Tag: available capital

Earn stable returns with diversification on Debitum Network platform

Earn stable returns with diversification on Debitum Network platform

Minimizing risk and increasing reward ratio makes for a successful investment strategy in the long haul. ‘Do not put all of your eggs in one basket’ cliche clearly conveys the importance of diversification. Investors should not rely upon a single investment with a futile hope that it will somehow perform well. The way to reduce risk is to spread it over a lot of assets in a portfolio. How can it be done? What benefits does diversification have and how you can take advantage of them on Debitum Network platform?

|

Diversification helps you to minimize loss |

One investment may perform poorly over a specific period of time and if you have built a large portfolio with many assets in it, the other investments would perform better. It would decrease the potential loss and even increase profits on the aggregate of your investments.

If an investor fails to diversify among various risk classes he may suffer the losses that the specific asset class is vulnerable to, for example, stocks to market cycles and specific conditions of the market sector they belong to. We, at Debitum Network, care about the safety of investors’ funds and, therefore, encourage investors to diversify among various industries and specific assets in the industries on our platform: Wholesale, Manufacturing, Logistics, ITT, Retail, Services, Health and etc. Similarly, an investor can diversify among the assets from existing loan originators: Factris Lithuania, Chain Finance, TradeBacking or Aforti Finance. With the minimum investment amount of just 10 Euros, an investor can spread the amount of 200 Euros into 20 different assets and all existing industries on the platform.

|

It preserves your capital |

Inflation eats away your earnings as well as savings if you do not increase our funds by investing them. Diversifying your investments among various risk classes helps you to preserve your capital. Funds spread over a number of assets helps you to protect against adverse market conditions in specific sectors when others are in greater shape.

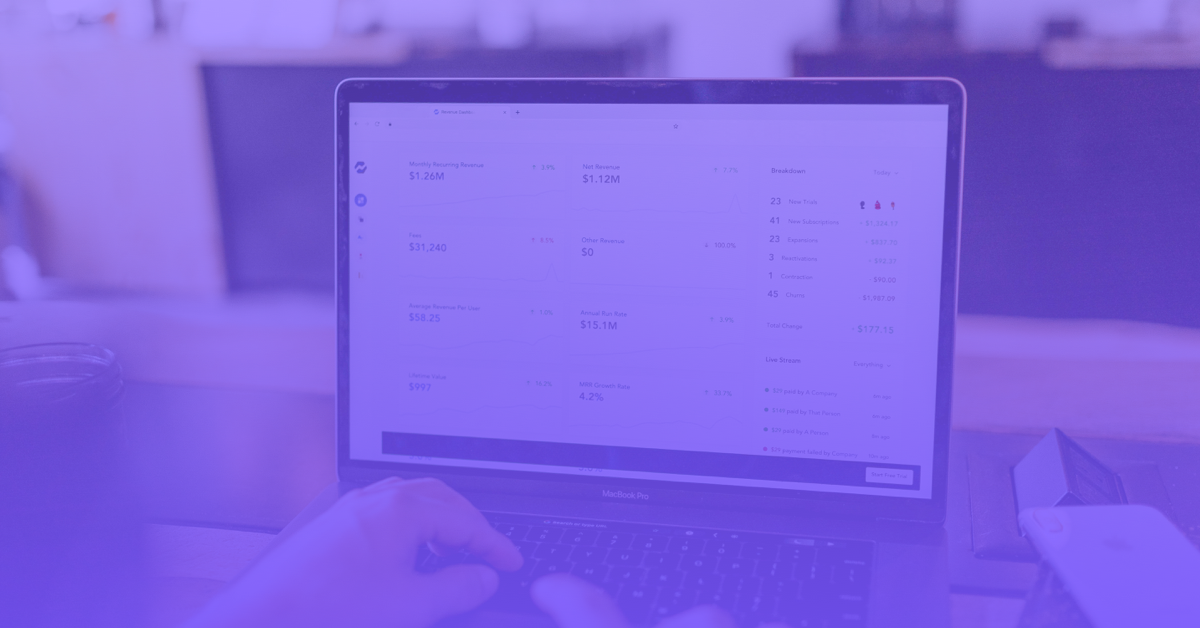

If you invest on Debitum Network platform, you can spread your investments across a number of industries and assets. By doing that, you will not have to worry about repayment of one or another asset, or if some specific loan defaults (very low probability as not a single default on Debitum Network platform in 8 months). Taking into account, that average annual returns on our platform stand at 9.72%, choosing diversification with us might help you to beat inflation and earn extra, more than using most of the popular traditional investment/diversification. Refer to the chart below!

|

Investors hedge their portfolio by diversifying |

Hedging is one of the ways to grow your portfolio when assets in one market sector crumble and start showing negative values. If you choose assets from 2 different industries on our platform, let’s say Construction and Wholesale, you may see different results in specific investments. One asset can be late due to seasonality effect, the other does great with the repayments coming as scheduled. Thus, you hedge against risks that are characteristic in specific market areas.

