Tag: Aforti Finance

Current trends in P2P/P2B lending and where does Debitum Network stand

Current trends in P2P/P2B lending and where does Debitum Network stand:

P2P/P2B lending market has been growing by leaps and bounds since 2005 when the first lending and investing platform of its kind (Zopa) was launched. The growth started accelerating after the financial crisis of 2008 when Central Banks slashed interest rates close to zero (or even below it). Attractive interest rates offered by alternative investment/lending platforms attracted a lot of retail and institutional investors and the market has grown from 1.2 billion dollars in 2012 to 64 billion dollars in 2015. It is expected to reach 500 billion dollars by 2025 by some moderate estimates or even 1 trillion dollars. What are other trends in the market and where Debitum Network stands in relation to other similar platforms? Stay with us and find out.

More platforms are expected to join an alternative lending/investment market

According to Reuters, P2P lending is among the fastest-growing segments in the financial lending market. Alternative investments are popular with the current generation and this means more market players will join the market. The market will continue growing as distrust in commercial banks remains huge. The interest rates offered by mainstream lenders are very low, and they still do a poor job in financing small and medium-sized businesses as well as consumers. The potential for Debitum Network (a P2B investment platform) is still great as SMEs in Europe are still underfinanced and the interest in alternative investments is on the rise. Check out the credit gap for SMEs around the world.

Source: smefinanceforum.org

More bankruptcies of careless P2P lending platforms

Alternative lending platforms have to be careful who they lend money to or what loans they upload on their platforms for investment. Within the last year, 3 prominent alternative lending/investment platforms in the UK: Collateral, Lendy, and most recently Funding Secure went bankrupt. Tens of thousands of investors lost a lot of money, despite the fact, that Lendy and Funding Secure were regulated by the UK regulators. The UK is not an exception. A year ago, China underwent a turbulent period when thousands of P2P lending platforms went broke causing millions of investors to lose their money. The industry in China is close to $ 200 billion. Regulators have seriously cracked on online P2P lending platforms and only a few regulated ones will remain alive in the long run. The chart below says it all.

Source: bloomberg.com

Debitum Network takes seriously the safety of investors’ funds and therefore we have implemented a number of safety measures to ensure that. Firstly, we have a thorough screening process of potential loan originators to make sure they offer good loans with an excellent base of borrowing companies. Our risk management team follows up with a thorough investigation of the financial situation of a lender who is already onboard of Debitum Network and does responsible quarterly due diligence process. A case with Aforti Finance was an example of how the team’s work helped to avoid potential risks to investor’s funds and thus the assets of the mentioned loan originator were removed from our platform.

We have also implemented a buyback guarantee, which means that if the borrower is late with the repayment by more than 90 days, the broker who issued the loan will have to buy it back with the outstanding principal and interest. Most of the loans on our platform are with the buyback guarantee! Last but not least, we have independent risk assessors that do a risk assessment for the borrowing companies whose assets are uploaded on our platform. This type of risk assessment increases transparency, provides a more accurate risk scoring, and protects investors’ funds.

Acceptance by the mainstream

Governments around the world start welcoming fintech companies, including P2P/P2B lending/investment platforms. They seek alternatives to current established lenders (commercial banks) to increase options for small and medium-sized businesses to get funding. Thus, investing on these kinds of platforms becomes a part of recognized financial products just like the ones offered by traditional lending institutions. P2P lending has been authorized in all of Brazil since last year. Malaysia has a P2P scheme for first-time buyers. And in the US, P2P lending is regulated by the SEC (Securities and Exchange Commission). Thus, the importance of P2P/P2B lending is recognized by governments around the world.

Increase in institutional investing

For quite a while, most investors on the alternative investment platforms were retail investors who would typically invest from 50 EUR to 5,000 EUR. The trend has been slowly changing across the board. Some platforms experienced it tremendously. Lending Club, the leader in consumer loans in the US shared in their blog post the following stats. The investments from institutional investors in 2010 covered less than 5% of all investments on their platform (10 institutional investors). In 2018 institutional investors comprised 95% of all investments (200 institutional investors).

