Tag: Funding Circle

Buyback guarantee and its’ importance in online lending

Buyback guarantee and its’ importance in online lending

In P2P and P2B lending platforms a buyback guarantee is a guarantee provided by a loan originator regarding a specific loan. If repayment of that particular loan is delayed by more than a specified number of days (typically from 30 to 180), then the broker (loan originator) is obligated to buy back the loan by fully or partly compensating investors for their remaining principal invested as well as outstanding interest. Platforms differ on the percentage of principal returned and the amount of interest paid.

In a way, it resembles an insurance system, albeit for loans on p2p platforms. Thus, if the borrower fails to pay off the loan in time, it will be bought by the broker (loan originator), so the investor will not lose the money and in most cases, the accrued interest will be returned too.

How investors get liquidity in online lending?

Understanding how investors get liquidity is important as on some platforms loan maturity for loans may be a few years and if investors on those platforms invest in loans, they effectively become longer-term lenders themselves. As in most cases, they cannot get out of their positions and access their capital in a predefined time of the loan by agreement, any investor would want to know how liquid the assets he invests in are and if his capital is protected in case the borrower defaults.

Sure, certain platforms offer a secondary market as a viable option for investors to sell their stake in loans. At the time of writing only 29% of all investors on one of the largest European p2p platforms, Mintos, have made at least one investment via the secondary market. In addition, there are around 2 times as many assets available on the secondary market compared to the primary market over there. It seems that other investors on the same platform are not so keen to buy late and long loans from their fellow investors. Hence such option adds value and liquidity but is not a silver bullet and we have to go back to brokers (loan originators) for liquidity solutions.

A broker (loan originator) should have enough equity to be able to take a loss on a late or defaulting loan. Institutional investors who provide a larger amount of funding to lending companies usually request that the leverage on equity is not more than 4-10 times. Meaning that for each 1 million EUR of a loan portfolio, a broker (loan originator) would have between 100k-250k EUR in equity. What does it mean? It means that if 5% of all loans default, a lending company can still cover all losses from their equity and continue their operations.

So, a lending company with a healthy equity vs portfolio ratio is a choice trusted by institutional investors managing large funds and most likely is a better liquidity provider for a final investor in a loan if compared to a secondary market on the same lending platform.

Do high-interest rates compensate risks and absence of buyback guarantee?

Some platforms, such as Bondora bypass loan originators and keep all interest to themselves without offering any buyback guarantee. They offer plenty of high interest (30-200%) high-risk loans. A high percentage of them will default. You have to be a very picky investor in order to figure out, which loans are worthwhile investing and you will find out that the expected returns hardly ever become real ones. Statistics that Bondora have shared with their users shows that around 25% of investors on their platform have suffered losses, and have not made profit.

Loan originators on Mintos and Twino platforms offer buyback guarantee after the loans are not repaid 60 and 30 days after maturity term. On our own Debitum Network, the brokers would buy back a loan if the repayment of the loan is late more than 90 days. The best part is that the brokers pay not only the principal but also the interest, which makes investing in the offered loans seemingly risk-free. Interest rates on these platforms are relatively lower than on Bondora or on platforms that offer payday loans to invest in.

Let’s look at some data of the most popular platforms around Twino and Bondora as well as our Debitum Network and try to figure well they fare protecting investors’ capital, what security measures they measure and a few other pieces of data:

From the table above we may draw a number of conclusions. Firstly, high-interest rates without a buyback guarantee will not deliver expected or promised returns as the number of defaults on these type of platforms (e.g. Bondora) is very high and most investors actually lose money as selecting loans that will actually be paid off by the borrower is inexplicably difficult.

If businesses or people are able to borrow at smaller interest rates, there is a higher probability that they will repay the loans, as opposed to borrowing at high interest rates that exceed 30% annually. Smaller interest rates will likely have smaller expected returns, but as the rate of defaults is much smaller, the real net return will be higher than with loans that have very high-interest rates and no buyback guarantee.

Shorter term loans effectively decrease your risk. What is the logic behind it? Very simple! If the company has been paying interest for the whole year, it will most likely not default if there are a couple of months left. This is one of the reasons why Debitum Network focuses on short-term loans for SMEs. We see that offering investors to invest in 1-3 months duration loans carries less risk and psychological pressure for them than keeping funds locked for a year or more with limited possibilities to exit the position.

Do buybacks eliminate risk completely or how can investors protect themselves?

A loan originator may go bankrupt and in that case, your money invested in the loans of the originator will most likely be lost. Eurocent loan originator went bankrupt and the loans it put on Mintos platform defaulted, thus causing investors to lose money on both principal and interest (Mintos doing their best to get the investors’ money back). Thus again, a buyback guarantee is as good as the company behind it.

Investors could choose only loans that have a buyback guarantee from a broker. It would be wise to choose only those that offer the option of buyback even at the expense of getting smaller interest rates. You want as much clarity from platforms and brokers operating on them regarding buybacks too. In March 2017 Twino introduced ‘payment guarantees’ rather than buyback guarantees. This change means that investors are now left owning non-performing loans for up to 2 years, and relying on Twino to make the payments due. The loans cannot be sold on the platform. Thus liquidity for investors dries up and investors have to wait for years until the money is eventually returned in case of default.

Spreading your investments in different loans and possibly different loan originators or even platforms is one of the options as diversification significantly reduces risk due to the fact that an investor ‘does not keep all eggs in one basket’. Asset-backed p2p or p2b loans are also a form of insurance as in case of a borrower’s default an asset can be sold and investors’ money paid back. Smaller interest rates for businesses is an advantage too. If borrowers are charged smaller interest rates they have a higher chance of repaying it rather than defaulting as they would if they were charged some rates from 30-50% annually or more. In the same fashion, collecting payments on an asset-backed business loan is simpler and usually faster than collect them from a bankrupt private person who defaulted on a payday loan issued by some payday loans’ platform. Thus, Debitum Network can proudly go shoulder to shoulder with long seasoned p2p platforms such as: Funding Circle, Lending Club, Zopa, Assetz Capital, Fellow Finance, Grupper, October, Ratesetter, FundingSecure, Lendy, MoneyThing and etc.

Investing with Debitum Network

Short-term loans with maturity mostly from 1 to 3 months, interest rates from 7 to 10.85% and a buyback guarantee is an offer from Debitum Network to investors on our platform. This enables investors to gain a number of things: earn attractive interest, have a fast turnover of their capital (1-3 months) and by means of buyback guarantee to protect their investments as much as possible.

Got interested? Try DEBITUM NETWORK!

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Debitum Network – a leader in interest rates for Invoice Financing loans

Debitum Network – a leader in interest rates for Invoice Financing loans:

High yield assets are definitely one of the top reasons that attract investors. The second one would be assets that are secure. After the 2008 crisis, most Central Banks slashed interest rates to zero or even below it. Keeping money in savings accounts became an unprofitable way to handle your money, despite a safe one. Alternative finance/investment platforms both P2P and P2B started growing like mushrooms after rain. They started offering above-average returns, in most cases higher than one can expect to get investing in most popular options such as stocks, hedge/mutual funds, or indexes. Debitum Network is not an exception as it offers some of the highest interest rates among investment platforms for loans in Invoice Financing category.

Overview of alternative investment platforms

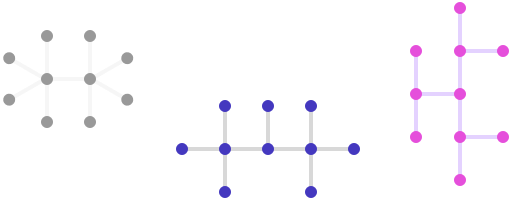

P2PMarketData gives us an overview of the major players in alternative investments (P2P/P2B. There are currently around 80 well-established investment platforms around the world. Most of them specialize and accept/originate specific types of loans as assets for investment. They basically fall within three major categories:

- Consumer loans (33 platforms)

- Real estate loans (22 platforms)

- Business loans (28 platforms)

We can see that the distribution of these three types of loans among platforms are almost equal. Statistics regarding returns vary and it would be difficult to say the exact percentage for each platform as; not all are secured loans or have buyback guarantees, interest rates on assets vary and they change.

Let’s say you choose Lending Club, which is a top P2P lending platform in the world. They provide unsecured consumer loans for investment with various returns based on the risk category. What it actually means is that you can make 15% or you can lose all your money if you invest in loans that default and become uncollectible (this week one of the leaders in UK P2P platforms Funding Secure went bankrupt).

A leader in business loans Funding Circle (in the UK) also offers investment in unsecured business loans (development loans secured by property and land). The expected returns with the platform would be up to 7%. Taking into account, that most loans are unsecured, the returns are really low.

A lot of other investment platforms both in consumer and real estate will offer returns of around 8%-13% annually. But there is one but!

Expected Returns differ from real ones

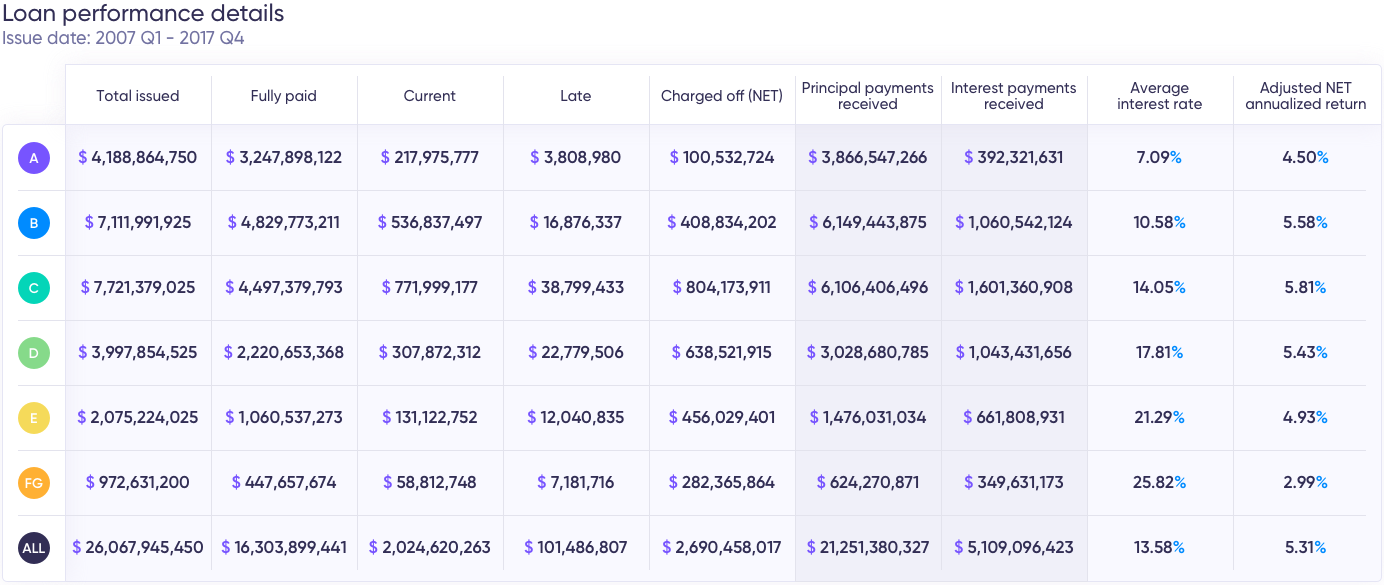

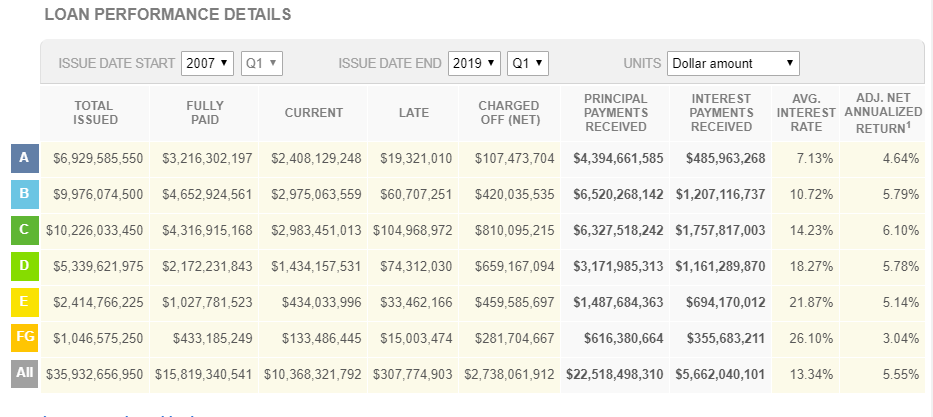

It is obvious that returns depend on risk levels. If the platforms do not have an implemented buyback guarantee, the expected returns can be radically different from the real ones. Lending Club has shared some stats on their website and you can see for yourself how greatly adjusted annualized returns differ from the projected interest rates under specific risk categories. Defaulted loans can drag your real returns down up to 3-6 times.

