Latvian Forest Development Fund’s Q2 performance

We are sharing the latest news from one of our note issuers, Latvian Forest Development Fund (LFDF). Their second quarter results for 2025 are in, and the progress is clear, bringing them closer to their goals.

LFDF’s target is to acquire and manage a growing portfolio of local forestland, and their Q2 performance brings them closer to their goal of owning 10,000 hectares.

Strong growth in key areas

The Q2 results highlight a substantial increase in key metrics when compared to the first quarter of the year.

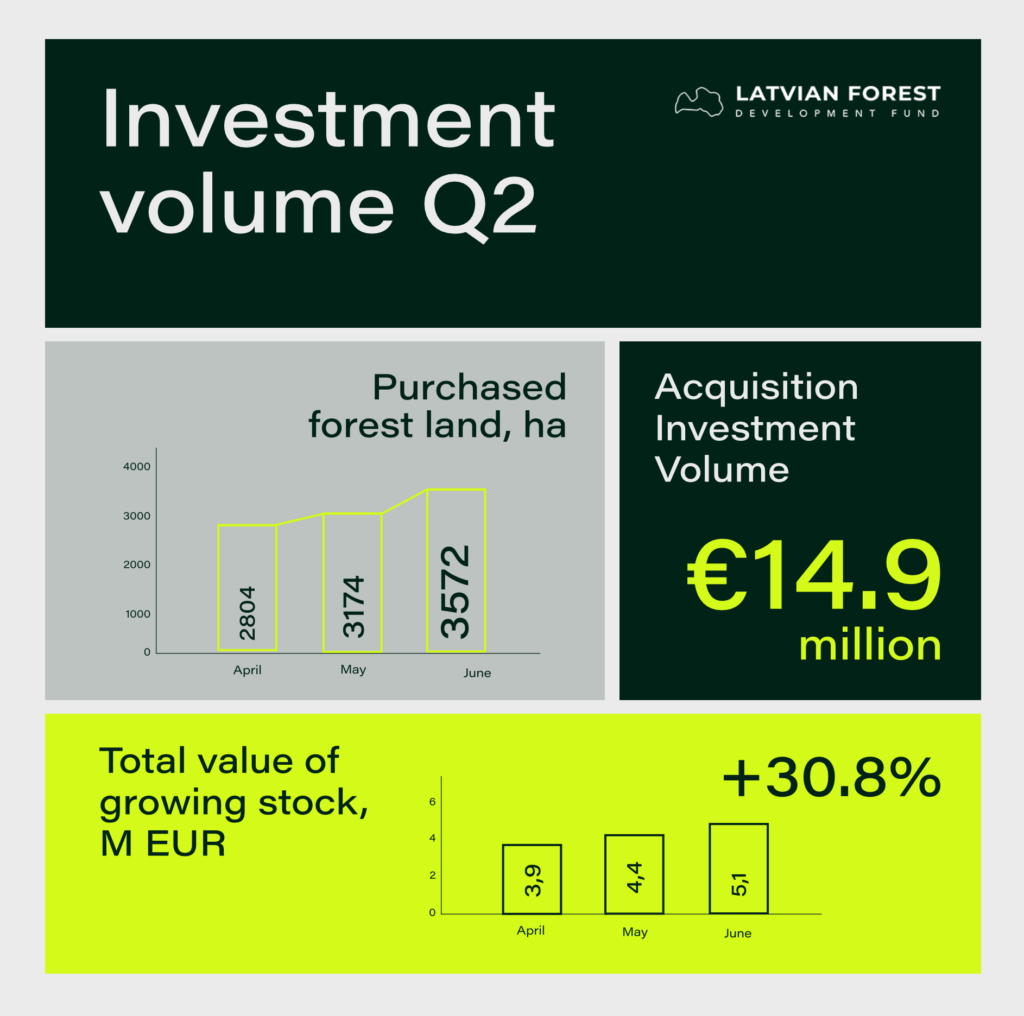

Acquisition of forest land

The total amount of Latvian forest land acquired reached 3,572 hectares by the end of Q2. This represents an increase from the 2,480 hectares acquired in Q, showing a consistent upward trend in acquisitions.

Growing stock value

The total value of the growing stock increased by 30.8% due to the additional forest area purchased and the resulting higher volume of standing timber. This positive trend reflects the natural growth of the forest assets and the successful management practices employed by LFDF.

Acquisition investment volume.

The total investment volume for acquisitions reached €14.9 million by the end of Q2. This represents a considerable increase from the €9.8 million invested in Q1, indicating a confident investment strategy over the first half of the year.

Financial overview – comparison first half year 2025 vs. first half year 2024.

– Total assets almost 4x from €4.34 million to €16.56 million, representing an increase of 281%.

– The company’s equity went from a negative – €46.242 in 2024 to a positive €1.5 million in 2025. This indicates a much stronger and more stable financial position.

– Liabilities increased from €4.3 million to €14.9 million. The company is currently in a growth and expansion phase.

– The company’s earnings more than doubled, from €44.880 to €99.431. An increase of 121.5%.

Full overview can be seen here.

These growing numbers are the result of dedicated teamwork and a well-executed plan. A big thank you goes to the entire LFDF team for their hard work and commitment, which continues to bring them closer to their long-term objective.

We would also like to once again welcome the new LFDF CEO Edgars Birks, who brings valuable experience from the forestry sector. He has played a crucial role in building Latvia’s third-largest private forest portfolio – over 50,000 hectares. We are confident that his expertise will help the company achieve its ambitious targets.

Grow your portfolio with a stable business that supports economic growth.

Take a look at the available LFDF assets here.

The charts below show the key performance indicators for Q2 of 2025.

This is a marketing communication and should not be interpreted as investment research, advice, or an endorsement to invest. The historical performance of financial instruments is not indicative of future outcomes. Investing involves risks; the value of investments may fall as well as rise. Be sure to assess your knowledge, experience, financial situation, and investment goals before investing.