Source: Lending Club

Debitum Network has been open to both retail and institutional investors since its inception. We have seen more and more institutional investors onboard our platform and expect the trend to accelerate as more loan originators onboard our platform and investors are offered a more diverse range of assets for investment.

More regulation for P2P platforms in the near future

The unregulated environment allows for more irresponsible lenders to exist and act carelessly with investors’ funds. This means that governments will not only encourage P2P lending/investing but will step up and increase regulation over the process. This will likely weed out those that compete unfairly and strengthen those that play by the rules and responsibly. Wild West for risky investment platforms that offer high returns and no security for investors’ funds might be over sooner rather than later.

Debitum Network is currently in the process of getting a license with one of the European financial regulators. We expect it to happen before the end of the year or the beginning of next year. We want to transparent, responsible and a safe environment for investors’ funds.

With that in mind, let’s proceed to our special offer for the week.

Top asset of the week

This week want to offer you an excellent asset that comes from our partner and loan originator Factris. The borrowing company is a wholesaler of hardware equipment. It has more than 25 employees, revenues of more than 4.1 million EUR, and has been in business for more than 21 years. The purchaser of the invoice is a distributor of metallurgical products, operates in Europe and has more than 270 million EUR revenues. Does it sound good enough? Check out the asset.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Regarding Aforti Finance assets on Debitum Network

Regarding Aforti Finance assets on Debitum Network:

Please be aware that on the 25th of July, all Aforti Finance assets were removed from Debitum Network and the entire invested amount plus due interest were bought back. We have come to this decision as a result of a thorough investigation of Aforti Finance financial situation while doing the 1st and 2nd quarter follow-up due diligence process. We didn’t wait until investors possibly got stuck with unpaid repayments and nervously wait for the situation to resolve itself. We wanted to protect investors’ funds and decided to act proactively.

Our risk management team did a thorough analysis of the financial data provided by Aforti Finance and had a number of important questions to ask. Correspondence between teams lasted more than a month and as some of the important questions were not answered or were answered vaguely, we decided to suspend offering Aforti assets for investment.

Our collaboration and partnership agreement with Aforti Finance still stand. We are going to review their data for the next quarter, and if the previous worrying questions are solved we will resume accepting their assets on our platform. For the time being, no more assets from Aforti Finance will be uploaded on Debitum Network until our risk management team ensures us otherwise.

We, at Debitum Network, always look ahead and try to avoid the risks before they arise or worse, get out of control. We have a very strong risk management team and a thorough due diligence process, which should help you stay calm with your investments and security of funds. We might be too cautious, but better safe than sorry. Thank you for your trust in Debitum Network.

Best regards,

Debitum Network team

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

What are the risks of investing in short term loans on P2P/P2B platforms

What are the risks of investing in short term loans on P2P/P2B platforms

Risk/reward ratio is at the heart of each type of investment. A rule of thumb remains the same, the higher the risk, the greater the reward, the lower the risk, the lower the reward. Institutional investors seek the type of investment options that offer the highest return with the lowest risk. Risks may vary and some investments may have so many of them that it may be unwise to even consider them. A relatively new way to invest is P2P/P2B platforms. Despite criticized by the mainstream these alternative finance platforms have gained more and more popularity in recent years. Let us look and see how risky they are and how those risks can be reduced, and profit increased.

Not all alternative investment platforms are created equal

Even within the alternative lending/investment platforms, there are significant differences that may impact your risk/reward ratio. Some platforms offer personal loans to invest in, other real estate projects, others such as Debitum Network, focus on investing in short term loans for businesses (invoice financing and business loans).

Obviously, the percentage of defaults on the platforms vary greatly too. One of the leaders in the alternative lending/investment market Zopa has around 0.6% of defaulted loans, while another prominent player in the field (according to independent research) may have around 30%. In the 9 month period of existence, there has not been a single defaulted loan on Debitum Network platform. Commercial banks typically have around 1%-2% of defaulted loans.

Online platforms that offer users to invest in personal loans or payday loans may have high-interest rates: 15%-35%. However, taking into account that on some of the platforms 1 out of 5 investors may lose money, the average net return on them will go down to around 10%. It is obvious that the aspect of safety should be taken more seriously while talking about investments and returns on the platforms.