Source: https://www.lendingclub.com/info/demand-and-credit-profile.action

For the sake of being discreet, we are not going to name specific names, but there are platforms that have default rates of 30%. It means that investing in these types of loans you are basically buying a lottery ticket. You may get lucky and earn around 20% annually, or lose all of your money. You have to do a thorough and time-consuming analysis before you can make the right picks for investment.

Debitum Network returns and conditions

Currently, Lifetime Invested Interest Rate on Debitum Network platform is 9.20%. Most of our investors get even better returns. How is that? Well, you can exclusively invest in 9.50%-10% assets and your returns will be higher than the average. Additionally, most of the loans on the platform have a buyback guarantee. In case, a borrower defaults on his obligations, the broker who issued the loan will have to buy it back with the outstanding principal and interest. Thus, the returns are real. Very few platforms will offer that returns with a buyback guarantee. Due to the guarantee, there has not been a single default on Debitum Network.

Furthermore, not only most of the assets have a buyback guarantee, but each asset will have a specific penalty rate, which an investor is going to earn, in case the borrower is late with repayments by more than 15 days (15 days is a grace period when no penalty is charged to a borrower). Penalty rates vary from 2% to 4.5%. It means you are able to earn beyond the platform average of 9.20%. Very few platforms will offer a penalty rate for late loans.

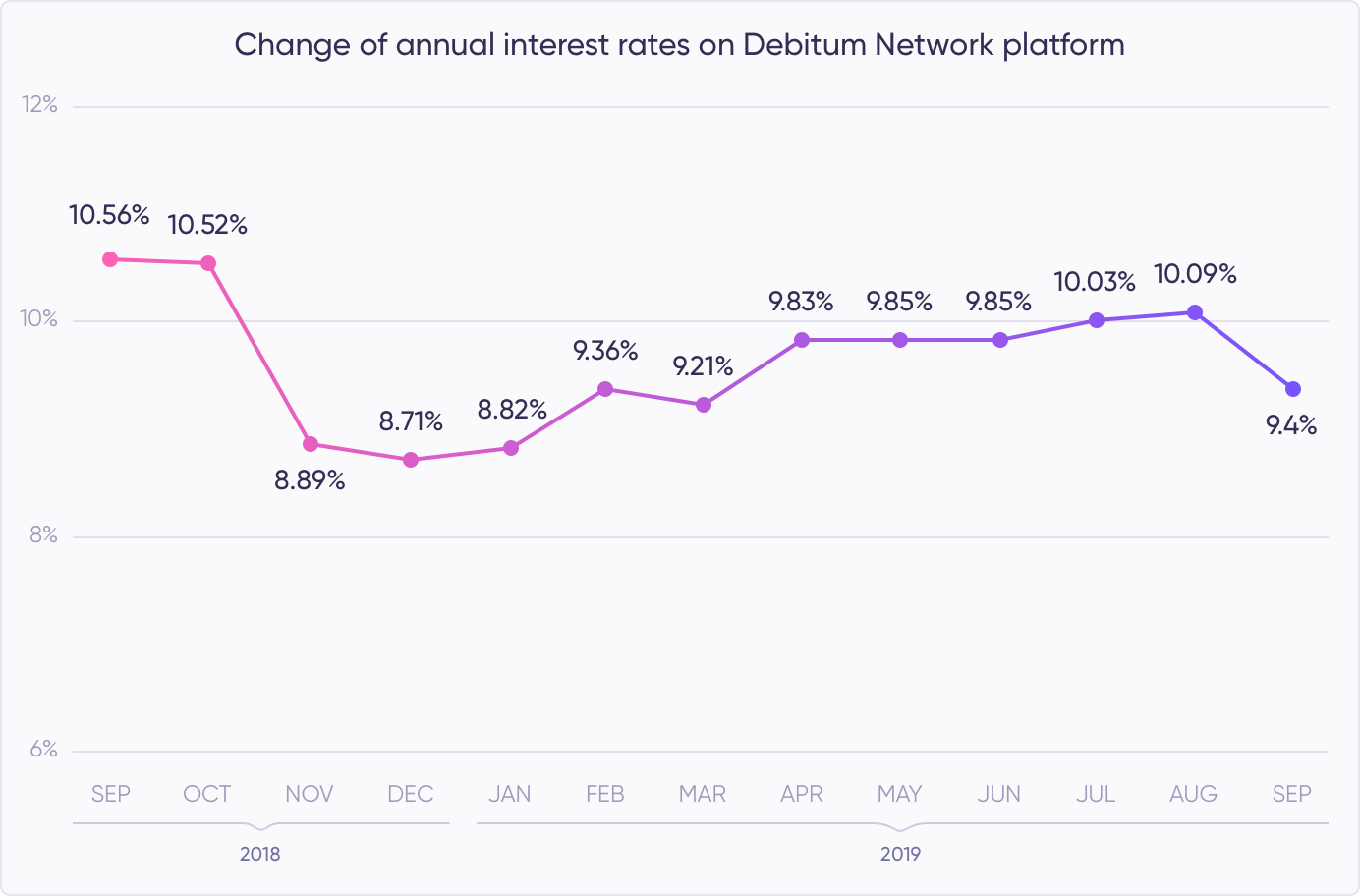

Thus, taking into account a current Lifetime Invested Interest Rate, a buyback guarantee, and a penalty rate, we can state that Debitum Network has the highest interest rates in Invoice Financing category. Take a look at how interest rates (earned) fluctuated since the launch last September, till the beginning of October this year. Have in mind, that these are the rates investors really received, (not adjusted) and there were no factors that could reduce them (no defaults due to the protection by a buyback guarantee).

Top asset of the week

The asset is from our partner and loan originator Factris. The borrowing company is a producer of electricity which has more than 340 thousand EUR in revenue, more than 60 employees and has been in business for more than 7 years. The Purchaser of the invoice is a manufacturer of petroleum products. It has more than 4 billion EUR in revenues, employs more than 1000 people, and has been in business for more than 28 years. Like what you see? Be sure to add it to your portfolio.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Investments in business loans versus consumer loans

Investments in business loans versus consumer loans

High-interest rates remain the key factor which attracts people to invest in assets on alternative finance platforms (P2P or P2B/B2B). Low-interest rates in the banks have driven people to search for alternative ways to put their money to use instead of keeping them in savings accounts for ridiculously low returns. P2P and P2B lending platforms offer way more appealing options to gain returns than most other investment solutions around. However, promised returns may not be the delivered ones. Let us look at what impacts the real returns and why investing in business loans might be a better option than consumer loans.

How are business loans different from personal/consumer loans?

Business loans are issued solely for businesses and for business purposes. They can be secured (company’s assets are pledged as collateral to be used in case of failure to repay the loan) or unsecured (no assets are pledged as collateral and the lender can only make a general claim for the assets of the borrowing company). Secured loans, naturally carry smaller risks and, consequently, have smaller interest rates.

Consumer loans are personal ones and are issued for private individuals, typically for non-business purposes (buying a home, car, covering social security liabilities, paying of bills). If an individual fails to pay off the loan, the lender will come after his/her personal assets to get back the lent money. As lenders usually have collateral from businesses they won’t require personal guarantees from business owners, which they would do from individuals taking out a personal loan.

Some facts about the leading P2P/P2B lending platforms

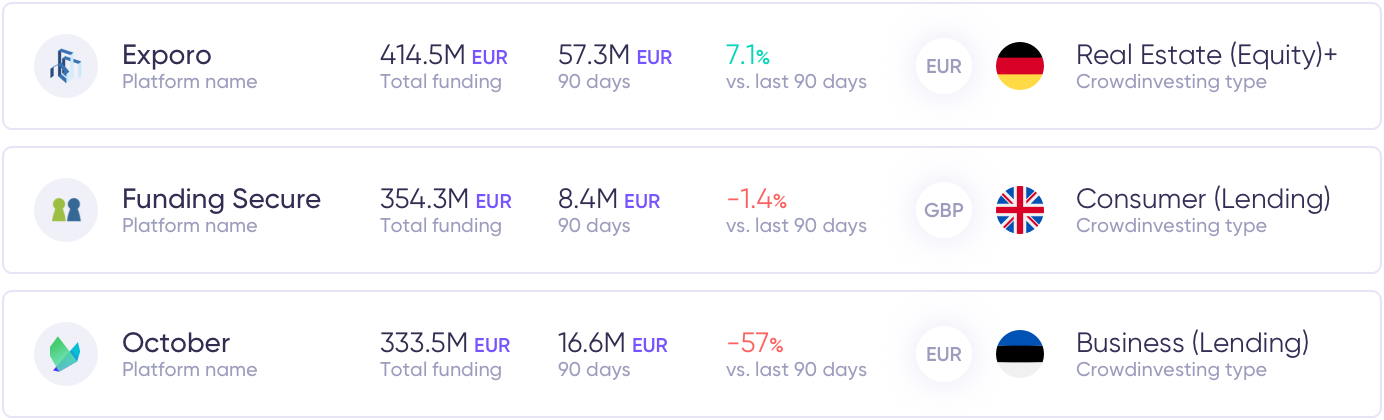

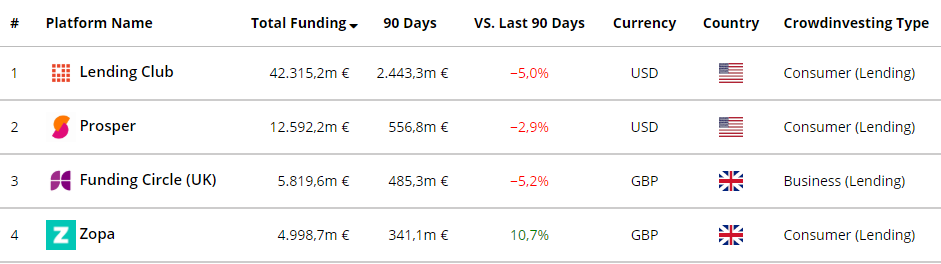

Source: p2pmarketdata.com

According to P2PMarketData.com out of 74 top P2P lending and equity platforms (Debitum Network included) about 20 focus solely on consumer lending. Among them the leaders in volume and total financed loans (Lending Club and Prosper) in the US. 12 of them do both, but with a tendency to offer more consumer loans (leading platforms: Mintos, Twino). 17 belong to Real Estate (Lending) with Sharestates (in the US) and Octopus Choice (in the UK) being the leaders in the sector (we will do comparisons with these platforms and business lending in future posts). 23 platforms focus solely on offering investments in business loans (Funding Circle from the UK being the leader of the group of platforms and our own Debitum Network belongs to the group too).