Good news is that with Debitum Network, it does not matter which industry asset is from as we have implemented safety measures to protect investors’ capital with a buyback guarantee. It means that if the borrower is late with the repayment by more than 90 days (it depends on the loan originator who issued the loan), the loan originator of that specific loan will have to buy back the outstanding principal and interest on the loan in full. Plus, late loans have penalty rates, that help you to earn extra profits if a specific loan is late. So, at Debitum Network, with the help of buyback guarantee, we help you to hedge against various risks and retain your earned profits in case of a bad loan.

|

Diversification helps to increase your returns |

When you keep all of your balance invested and spread over a wider variety of assets, this increases your potential to increase your returns exponentially. Annual interest rates among various assets on Debitum Network platform are 9%-12%, with the average interest rate paid to investors – 9.72%. With the increase of assets and annual interest rates on the platform, investors can increase their investments by adding more assets to their portfolio and generating bigger returns as a result. As funds are protected under a buyback guarantee and earned profits with the existing balance can be reinvested into even more assets, investors’ returns grow steadily. And if an investor has an active auto-investor plan, he can sit and watch how the interest earned starts compounding.

Check out the asset from Debitum Network platform for diversification

If you are interested in diversification of your investments other than the most traditional ones such as stocks, commodities, bonds and etc., we invite you to check the assets on our platform. To help you with that, we have chosen one for you. It has an annual interest rate of 10.5%, an excellent credit rating of A-, a buyback guarantee, and a penalty rate of 2% (in case the loan becomes late). The borrowing company specializes in the re-sell of authentic branded products for customers in over 100 different countries. It has over 50 employees and over 500,000 EUR in revenues.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Available capital should never stay idle

Available capital should never stay idle

Investors and smart money are in constant search for good options to invest their capital with as high expected returns as possible and as minimal risk level as possible. Despite the fact, that risk and safe hardly ever walk together, historical records show that above average returns abound in newly established markets and financial assets that within a couple of years from their introduction tend to become a boom.

Research, likewise shows that the vast majority of investors ignore sound principles of diversification. Keeping all eggs in one basket or rather one kind of eggs (even safe ones) in the same basket is a common mistake most people make while deciding on how to deploy available capital for investments. Others sit on cash and keep their money in savings accounts and no wonder, inflation slowly, but surely eats away their capital. Taking the above mentioned into account, making available cash work for you, becomes an imperative rather than an alternative.

Investing for the long term often involves systematic risk or market risk related to specific investment. Systematic risk incorporates factors that are common for the whole country or industry (e.g., cryptocurrencies): interest rates, regulation changes, recessions, and wars, among others. They can be mitigated only by incorporating assets from multiple markets, including short or medium-term ones into their portfolio.

We also want to state that opinions presented here should not be regarded as investment advice, but it is given for informational purposes. You should seek advice from a licensed professional that would be able to match your specific needs.

Doing things “the old way” versus alternative investments

There probably are as many ideas about safe, secure and profitable investments as there are investors around. It is obvious that available capital should be diversified proportionally, taking into account risk tolerance, various market sectors and expectations for possible returns. Mutual funds and other “packaged” investment solutions sold by financial institutions is one way to mitigate political, macroeconomic and currency risks. The rising wave of web-based peer-to-peer financing platforms and other distributed solutions provide an even more affordable and transparent alternative, despite riskier, but with much higher expected returns.

The focus of markets shifts to new blockchain driven companies

As returns steadily decreased with most hedge funds and other active investors after the 2008 crash, interest in alternative investments, particularly, blockchain driven companies, and their ICOs have risen. The promise of “alpha” returns is now attracting more and more of investing communities to take a more active part in blockchain space.

There are around 75 funds that have created portfolios out of a basket of digital currencies. No wonder why! Venture capital firm Mangrove Capital Partners did research and posted their results on Business Insider, which shows that if one had blindly invested €10,000 in every new alternative finance project, including the significant number of those that failed, this would have delivered a 1320% return.