What are the risks and how can they be reduced?

A borrower may default on its’ obligations to pay off the loan and it is the biggest risk for an investor who has put money into such an asset. The invested money can be lost and never repaid.

To avoid such a scenario, a lot of (not all) platforms have implemented a buyback guarantee, which basically means that if the borrower is late with his repayments by more than 30-90 days (60-90 on Debitum Network platform. The actual number depends on the loan originator that issued a specific loan), the broker/loan originator will have to buy back the specific loan with the outstanding principal and interest. So, if a specific loan defaults, the investors’ risk is reduced to the minimum.

Another risk, that has much less likely probability of happening is when the loan originator goes default. This happens from time to time. When Eurocent loan originator (on Mintos platform) went broke, investors that invested in the assets of the loan originator, lost their money. Despite the fact, Mintos is doing everything in their power, there is little hope for investors to regain their invested balance and the interest earned on it. That’s why the buyback guarantee is as good as the loan originator that provides it. A proper selection and thorough screening of loan originators are necessary before onboarding them on an investment platform. Debitum Network selects loan originators carefully as well as their assets that are placed on our platform for investment. Due diligence parties as well as risk assessing companies do thorough risk rating defining the probability of default of the borrowing company and the loans uploaded on our platform.

Extra measures to ensure the safety of investors’ funds

Debitum Network solely focuses on loans for businesses as businesses have a higher chance of repaying the loan than private individuals. Businesses will unlikely borrow at such high-interest rates that some P2P lending platforms offer. Offering extra guarantees and taking extra risks borrowing at 20% is something that SMEs will hardly ever do. Private individuals that may take a loan for a car or a home will have to undertake very high risks that they are not very skilled at handling, thus increasing the likelihood of a potential default and consequently loss of the investors’’ money in the given loan.

P2P platforms similarly use other protection methods for investors funds. Collateral from borrowers or real estate can serve as a guarantee that in case of default, it will be used to repay the investors. However, even sold the collateral may not be enough to compensate the entire invested amount, to say nothing of the outstanding interest. Real estate in the same fashion can be an illiquid asset and it may take a lot of time to sell it to repay the investors (with no assurance that they will get the full invested amount back or due interest). In that respect, a buyback guarantee is a far superior method for protecting investors’ funds and profits and the loan originator (in case of default of a specific loan) buys back both outstanding principal and interest.

Personal guarantees from the owners of the borrowing businesses are yet another protective measure to ensure the safety of investors funds. By the guarantee, the owner of the business guarantees, that if the business fails to pay off the loan, he/they will pay it off. It is typically not tied to a specific asset. In the event of non-payment, the lender can go after the personal assets of the guarantor.

Some platforms employ third parties to do risk assessment and due diligence services. This ensures transparency and quality of services as no conflict of interest is involved. Our own Debitum Network takes these service providers from countries where borrowing parties reside and thus, risk assessment or due diligence services are more accurate due to the specialization of the party doing the services and the knowledge of the local market.

Want to invest in low-risk assets in Debitum Network?