What are the risks of investing in consumer loans?

Independent reviewers state that investing in consumer loans, even on the most secure P2P lending sites such as Lending Club or Prosper can help you make a 15% return on your investment or cause you to lose money. How is that? The answer is quite simple, different loans perform differently. Some borrowers go bust and they never pay back. Investors typically lose money on these type of loans. Unlike businesses private individuals may not have cash flows to offer, or valuable assets as collateral and the ones that are offered are often not enough to cover the principal of the loan, to say nothing of the outstanding interest. Thus an expected 15% return on investments in consumer loans may be significantly slower and if an investor picks non-performing loans he may not make any money, but lose all of his investments.

Most of the lending sites rate their loans and the loans with the lowest risk get the lowest interest rates, and the worst risk rate loans get the highest interest rates, some might be as high as 30%. However, even low-risk loans sometimes underperform and default. It takes thorough analysis, wide range classification, and insight to select the most secure loans to get a conservative 5%-7% adjusted annual return on the investments. Lending Club (one of the most trusted P2P lending platforms) gave this table to show how average interest rate may differ from adjusted annualized return for investors.

Data source: https://www.lendingclub.com/info/demand-and-credit-profile.action

Data source: https://www.lendingclub.com/info/demand-and-credit-profile.action

What about the risks of investing in business loans?

The main risk of investing in business loans is the same as that of investing in consumer loans – a loan may default and investor lose all of his invested money. So, why not invest then in consumer loans if they offer higher interest rates? The question is logical and it has the logical answer. Business loans are inherently safer to invest in as they will offer more safety for investors’ funds. A business may pledge collateral (equipment, warehouse, cars, goods), invoices as a guarantee that the loan will be fully repaid. In case of borrower’s failure to pay off the loan, the lender can go after the assets of the borrower and get back the principal and interest due on the loan (in the best case scenario).

On some platforms (Debitum Network included) loan originators that upload their assets on the platforms also offer a buyback guarantee for the loans they have issued. This means that if the borrower is late with the repayment of the loan by a specific number of days (typically 30-90 days), the broker who issued the loan will have to buy back the outstanding principal and the outstanding interest. This reduces the risk of investing in business loans on the platforms to the minimum.

Under these conditions, the real possible risk from the possibility (a rare one) that the loan originator will go broke and fail to buy back the principal and outstanding interest. It happens from time to time as in the example of the loan originator Eurocent (on Mintos platform), when investors lost their money invested in the loans issued by the mentioned broker. Despite the efforts of the platform to get back investors’ funds, the hope of positive outcome seems to be dim. Thus, the buyback guarantee is as good as the loan originator that provides it.

How safe is investing in business loans on Debitum Network platform?

However, these events are rare and lending to businesses with the protection under a buyback guarantee provides investors with maximum safety. In the period of 8 months since the launch of Debitum Network platform we have uploaded hundreds of loans to choose from, and there hasn’t been a single default. Thus, investors have got back all of their invested principal and earned interest. Plus, late loans give investors an opportunity to earn extra profits from existing penalty rates (those differ among loan originators and specific loans), thus increasing his/her profits along the run. At the time of writing, the average interest rate paid to investors on Debitum Network platform is 9.72%.

Want to earn attractive interest on Debitum Network assets?

We regard the safety of investors’ funds seriously and take only the best assets that our partners loan originators offer. Most assets are short term and this is another safety guard for investors’ capital because borrowers have to prove that they are able to pay off the principal and interest for a considerable term after taking a loan before we accept it on our platform. Short term, also means that your capital is never frozen for a long period of time. Fast turnover and compounding interest is what makes our platform attractive! Want to start investing?

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Platform updates: new milestone, referral program and January statistics

Platform updates: new milestone, referral program and January statistics

New milestone – 1,000,000 euros in loans reached!

We are happy to announce that we have reached an important milestone for our platform. Investors have invested the first 1,000,000 euros in loans! We wanted to express our gratitude to everyone who helped us to reach the goal. Thank you for keeping up the good work and helping SMEs around the world to get cash for growth!

With an ever increasing number of investors, a larger variety of assets to choose from we are eyeing another milestone of 10 million euros to help small businesses function unhindered.

Get rewarded by using our new feature – Refer-a-friend

Reaching this important milestone motivates us to work even harder and keep updating our platform. We have recently introduced a new feature on Debitum Network – Refer-a-friend program. It is designed to allow existing users to invite their friends and social connections to try out investing in business loans.

This is how it works

The user has to invite a friend to invest at least 250 EUR over a 90 day period from the registration date in Debitum Network.

There are two options to invite a friend

1) by entering a friend’s email directly within Debitum Network referral page

2) by sharing a link via social media

Once the investment is made, both the referrer and the referred party get a 10 EUR bonus.

Feel free to try it out and let us know what you think. If you haven’t invested in Debitum Network – now is a great time to start! Join the program now.

Update on the progress of Debitum Network platform in January

Numbers have stayed positive since the launch in September through the first month of January in 2019. We have seen a steady rise in the number of registered users, money deposited and invested. The new industry leader has emerged. Let us look through some of the data.

