LFDF and Debitum in 2025: year in review

In 2025 our financing partner Latvian Forest Development Fund (LFDF) demonstrated significant operational growth within the Baltic forestry sector. Based on unaudited financial data as of December 31, 2025, LFDF expanded both its balance sheet and acquisition capacity during the year.

LFDF operational overview (unaudited)*

According to the operating balance as of December 31, 2025:

- Total assets increased to €43 909 945 (2024: €9 314 122)

- Inventory reached €36 793 040 (2024: €8 580 935)

- Accounts receivable increased to €5 569 410 (2024: €719 006)

- Equity rose to €3 056 447 (2024: €1 479 181)

- Net profit for 2025 amounted to €1 577 266

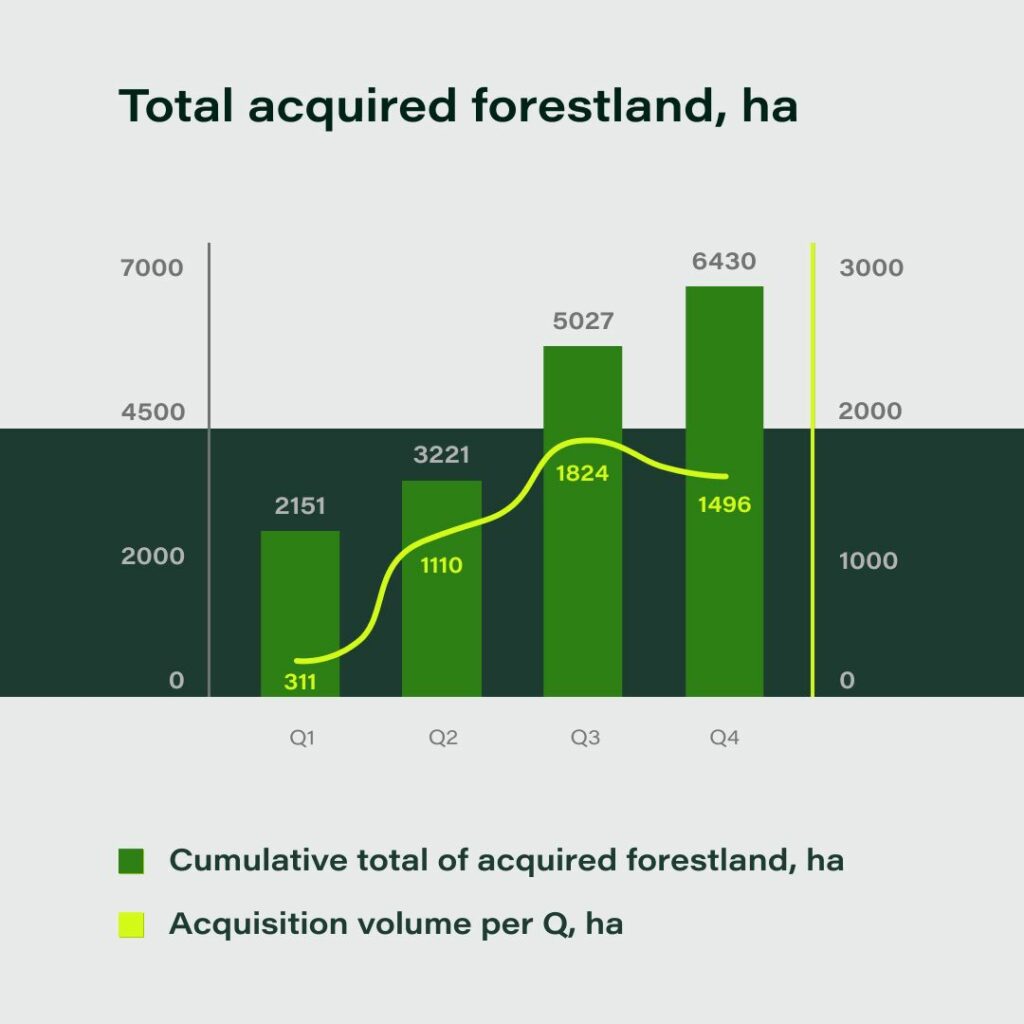

During the year, LFDF deployed €33 277 338 into acquisitions, securing 6430 hectares across 659 forest properties.

Quarterly acquisition activity accelerated over the year, with investment volumes increasing from €1.7 million in Q1 to €17.4 million in Q4.

*The above figures are based on management data and have not been audited.

Sector context

Importantly, this growth took place in a year marked by one of the largest forestry transactions in the region – the €720 million forest deal involving IKEA-related interests. The transaction reflects continued long-term institutional interest in Baltic forestland as a real asset class.

Within this broader market environment, LFDF increased its acquisition volumes and expanded its balance sheet. The year therefore represented not only growth in size, but also a step forward in operational capacity and financial strength.

Debitum investor activity in 2025

From Debitum side, 2025 also reflected continued cross-border investor engagement in forestry-backed business financing.

Top 5 investor countries in 2025, who invested in LFDF:

- Germany

- Spain

- Portugal

- France

- Lithuania

Top 3 largest individual investments in LFDF assets:

- €571 375

- €232 409

- €223 458

Average interest rate in LFDF assets in 2025 – 12.61%.

As a regulated EU investment platform, Debitum continues to provide access to business-backed financing structures, where returns are generated by real economic activity rather than consumer lending.

Partnership development

Throughout 2025 LFDF became one of the most active financing partners on the platform, expanding its operational footprint while maintaining structured reporting and collateral-backed financing arrangements.

For investors, the year reflected:

– increased deal flow;

– larger transaction volumes;

– continued geographic diversification of investor base;

– double-digit average interest rates.

At the same time, growth was accompanied by increased balance sheet size and equity strengthening on the partner side.

This is a marketing communication and should not be interpreted as investment research, advice, or an endorsement to invest. The historical performance of financial instruments is not indicative of future outcomes. Investing involves risks; the value of investments may fall as well as rise. Be sure to assess your knowledge, experience, financial situation, and investment goals before investing.