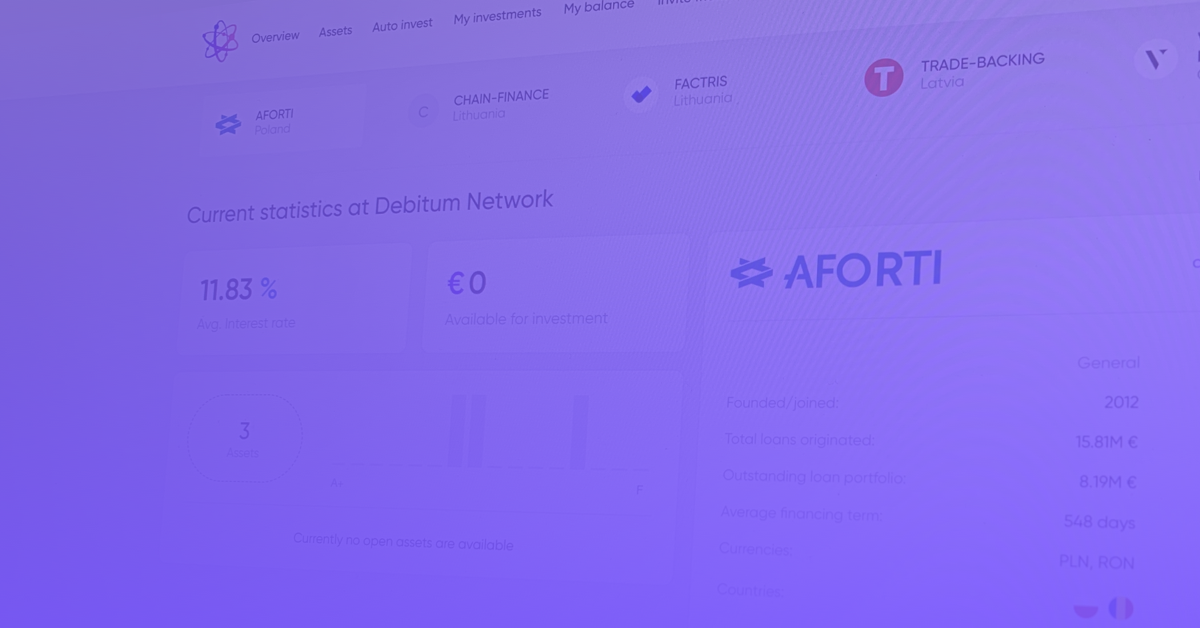

On Debitum Network we apply all available security measures to ensure investors funds’ are safe. Last week we onboarded a new loan originator Aforti Finance, who is the leading non-bank lender in the Polish market. This enables us to provide new investment opportunities, flexibility, and options to choose from for our customers. The first assets from the loan originator have already been uploaded on Debitum Network platform and you can start investing in them. They have attractive interest rates and a buyback guarantee. Check them out!

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Aforti Finance, the leading non-bank lender joins Debitum Network

Aforti Finance, the leading non-bank lender joins Debitum Network platform

Debitum Network keeps on growing and new parties onboard our platform each month. Today, we are happy to announce a new partnership as we onboard a new loan originator from Poland Aforti Finance. Aforti Finance is one of the leading non-bank lenders in the Polish market, which is one of the largest in the Central and Eastern European region. It is part of Aforti Holding, which is listed on the Warsaw Stock Exchange. We sat down to talk about the company with Tomasz Kaźmierski – the Chief Sales Officer (CSO) and the Vice President of Aforti Finance S.A. Get acquainted with our new partner!

How would you introduce Aforti to our community?

We are part of Aforti Holding – a company listed on the New Connect market being side market of the Warsaw Stock Exchange. We have been operating on the Polish market since 2014, is currently the largest non-banking financial institution providing financing to business clients, mainly small and medium enterprises. The Board of Directors team consists of experienced managers with a strong background in financial institutions as well as in non-banking companies. Therefore, in the credit assessment of customers, we implement procedures and rules similar to banking ones, which allows for skipping too risky customers. Also, we focus on process automation – which makes our offer really competitive in comparison to other market players in Poland. We offer our products through our own outlets and through dedicated Call Centers. At the same time, we work with brokers, however closing the deal is being done by Aforti Finance employees, what allows us to properly check the customer and greatly limit the number of bad loans and subsequent NPL (Non-Performing Loans).

Can you describe how your lending process works? How is it different from getting a loan in a bank?

Our process is pretty simple but precise and accurate. Also, what is important for our clients, it is really fast. As soon as we receive a client’s documents, we begin the analysis involving an automatic check of the client in external scoring databases (including bank databases), where our potential client shall be verified. In addition, we automatically process bank statements using specially designed software that ensures their authenticity. We can close the entire decision process in 4 hours – we meet the expectations of the client who expects decisions as soon as possible. If the amount of the loan granted meets the client’s expectations – we arrange a meeting with our verifier, who meets with the client in the place of his business to verify and confirm originals of all previously provided documents, including bank statements. Also, we visually verify client’s business activity, which allows us to eliminate almost any potential frauds and extortions in this area. No bank on the Polish market operates so fast while maintaining such high-security standards in parallel.