The number of users

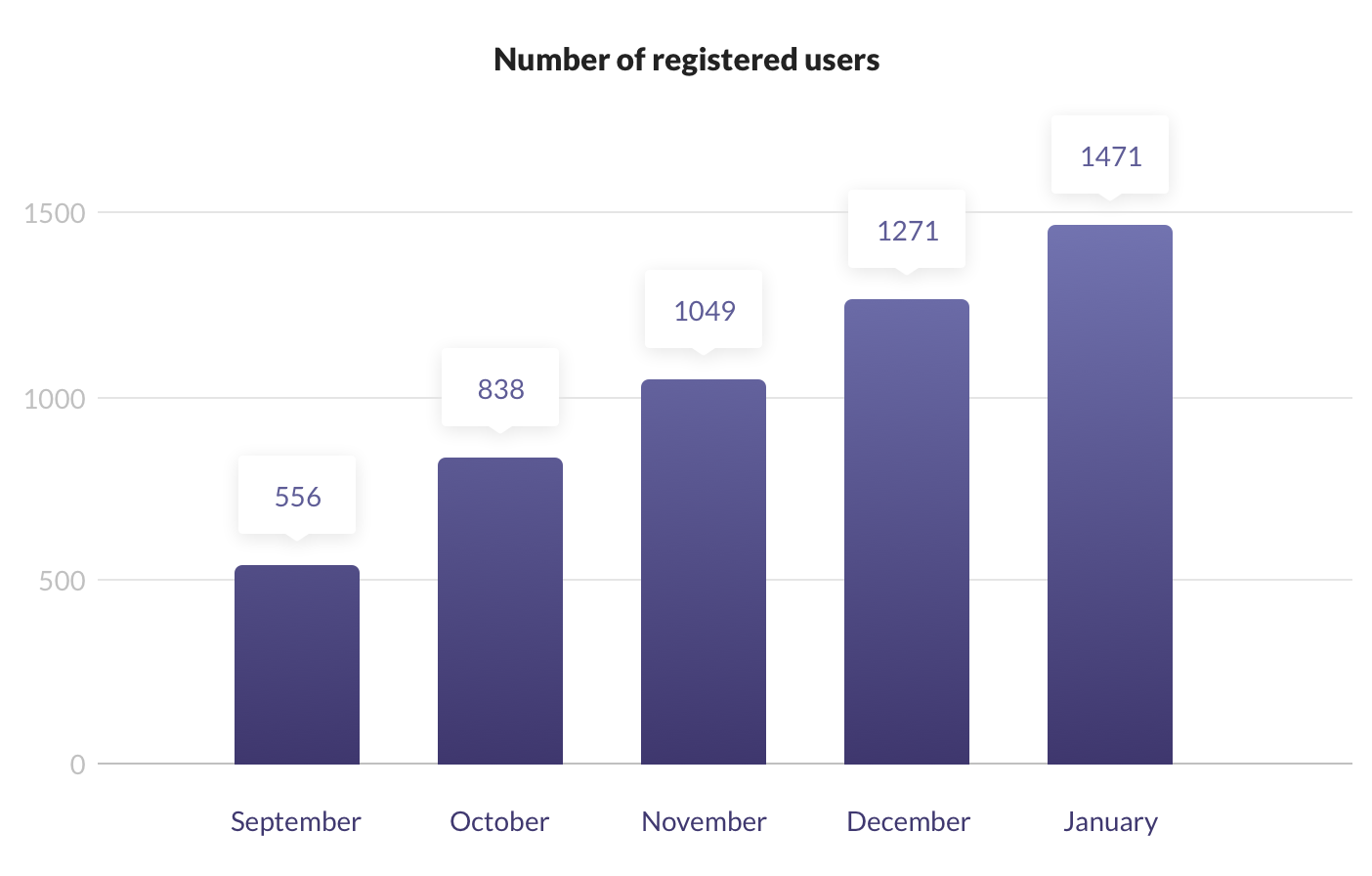

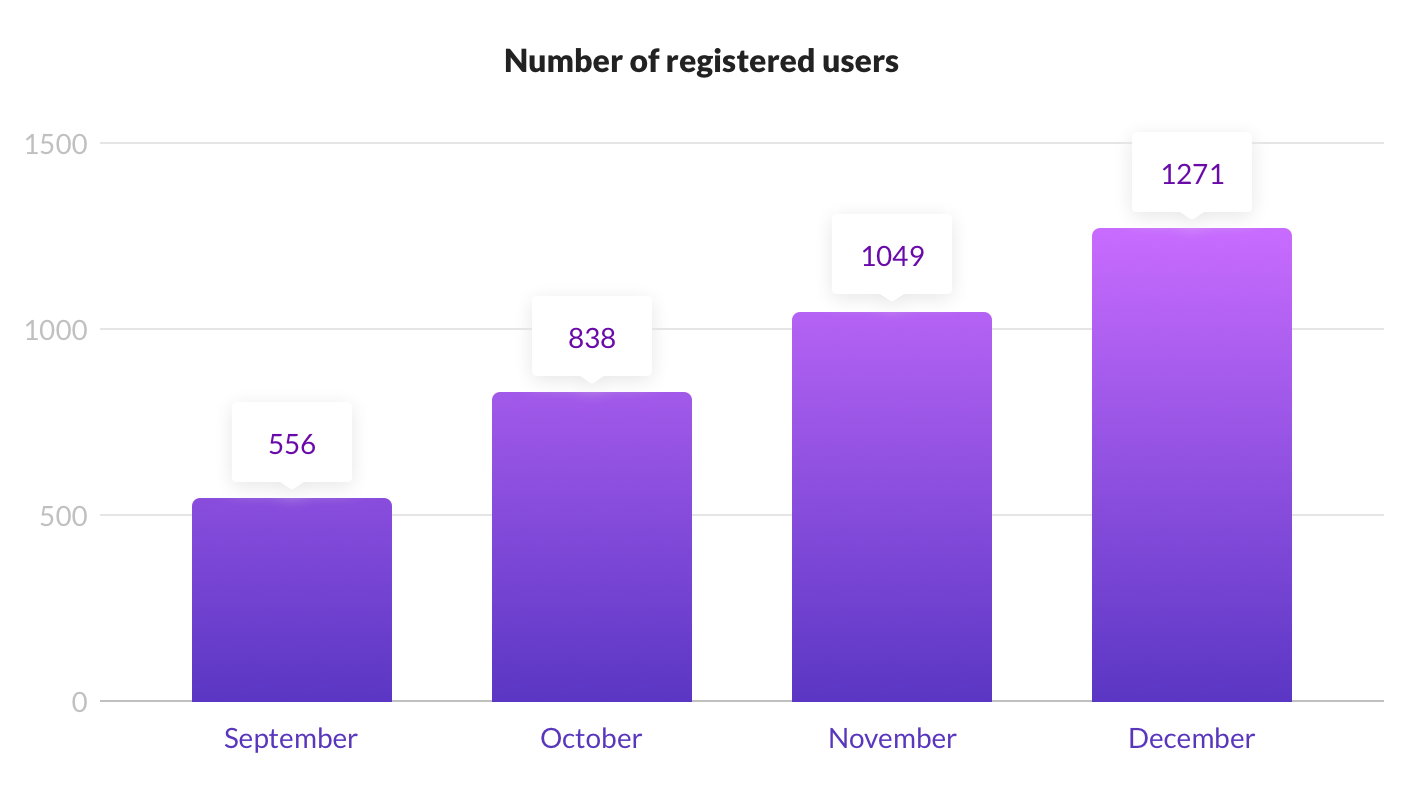

Users keep on registering and investing steadily on our platform. The number of users grew by 15.74% in January, from 1271 to 1471. In September we had 556 users, which means there has been 164.6% increase in 5 months (since the launch on the 3rd of September).

We want to remind that anybody can register on our platform for free without obligation to deposit or invest. You can see what functions and functionalities are on our platform before you make up your mind.

Money deposited

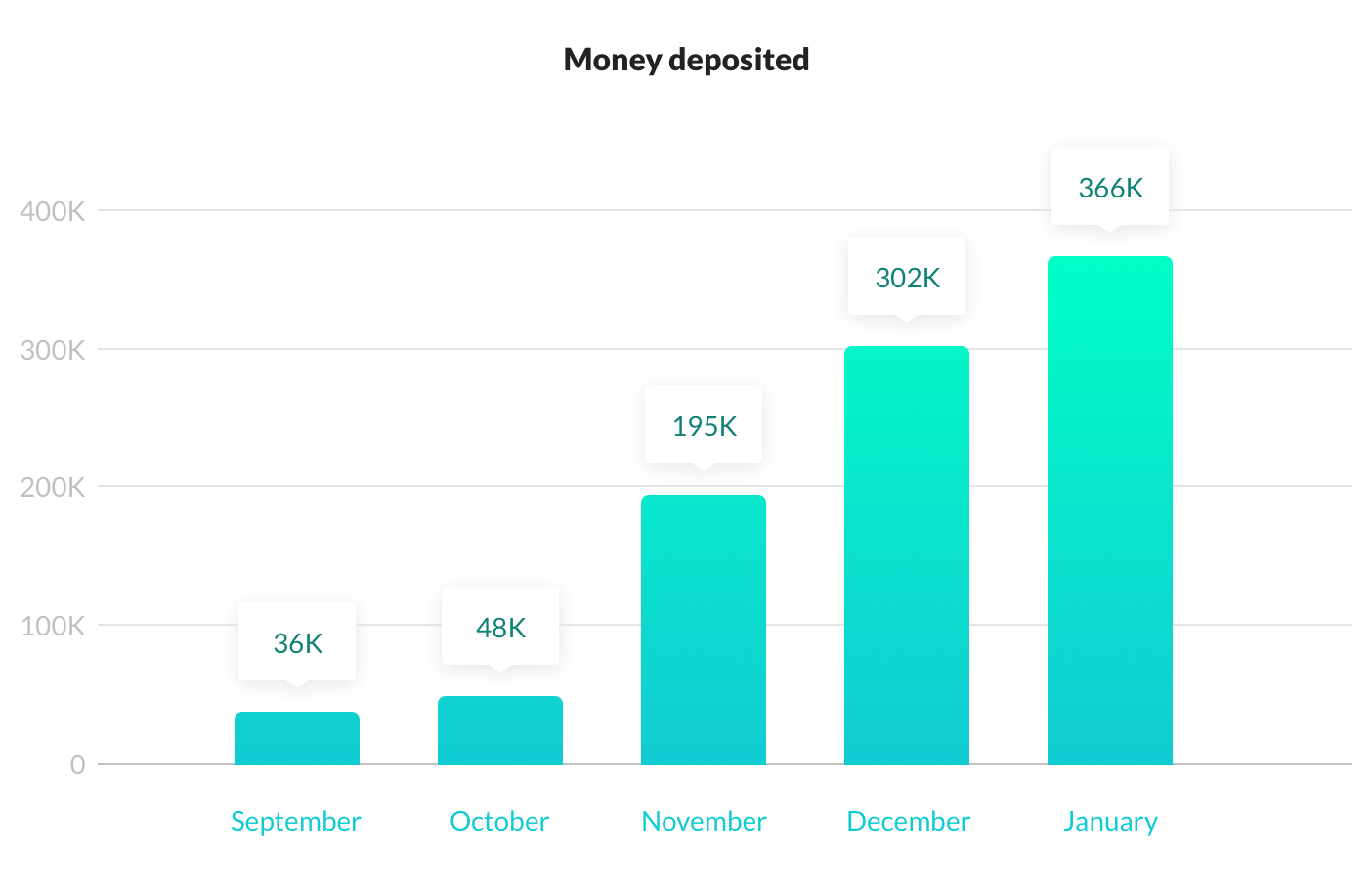

The number of deposits grew by 21.36% from the month of December, from 302,169 Euros to 366,724 Euros. Total growth of deposits from the launch month by the end of January was 916%. Users can deposit flexible amounts on our platform, the minimum being 50 Euros from SEPA accounts (deposits can be done in British Pounds (GBP) from local accounts, and US Dollars (USD) from US-based accounts). Minimum investment amount is 10 Euros. All investments in assets are transacted in Euro currency.

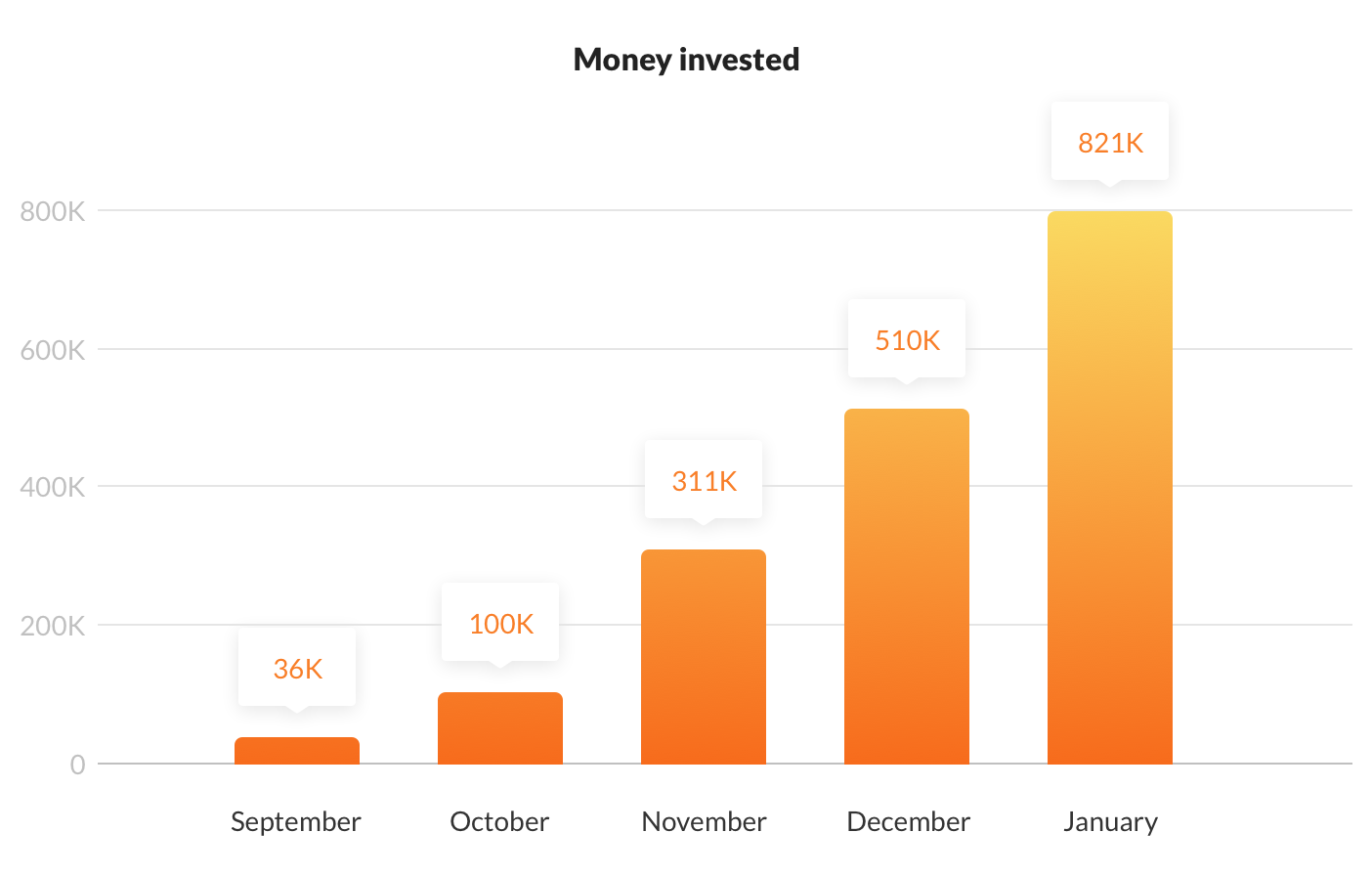

Money invested

Invested money increased by 55% in the month of January with a total of 280,358 euros invested. From September to the end of January, that is a 2098% increase in investments. We expect the trend to continue. As more investors join platform each month and keep on reinvesting both the principal and earned interest exponential growth will be the outcome. We want to remind all investors that they can use an auto-invest function to take advantage of the possibility to earn compounded interest.