The meteoric rise of new start ups

The year 2017 witnessed a spectacular rise in popularity in new type of startups. More than $2 billion was raised in the year. Companies that run on blockchain technology, their startups have become major receivers of funding greatly surpassing that of VCs that are based on a traditional and centralized business model. As a result, even more risk-averse hedge funds and investment banks started expressing an interest to invest in startups connected to blockchain. The trend of the meteoric rise of a new type of startups connected to blockchain is getting even stronger in 2018 (with $6 billion raised so far, and 86,000+ projects being in progress now) even though the price of digital currencies collapsed at the beginning of the year. Even JPMorgan Chase admits it is a real decentralized blockchain revolution.

Business schools and universities are also overwhelmed by the boom and they are rushing to introduce new courses on blockchain and currencies. Interest from mega-companies, such as Google, Amazon, and Microsoft are increasing steadily as they want to have a share in this futuristic technology too. P2P and B2B platforms such as Debitum Network, Mintos, Bondora, Twino, Funding Circle, Lending Club or Assetz Capital are on the rise too.

Prospects of decentralized blockchain companies

Some hedge fund managers liken businesses built on blockchain to internet companies in the early 1990s. There was a lot of risks involved for investors back then and we know for sure that a lot of internet companies are no longer around. However, those that remain have risen 1,000% or even 3,000%. We may state that the same thing is in the early stages in blockchain industry. Neglecting the area essentially means missing your chance to invest in future “Apple”, “Facebook” or “Google”.

Investors should strive to maximize return within acceptable risk boundaries with minimal effort in the medium – to – long run. None of us knows for sure what companies built on blockchain will be attractive in 20 years. Moreover, even if blockchain will exist at all by that time. However, they are here now and the returns they offer far surpass the ones offered by investment choices that have been there for decades or even more.

How are we different from other blockchain based businesses?

Alternative finance has undertaken to fill in the gap of credit, mostly by means of internet and P2P platforms. However, a clear majority of those operate in single or limited markets and quite often in most developed countries such as USA, Great Britain or other rich EU countries. Debitum Network has created another way that would enable to connect various local communities around the world with global finance in a decentralized and trustworthy way in 50+ countries!

Our value proposition compared to other similar investment opportunities

- High-liquidity: most of the loans on Debitum Network will be short-term (up to 6 months). Hence potential investor is ensured a quick capital turnaround with a possibility to exit Debitum Network at any point.

- Diversification: from day one we will offer business loans in invoice factoring as well as regular business loans (collateral or third-party guarantee). It is also possible for an investor to diversify among all available assets by financing a small part of each separate business loan. It is not obligatory for one lender to finance one project. Investments are made by a few or many more individual or corporate lenders from around the World.

- Flexibility: an option to invest any amount you want – each asset on the platform allows partial investments. This adds flexibility for investors and ensures quick investments.

- Blockchain environment: Debitum Network is a successful project that raised more than 20’000 ETH and received appraisal reviews from Clif High, Jsnip, Suppoman, Lex Sokolin and many more.

- Our experience: Debitum Network is based on our outstanding business experience in alternative lending from Lithuania (invoice finance portfolio of more than 5M EUR with invoice turnover of more than 50M EUR). Three years in a row ranked fastest growing business and featured on Forbes as well as Fintech News in Switzerland.

The cycle of the financing process

Financing process of SMEs is decentralized, not a locked one as it usually is in a traditional banking system where a single institution performs all the necessary steps in providing a loan. Starting from application for a loan on blockchain driven platform to the final stage when principle loan with interest is paid back by the borrower, each step will be marked by creation of a contract, followed by another contract in a chain of blocks, where everybody will be able to see each consecutive step is taken and a specific counterparty providing service and implementing necessary steps for that specific stage. The end of the process will automatically trigger Trust Arbitrage Rating contract where each counterparty and community will get evaluated.

Stages

- Pre-qualification and application: First-time borrowers are pre-qualified to ensure their compliance with minimal conditions before joining Debitum Network.

- Asset verification and risk assessment: Verifiers check if the asset corresponds to the description. Risk assessors evaluate loan application, available collateral and estimate risk.

- Insurance: Insurers may be used to ensure the future investors against the default of the borrower and guarantee partial or full repayment of the loan.

- Funding: Investors assess available information and choose to finance one or multiple loans.

- Secondary market: Current investors can sell their investment in a loan; new investors can buy it.

- Collection: Debt collection is fully paid by a borrower or debt collection process starts.

- Trust Arbitrage: Trust arbitrage smart contract updates trust rating and defines further conditions for all involved counterparties.

Final Thoughts

If there is one thing certain when thinking about the future, it is that things rarely remain constant. And just like the supply of funds from investors is rising, demand for financing from SMEs is growing too. This growing economy provides ample opportunities to invest. Take your time to think whether you want to diversify your investment portfolio by financing SMEs around the globe and become part of a global revolution shifting financing model towards more decentralization, transparency, and efficiency.