Which markets do you operate in and what are your plans for future expansion?

At the moment, we run our business in Poland, where we have over 70% market share. At the end of October 2017, we were officially licensed by the National Bank of Romania to operate in Romania and we want to start our operations there in max a few weeks. Our plans are not limited to Romania – we want to expand soon our presence to other countries in the region.

What distinguishes Aforti from other loan originators in the region?

We operate very quickly, much faster than our competition. We are in a position to do that without losing the quality of loans cause we implemented a significant number of automated processes in the area of assessing the customer’s creditworthiness using internally prepared scoring. Also, we are in a position to grant a loan needed to pay off the client’s liabilities in ZUS (Social Insurance Institution) or unpaid taxes. Such purposes of the loan are unacceptable for most of our competition. Allowing that we help entrepreneurs to improve their financials and at the end to enable cooperation with banks. For us, it translates into a growing number of satisfied customers, more recommendations of our services, and finally into better financial results and bigger dividend for our shareholders.

Who is a typical customer of Aforti?

Almost 80% of our clients run their business for more than 24 months, and more than half of them – over 48 months. We do not offer our services to newly established entrepreneurs. The average age of our entrepreneur exceeds 40 years. These people – before starting their own business – have gained experience in other companies. A typical client runs its business as a sole proprietorship, focusing its activity on trade (wholesale and retail), transport, storage or construction.

What are the products presented in your offer?

We offer unsecured loans to the sole proprietorships and limited liability companies. In both cases, the maximum loan value is 150k PLN, and the maximum loan maturity is 36 months. In our product portfolio, there is also mortgage loan and in this case, it is possible to obtain financing up to 500k PLN, LTV up to 70%, for a period of up to 60 months. The average value of granted loans amounts to 86k PLN, and the average maturity is 18 months.

How was 2018 for Aforti and what are your plans for 2019?

2018 was another year of strengthening of Aforti Finance position in the area of B2B loans for small and medium enterprises.

In 2018, over 3,820 loan applications were submitted for an amount of PLN 479 million, which means over 50% growth comparing to the previous year. In terms of sales numbers, we granted loans worth over PLN 59 million, beating last year record in terms of volumes and the number of loans.

Currently, we are the leader on the Polish B2B loan market (loans granted by non-banking financial institutions) and we intend to maintain this position in the coming years. Talking about further expansion and business development – in November 2018 we’ve obtained a license granted by the National Bank of Romania allowing us to start our operations in this country. Likewise, as soon as possible we want to start our operations in other “low entrance costs” countries in the region.

What are the benefits for investors to invest in loans issued by Aforti?

From the 3 most important features of every investment (profitability, liquidity, risk level), we put all our efforts on the last one: lowering risk. As described on previous pages, before we grant a loan – we thoroughly verify involved risks including the activities carried out by the customer. Our target is limiting to the minimum or even eliminating the risk of frauds. Nevertheless, we understand that running a business always involves risk – so even the best scoring systems will not provide a 100% loan repayment guarantee. Therefore, regardless of the period for which we provide financing, we give to the investor a guarantee of buying back loans offered on the Debitum platform in case, when a borrower is more than 60 days late with the payment of their obligations to Aforti Finance. As a result, investors limit their risk level to the risk related to Aforti Finance, not to the borrower.

What are your expectations for cooperation with Debitum Network?

The most important for Aforti Finance is to build long-lasting and fruitful cooperation. As we plan to significantly extend the size of our operations, we need to be supported by a partner, who understands our needs, is technically and operationally advanced, and also has the scale of the business big enough to secure our financing needs. We believe Debitum Network can become such a partner.

The first assets from Aforti Finance are coming soon

The first assets from Aforti Finance will soon be uploaded on Debitum Network platform and investors can start investing in them. The assets will be short term with an annual interest of 11%-12%. All of them have a buyback guarantee. Got interested? Be the first one to invest in the assets and earn attractive interest.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.