Most popular industries

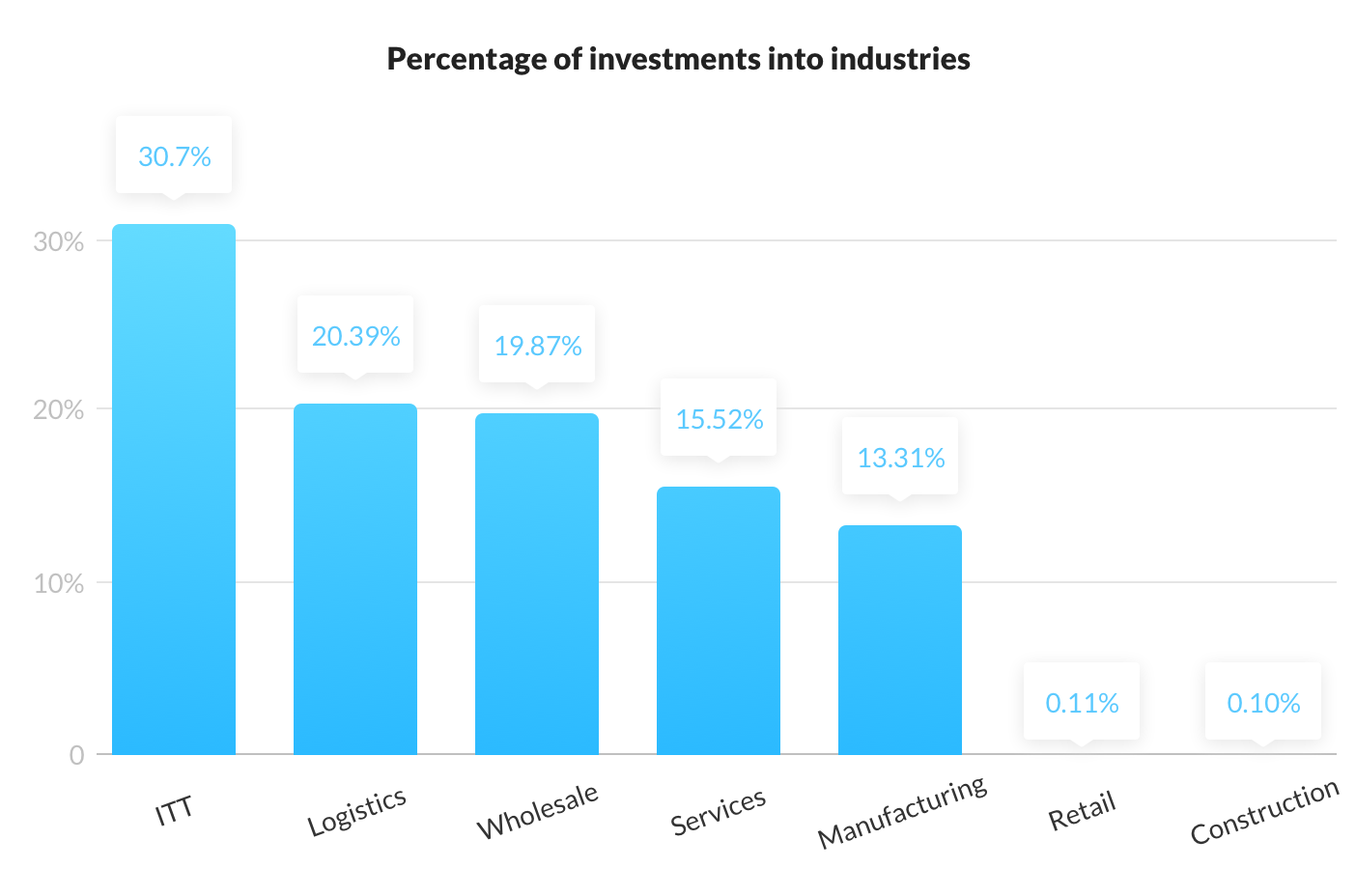

There has been a change in leading industries in the month of January. The Construction sector, which was the most appealing to investors in the first 4 months after the launch was taken over by ITT industry, which has some of the most attractive interest rates of all (average 10%). 30.7% of all investments were in ITT. Logistics, which is one of the most popular industries with our partners loan originators came second as around 20% of investments went into Logistics’ assets. Retail and Construction industries were the least popular in the month of January with 0.11% and 0.10% of the total amount going to those industries.

Platform growth continues

We are happy that despite being a young platform, in comparison to such P2P veterans as Mintos, Zopa, Funding Circle, Ratesetter, Viainvest, or Twino, trust in us has been growing steadily, together with the number of users and the invested amounts. Looking at increasing numbers and rising interest in our platform we do have bright prospects for the future. Many more functionalities are being prepared by our development team for the platform. Stay tuned!

If you haven’t joined the platform yet, it is the best time to register, start investing, and making compounded interest.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Moral debate: lending to businesses or issuing payday loans

Moral debate: lending to businesses or issuing payday loans

Lending at interest has caused lots of debates over centuries. In the middle ages, it was considered outright evil. Nobody thinks like that anymore. Lending institutions (banks) have become the largest business enterprises in the world. Borrowing and lending have become an inseparable part of business and economy growth. Both businesses and people borrow for a variety of reasons. The key question remains the same – at what price (interest rate).

In post-2009 crisis era, Central Banks have slashed interest rate close to zero. Keeping money in the savings accounts may actually cause one to lose money due to the inflationary economic environment. P2P platforms have become an attractive solution for investors that expect above-average returns on their investments. However, the issue of moral responsibility of lenders to provide qualitative services at reasonable interest rates remains of paramount importance due to a large number of online lending platforms and lack of accountability of some of them.

Payday loans and the issues connected to them

These are typically small amounts of money lent at very high-interest rates with the agreement that the money will be paid back when the borrower receives the next paycheck.

The size of a payday loan market is really huge and there is quite a large number of people who take out the loans. According to the research, around 12 million Americans take payday loans each year and spend around $7 billion on loan fees. The annual percentage rate on those fees ranges from 300% to 500%. The situation in Europe is quite similar.

In comparison, an average percentage rate on credit cards would be way smaller 15%-30% and 10%-25% on personal loans in a bank or credit union. Why would any person go to take a loan and pay such inconceivable interest rates to a payday lender? The same research shows that most customers of payday lenders are mainstream workers with the lowest annual income. Most of them do not qualify to get credit cards, have a very poor credit score, lack access to credit, and face regular financial problems. An average person in need to cover utility bills or short-term needs can use a credit card, while the people who don’t have to turn elsewhere to gain the necessary cash will go to payday lenders. Unfortunately, high-interest rates charged by payday lenders leave those people in an even worse financial situation than before the loan.

Short term repayment demands remain huge and borrowers have to return the loans within a short period of time, often cutting a huge amount of cash from their paycheck. However, there is another utility bill coming or need to buy food or pay the rent and if the borrower fails to pay off the entire amount fees, interest and penalties keep on growing, thus putting the borrower in an even more dire situation.

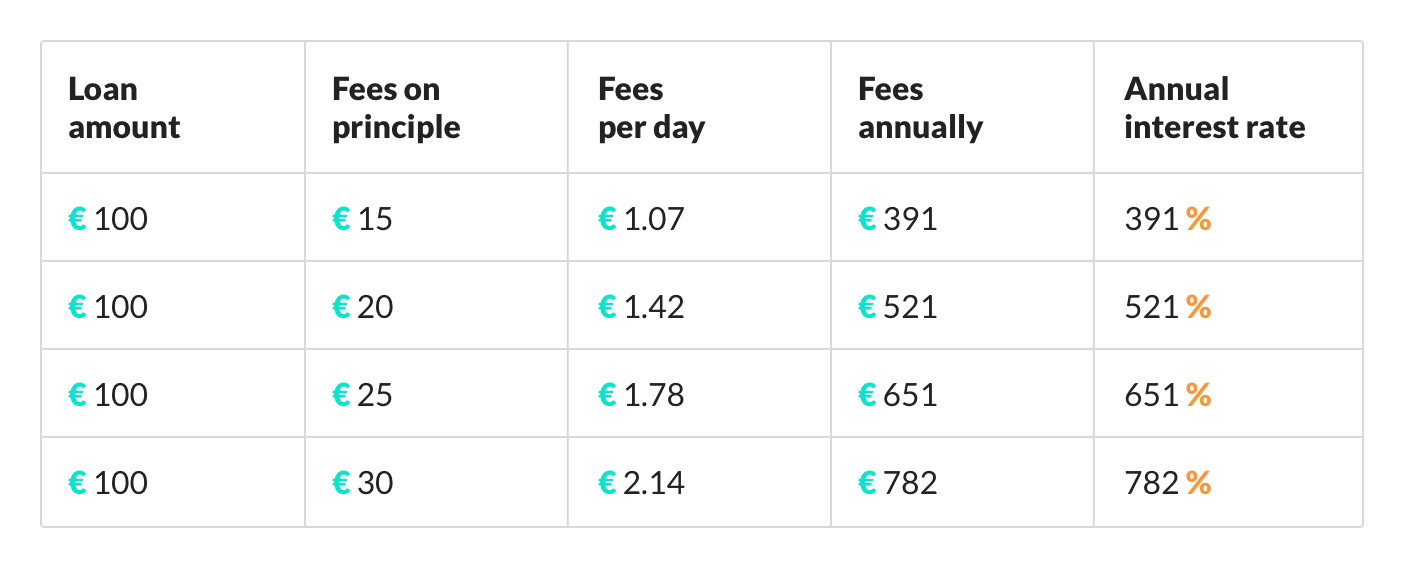

We may look at the price of a typical loan to the customer (borrower). Let’s say a short term payday loan is 100 Euros with a 10 Euros fee for 2 weeks. At the end of two weeks, a borrower will have to pay back 110 Euros to the lender. Let’s do the math and see how much it would cost a borrower to pay back the loan in a year.

EUR 10 / 14 days = EUR 0.71 per day

It does not look much, right? However, how much would you pay after a year?

EUR 0.71 x 365 days = EUR 261

Thus, apart from 100 Euros of principal, you would have to pay extra 261 Euros in fees (or interest), provided you pay off the loan in time, without delay. The annual interest for the loan would be 261%.

What if the fee is 15 Euros on 100 Euro loan, or even worse if the payday lender charges 20, 25, or 30 Euros on 100 Euro loan?

Let’s do the math and see how much it would cost a borrower to pay per day and annually.

So, if the payday loans are used often, or loans are rolled over to several terms it will become very costly to end users, who, as we have stated are cash negative. Fees grow exponentially throughout the year doubling, tripling or even increasing as many as 7 times of the original amount of a loan. Taking these type of loans may crush any borrower financially very fast. Then only short term benefit of these loans is that a borrower will cover his short term needs.

Credit gap for SMEs and advantages of lending to businesses

On the other hand, businesses around the world are always in need of funds to fuel their daily operations. In fact, according to Forbes, the most common cause for bankruptcies of companies within the first years of business is lack of access to funding. This is particularly true for small and medium-sized companies as banks are unwilling to lend to them. The gap of unfunded SMEs around the world widened from $2.6 trillion to $5.2 trillion. The reason was the main cause for the rise of alternative lending platforms such as Funding Circle, Lending Club, Mintos, Zopa, Ratesetter, Twino, Assetz Capital or our own Debitum Network.

The online p2p platforms that these companies operate have simplified lending process cutting paperwork to a minimum and reducing requirements for getting a loan. Take, for example, our partner and loan originator Debifo that puts loans (assets) on Debitum Network platform. It does not require long-term contracts or collateral and has no hidden fees. After completing a short registration form, clients can raise invoices for financing and receive the funds they need within a few days. The same procedure with the banks would take businesses 1-2 weeks. If young businesses can prove sales revenues exceeding 30 000 Euros, provide services and goods to other businesses and have been in business for at least 6 months, they would not have problems with getting funds. On the other hand, banks would not finance companies that have short business history, lack of real estate collateral or personal guarantee. Thus, a new market of alternative finance that provides necessary funds for SMEs has been growing steadily for over a decade.

Benefits gained from lending to businesses on alternative finance platforms

Lending to businesses creates far more advantages than disadvantages for companies that borrow and investors who invest in the loans (effectively becoming lenders in the process on P2P platforms) and loan originators, who can be more assured that the loan will be repaid. Here are some of the benefits of the lending process on such online platforms as Debitum Network:

As we may see from the points above, alternative finance has become not only a way of alternative lending but due to online P2P platforms – an excellent way to invest and diversify. In comparison to other traditional investment options, investing in short term loans for SMEs offers far more attractive returns than the traditional ones. You can read more about it in our blog post where we outlined all the advantages of investing in short term loans.

