimum is 10 Euros. Below is the example of an asset. If you want to find out what each item on an asset bar means, read this post.

Got interested?

Disclaimer: It is important to point out that the approach presented here is not necessarily suitable for everyone and is presented for information purposes only. It is not intended to be investment advice. You should seek a duly licensed professional for investment advice matching your specific situation.

Rising Importance of Third Parties in Lending Process

Rising Importance of Third Parties in Lending Process

Recently, the need for third-party vendors for giving out a loan has been rising. More and more different processes are being incorporated into proper loan management. As it is too difficult for the financial centers to take care of the whole process themselves, they keep third-party vendors in the loop. Even so, the relationship between the loan giver and the taker stays cordial. In case of any issues regarding insurance, assessing risks, or debt collection, third-party vendors, step in to help settle them. Such mediation helps financial centers to ensure smooth coordination with the clients. Whether it is insurance, risk management, or debt collection, an unbiased institution helps to create a win-win situation for both the client and the lender.

1. Insurance

Insurance regulations are very particular, and often unique, in each case. With the help of a third party, it can be assured that none of those are overlooked. Additionally, they ensure that policies purchased by the customers match with the criteria. In cases when they do not, they help to develop an agreement fit for both parties. As a result, any future disputes over claims is eliminated.

2. Risk Management

To offer an effective policy for a certain individual, risks must be calculated. As there is much specific information, risk management is therefore performed by a third party. Based on client’s history, collateral, location, performance and so on, these third-party vendors come to the relevant decisions. As handling such information requires in-depth knowledge, businesses choose to outsource this service for a faster and more accurate risk assessment providers. Also, several providers may provide a broader spectrum of analysis and give a 360-degree view.

3. Debt Collection

To offer the best possible service for clients while maintaining profitability, companies are trying to keep their workforce to the minimum. Thus, debt collection is becoming quite a difficult. The most complicated part of this process is following up with loan defaulters as the complications are very specific. In such cases, it is more sensible for financial institutions to leave the matter in the hands of the third parties who specialize in the field and are localized. This approach helps to ensure that the problem is sorted quickly, following the local legislation and with minimum losses.

The Benefits of Third Parties

To guarantee a good use of the employment of third parties into the processes, specific guidelines must be followed. While not all the companies do that yet, those who do, unquestionably make processes easier and more efficient, which consequentially results in better overall service for the client.

Debitum Network Platform enables multiple third parties to be participating and providing competitive services to borrowers and lenders. Each provider will go through and check procedure ensuring, or requirements are met. Also, service providers will be rated thus giving everyone a chance to not only evaluate investments but service providers as well.

You can read more about the rating in our blog post Trust Rating: Debitum Network and KTU partnership.

Credital and Debitum Network partnership details

Credital and Debitum Network partnership details

A month ago we announced our partnership with Credital. Now it would be a good time to explain a bit more about this in detail. This partnership works great for both parties.

Credital is an alternative lending company. They provide business loans to SMEs in Lithuania. Their core focus as a lending company is making loan issuing process quick and simple.

Credital is our first “institutional borrower” in the Debitum Network ecosystem. They will place individual loan requests on our p2p platform, to get access to additional services and lenders that are available in the Debitum Network. This will enable Credital to push their current operations even further and become faster and more efficient in providing services for their clients. Currently, the financing process will be done manually with support, guiding each transaction.

For Debitum Network this is a much welcome kickoff in the real-world financial transactions. Our team will be able to analyze, apply and test different functionalities, features, processes. It will give a deeper insight into market needed tools and potential integrations. After getting feedback we will be able to choose and adapt our process to match both: technological and business needs.

Here is the total summary of the 101,000€ portfolio they are onboarding:

Trust Rating: Debitum Network and KTU partnership

Trust Rating: Debitum Network and KTU partnership

We are pleased to announce our newest partnership with Lithuania Kaunas University of Technology (KTU). KTU will take part in the development of Debitum Network Trust rating calculation algorithm for ecosystem community members.

KTU was established back in 1922, since then they are working on a sustainable partnership between science and business developing and implementing new ideas, innovations, and inventions. As lending highly depends on the investors’ confidence in the borrower’s ability to repay on time as well as other ecosystem members’ ability to properly perform their tasks, Trust becomes one of the core pillars in the ecosystem.

We are working on to develop reasonable, reliable and objective Trust rating calculations for all the counterparties – borrowers, risk assessors, investors, debt collectors and other.

Currently, Debitum Network assesses the reliability and quality of all ecosystem members. This is not a long-term solution and thus an independent third party evaluation is needed.

During the development of version, ABRA Trust rating calculation rules will be semi-automated. How will it work? When the process for particular loan ends, for all members involved in the particular loan Trust rating will be updated according to the algorithm. Rating calculation will be based on transactions and activities executed by the party. Trust rating could be increased in case of successful execution of an obligation and decreased if one failed to deliver service.

Trust algorithm will also reflect the number of successful transactions, feedback from other parties, number of disputes, total transaction volume, etc.

As Trust rating will be based on historical performance, which could be collected only after a certain period of time after launch, we are also developing an initial Trust rating algorithm to be used for all new ecosystem members. All new ecosystem members will have an initial Trust rating assigned, based on performance in the market.

Trust rating will allow all members of the ecosystem to see the trust level of any borrower, lender, service provider at a glimpse even before they submit an order.

Trust rating will enable informed decision making. Different businesses have different requirements when it comes to trust and price. Trust rating will open the platform for all these businesses and allow them to choose themselves.

We believe Trust rating will motivate borrowers, lenders, service providers, and investors to improve quality, act responsibly and adapt to market needs when delivering services. We are planning it could define availability, price, or priority for further actions within Debitum Network to promote the best performing members of the ecosystem.