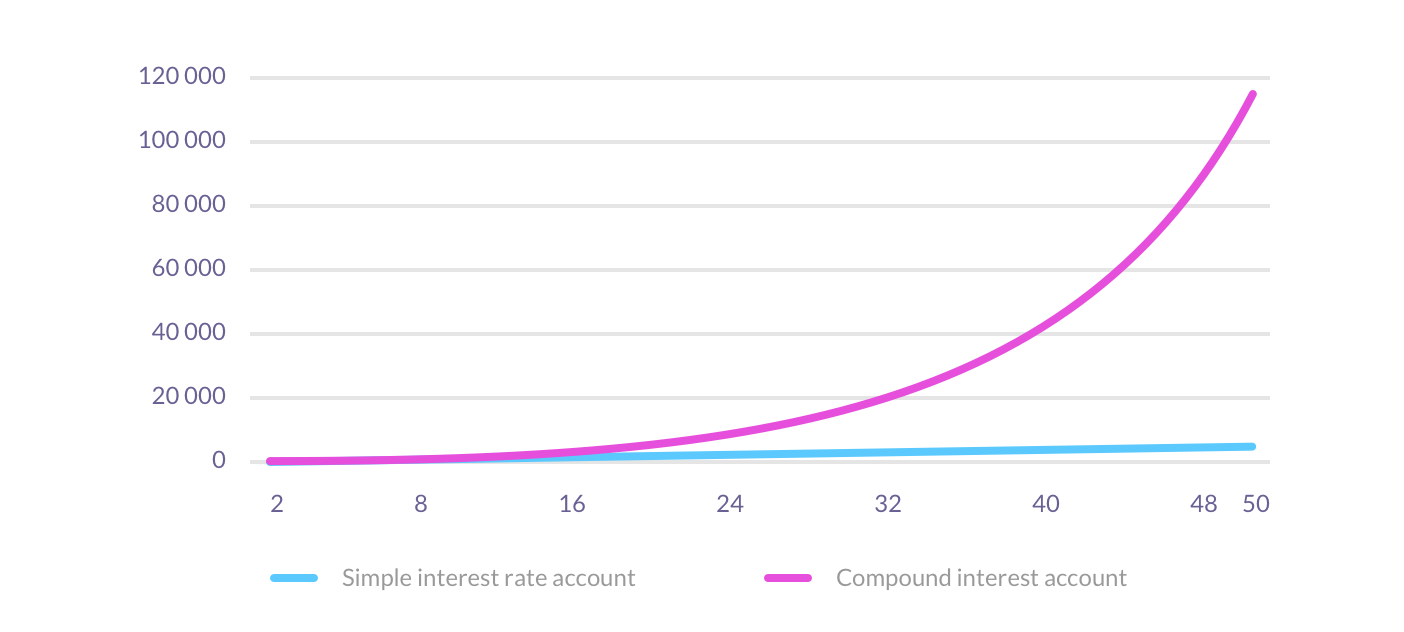

We have done calculations how much an investor can make if he invests in short term loans and reinvests the principal and interest to take advantage of the principle of compounding interest investing in loans for businesses on Debitum Network platform. More on that can be found in this blog post. However, we would like to present a couple of examples to outline profits that compile in the long run due to compounding.

For example, you invest 1,000 Euros at an annual interest of 10% for both simple and compound interest rate (compounded once a year). At the end of the second year, you will have 1,200 Euros on a simple interest rate account and 1,210 Euros on compound interest rate account (compound interval once a year). If that does not look much, look what happens if you keep the money in the account with the same interest (compounded once a year) for 5, 10, 25 and 50 years.

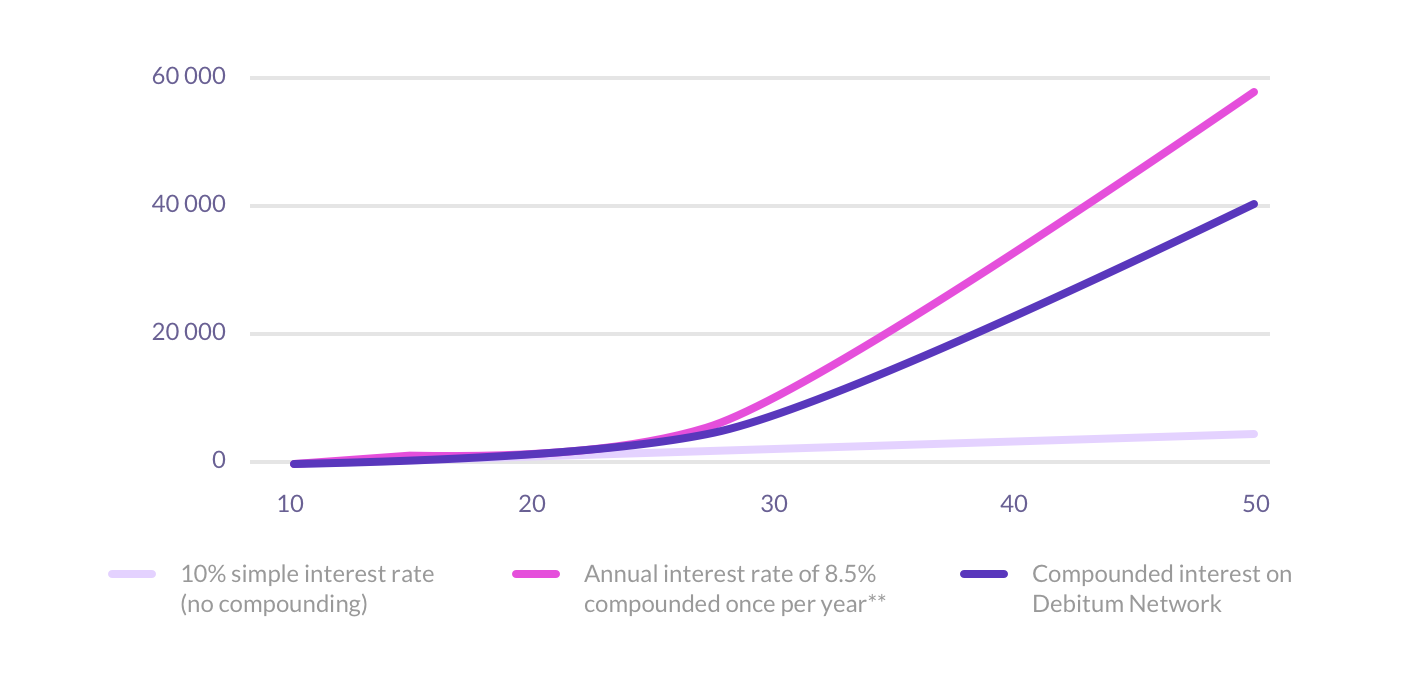

How would you fare if you invested 1000 Euros with Debitum Network at an average 7.5% annual interest rate compounded interval every month, 8.5% compounded once a year and simply put the same amount for 10% simple interest rate into a savings account for 5, 10, 25 and 50 years respectively?

All participating parties benefit

The examples clearly show the lending process can be beneficial for investors. Those that invest in the loans earn exponential income over the years as the principle of compounding accelerates profits from both interest and principal. However, not only investors benefit from the process. As investors reinvest their money in short-term loans, businesses regularly get the necessary funds for functioning and can keep on borrowing. Loan originators that provide money to borrowers that are able to repay the loans have fewer defaults that those that keep on doing business with private individuals (that mostly borrow for consuming) and thus can function unobtrusively and be confident that lent funds will be returned.

Having looked through the facts regarding payday loans and lending to businesses we can clearly state that payday lending, actually, does more harm than good for those who take them. It also damages the image of lending due to extraordinarily high-interest rates and the harm it does to average borrowers. The only beneficiaries in the process are those that issue those loans – payday lenders. Unfortunately, a huge number of defaults on these type of loans may actually cause a payday lender to go bankrupt too.

On the other hand, lending to businesses at reasonable interest rates creates inherent value for all parties participating in the lending process: companies that borrow, investors that invest in the loans, loan originators that issue the loans. The process leads to job creation and growth of the economy in general too. Furthermore, it may sooner, or later become a real competitor in terms of investment to traditional ways to invest due to a quick turnaround of invested capital and the principle of compounding interest.

Ready to invest in business loans?

We want to offer everybody a possibility to take part in the lending process by investing in short term loans for SMEs. Minimum deposit is 50 Euros, minimum investment just 10 Euros. Interested?

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

How did Debitum Network platform perform in 2018

How did Debitum Network platform perform in 2018

A year has passed, many people have made their New Year resolutions, some looked back to see what happened throughout the past year to determine what was achieved and possibly started making new plans. Businesses, similarly, turn back to look how profitable the year was, evaluate results, prepare for the new business year and cycle.

We, at Debitum Network, want to be as productive as possible and offer the best services for investors and borrowers, as well as third parties offering their services on our platform. In our previous post, we shared what features and functionalities have been implemented on our platform since its’ launch on the 4th of September in 2018. In this post, we want to look at some statistics on our platform and share the numbers with you.

The platform is young and since the platform launched in September, statistics reflects just the last quarter of 2018. The fields for statistics include:

- The number of registered users.

- The number of investors.

- How much money has been invested?

- How much money has been deposited?

- Amounts invested each month since September.

- How much was invested in most popular industries? What were interest rates for the industries?

Number of registered users

We started with 556 users in September and the number grew to 1271 by the end of December. That is roughly a 129% increase from the month our platform launched.

Registration on our platform is free and users do not have to deposit or invest. Anybody can try platform first and get the feel what is what, and how things work: go through different functions and functionalities, look through assets, do some filtering of assets according to risk levels: conservative, moderate or aggressive, check info about companies borrowing or who they offer their services to.

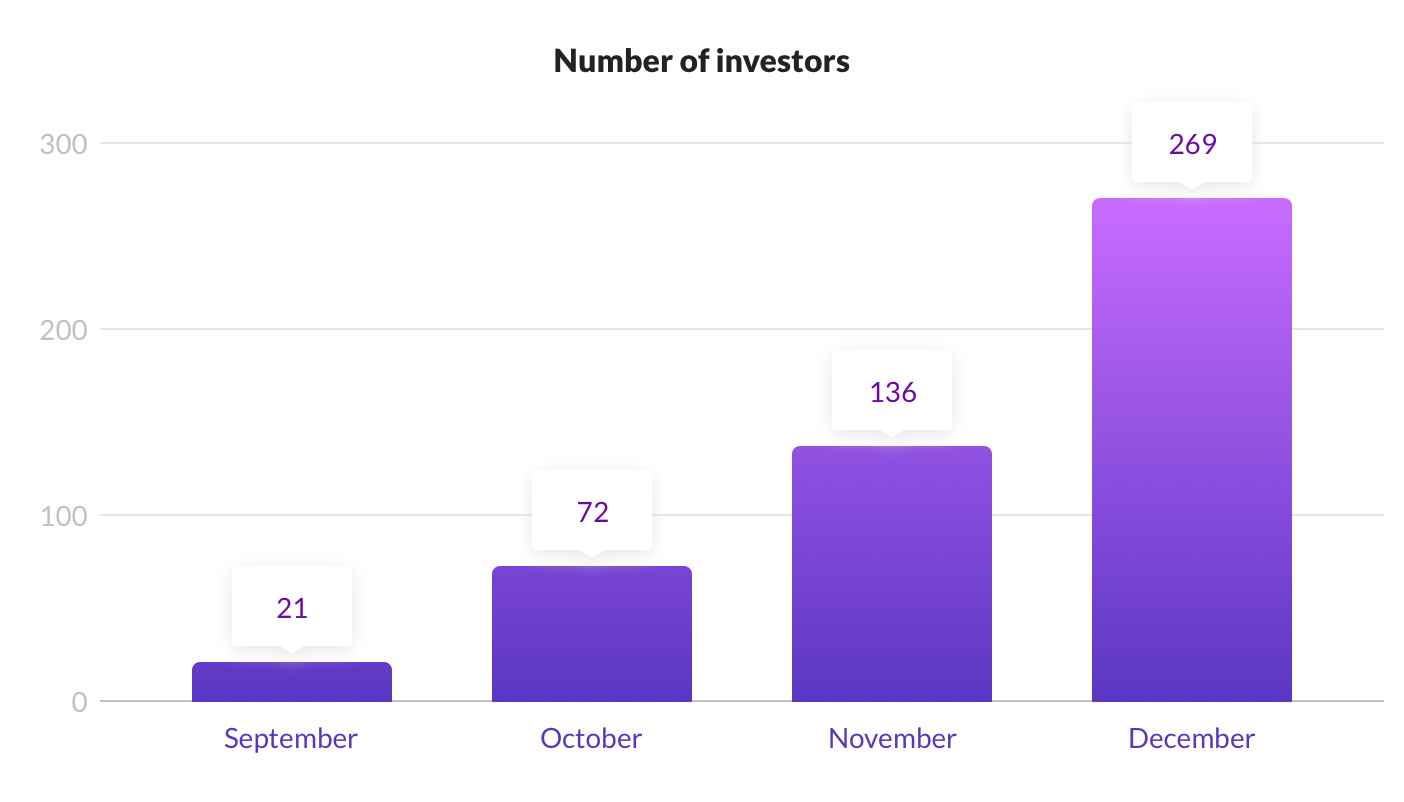

Number of investors

In terms of investors, we had a humble beginning as there were only 21 of them in September. However, by the end of the year, we experienced exponential growth as the number grew to 269, which is an astounding increase of 1,180%. We are really happy about it as it shows the trust in our platform and the number of those who commit their money to invest has been growing by leaps and bounds since its’ inception.

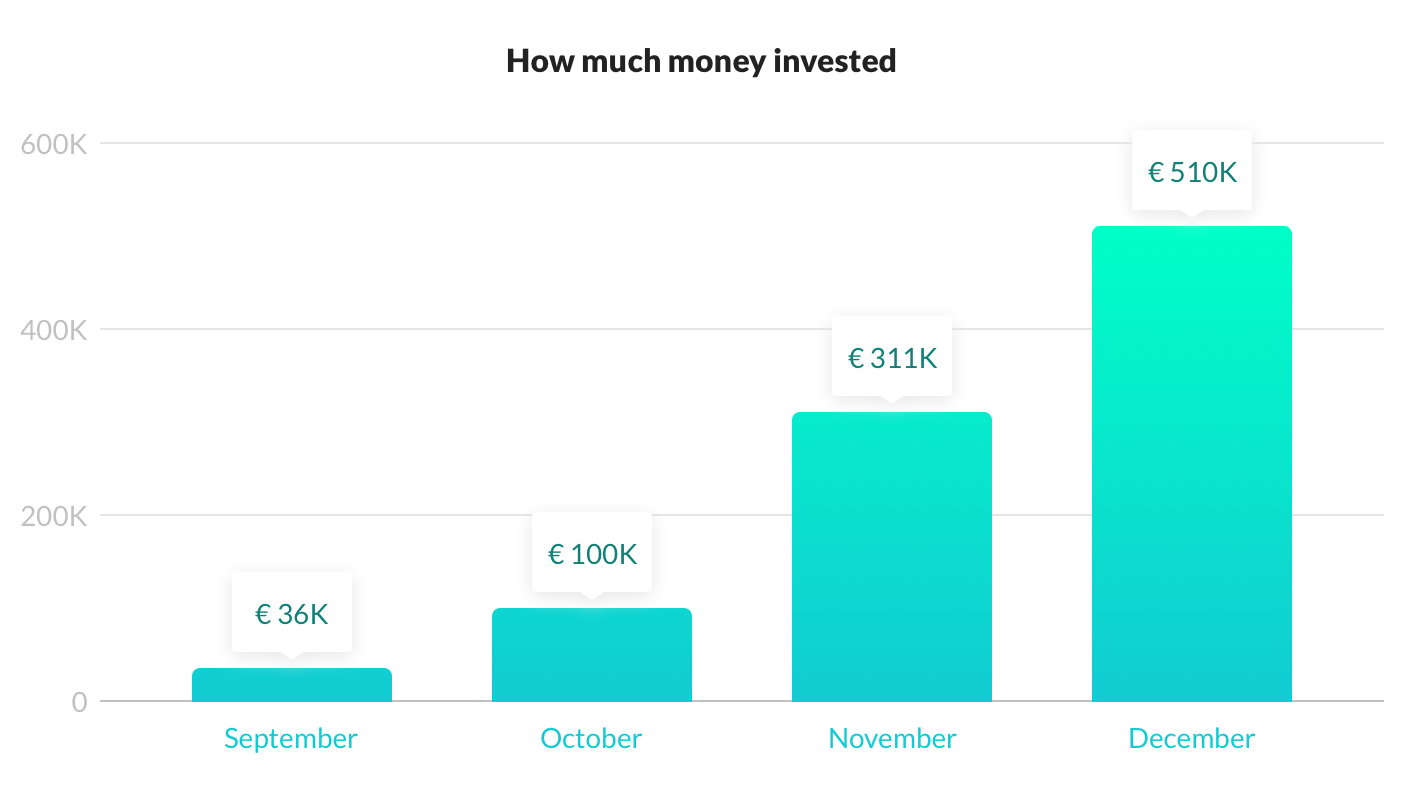

How much money has been invested

An activity of investors and turnover of funds accelerated throughout the four months of last year. From 35,957 Euros in September to 509,325 Euros in December, which points to 1,316% growth in just one quarter of the year. The amount itself may not seem huge in comparison to other mega p2p platforms, but sharp advance in the growth of invested money points to a positive trend of growth and optimism among investors in our platform. We expect explosive growth in 2019 and for the number to reach the milestone of 100 million Euros by the end of 2019. We want to remind that investors can invest from as little as 10 Euros in a single asset and there is no limit as to how much you can invest. Investors can choose if they want to get interest in Euros or our DEB tokens.

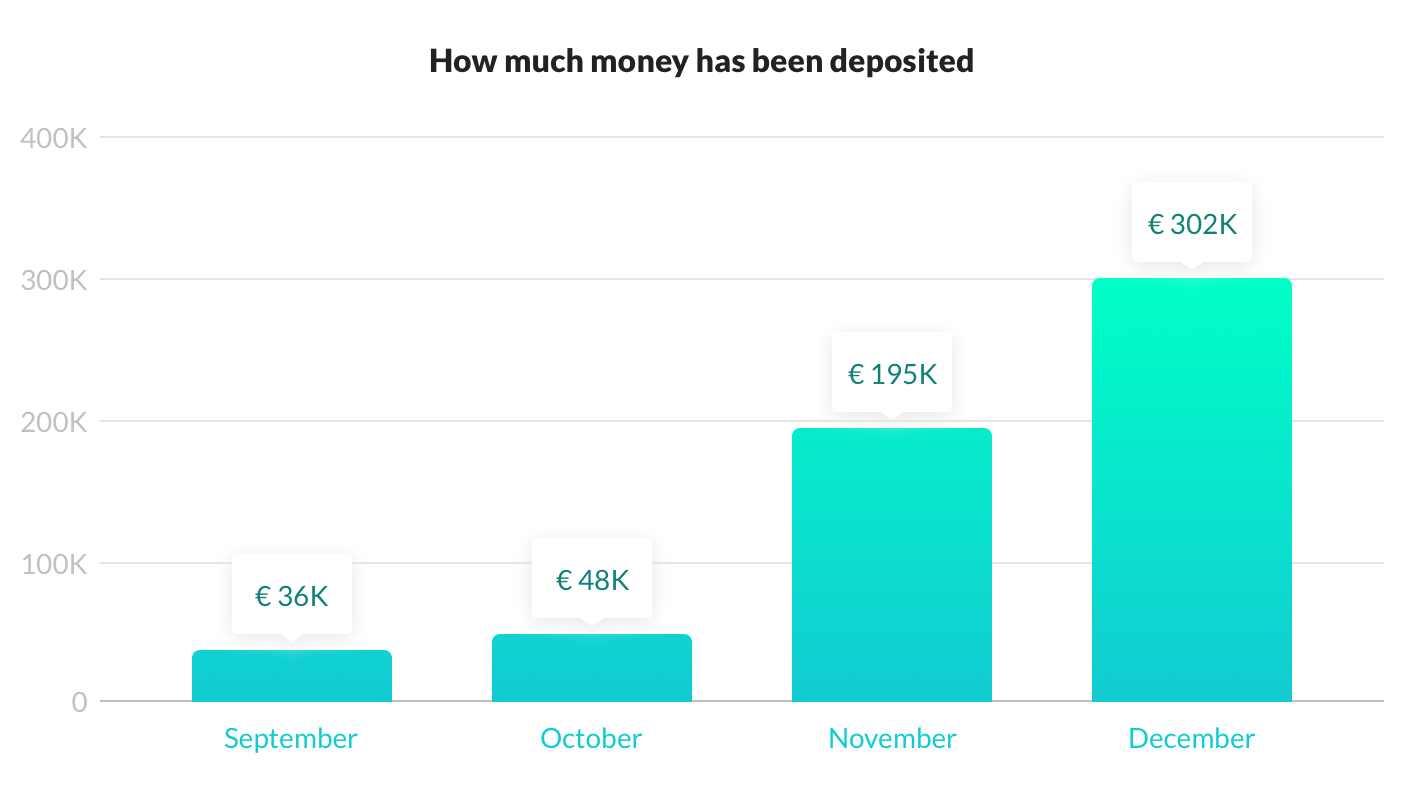

How much money has been deposited

The number of deposits picked up slowly in September (36,093 Euros) and October (47,646 Euros), but soared dramatically in November (194,826 Euros) and December (302,169 Euros). The number of deposits effectively increased 737% within the given period of time. Users can deposit flexible amounts on our platform, the minimum being 50 Euros from SEPA accounts (deposits can be done in British Pounds (GBP) from local accounts, and US Dollars (USD) from US-based accounts). All investments in assets are transacted in Euro currency.

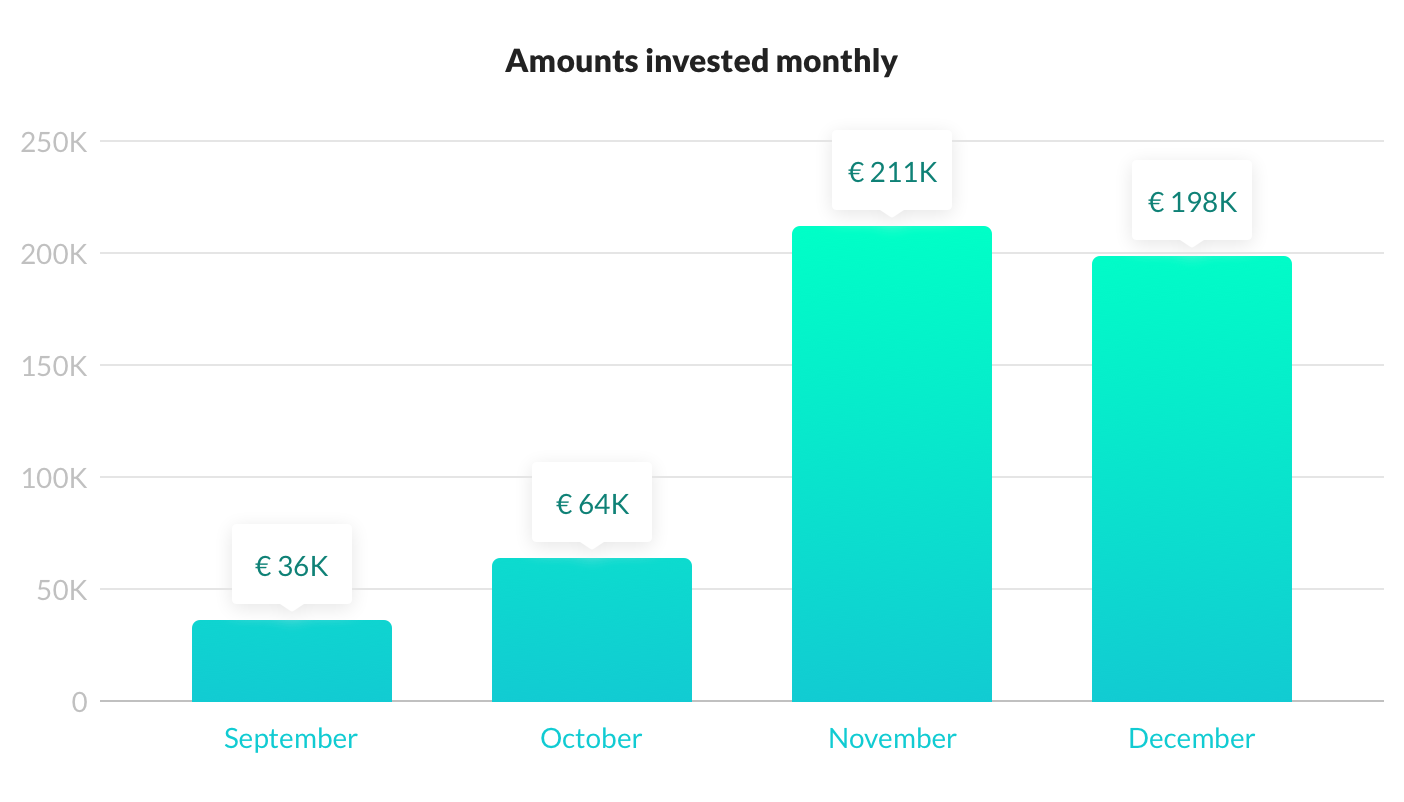

Below you can find specific amounts invested each month. As has been said, the investors started slowly in the first two months after the platform launch but became far more active in November in December. December saw a tiny decrease from November, most definitely due to the Holiday season, but the trend remained positive, and we expect each month to show bigger numbers throughout 2019. Most of the assets on our platform are short-term varying from 1 to 3 months, average asset term being 52 days, and the average amount of an asset is 10,750 Euros. Thus, you can choose a flexible amount to invest, or cover the whole asset if you want.

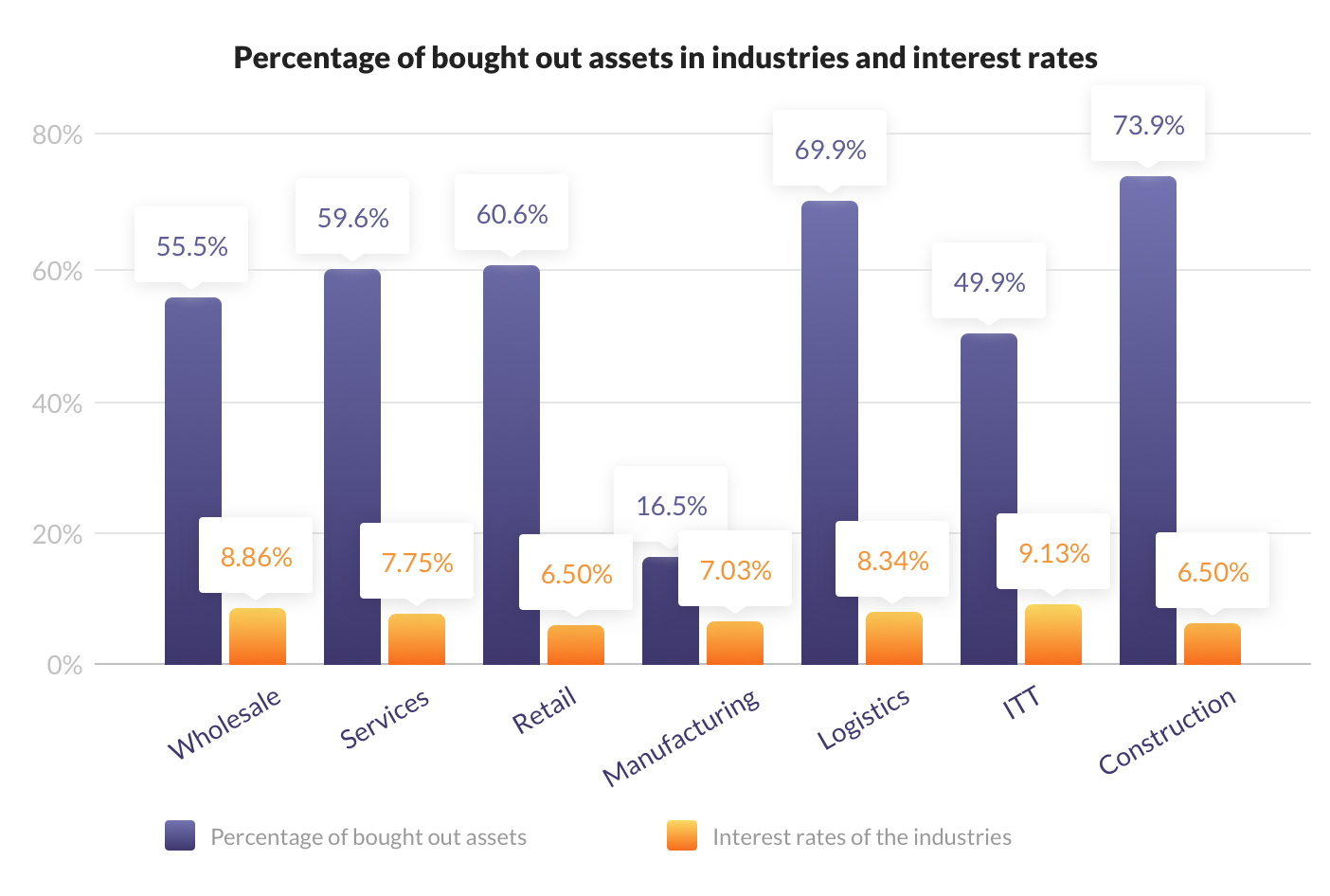

How much was invested in most popular industries and what were the interest rates

Assets on our platform are put into categories (industries): Wholesale, Services, Retail, Manufacturing, Logistics, ITT, Construction. Construction was the most popular of them as 73.92% of the assets were bought out, despite the fact the interest rates were the lowest of all (represented conservative style). We are oriented to providing the safest possible assets, thus conservative investment assets dominate on our platform. The highest interest rates were in the ITT sector (average 9.13%). The least bought out industry was Manufacturing (16.48%).

Average annual interest rates for the industries ranged from 6.50% to 9.13%. Lending to businesses comes at cheaper rates than those for personal loans. However, default rates for lending to businesses are much lower and our partners loan originators that upload assets on Debitum Network platform are able to keep default rates under 2%. Some p2p platform that will offer very high-interest rates for investments have around 30% of defaulted loans. Thus, we chose a much safer path to deal with lending to businesses.

Numbers reflect positive growth

The statistics point out to positive growth tendencies in all the respective fields. Upward trends point to both increasing trust and popularity of our platform. We know that 4 months period may not be adequate to come to reasonable conclusions and be compared to huge p2p platforms such as Mintos, Zopa or Funding Circle. However, new functionalities, upgrades, upward trends in user and investor acquisition, and an increasing number of assets, as well as qualitative service providers, gives bright prospects for the future.

Right from the start, Debitum Network set a goal to offer the safest possible assets for investors to invest and be a king of liquidity. Initially, assets had guarantees from owners, collateral and pledged invoices. Later, a buyback guarantee was added. Currently, the vast majority of assets have the guarantee, which means that in case the borrower is late with the repayment more than 90 days, the broker (loan originator) will be obliged to buy back the loan with the outstanding principal and interest. This aspect of extra security for funds keeps on boosting investors’ confidence in our platform.

If you haven’t joined the platform yet, it might be a good time to register and start investing and gaining all of the above-mentioned benefits.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Benefits of using Auto-Invest feature on P2P platforms

Benefits of using Auto-Invest feature on P2P platforms

After the 2008 financial crisis interest rates remain very low in most of the Western world. Keeping money in a bank will actually cause you to lose money as inflation is higher than the returns on most savings accounts in Europe. No wonder, market analysts and seasoned investors have been repeating the old cliché “The best way to defend against inflation is to invest”. The cliché is a proven fact. The statistics show that an average annual interest rate one will get by keeping money in a bank in the EU is 0.37%. At the same time, inflation is currently around 2.2% in the Eurozone.

It is obvious that investors started to seek for alternative ways to invest. They turned to alternative lending p2p platforms that offer projected annual returns from 4% to 15% (Funding Circle, Zopa, Mintos, Ratesetter, Assetz Capital, Twino or our own Debitum Network). As the returns far surpass most of the traditional investment options, p2p lending market has been growing exponentially: from a few platforms with minor volumes in 2011, to $26.16 billion volume in 2015 and is expected to reach 460 billion $ in by 2022.

What is an auto-invest tool?

As the market of p2p platforms is growing, these alternative lending marketplaces are searching for new ways to offer better services for investors and attract them to the platforms. We have already discussed one of the best features: buyback guarantee. Another one, which most of the alternative lending platforms have implemented (and recently our own Debitum Network has also added on the platform), is an auto-invest tool.

Auto-invest feature is a program of a set of ‘buy’ orders implemented on a platform, which enables investors to automatically purchase loans at pre-set parameters at a date in the future. An investor is in full control of what loan parameters he wants to choose in order for a loan to be purchased. Any time investor has cash available in his account, the auto-invest feature will automatically purchase loans. This saves time for the investor and makes sure that cash is reinvested quickly, which helps to maximize interest earned. What are the other benefits of using the auto-invest feature?

One of the best sources of steady income

One of the best benefits of auto-invest is that it can help an investor to grow income gradually more than any other investment. The feature allows investors to increase their returns exponentially over the years. We have already discussed a compound interest investing strategy. Most of the loans on Debitum Network are short term. So, if you put 1,000 Euros into 10 loans that have a maturity of 2 months each, you can reinvest the principal 1,000 Euros and 11.90 Euros of interest after 2 months into other 10 or 11 loans for the similar term (1-2 months). If you have parameters set for auto-invest, you will not have to do any manual work regarding your investing, auto-invest program will do everything on your behalf and all of your balance may be employed at all times. Even if some of the loans are late or default (very rarely) most of the loans on our platform have a buyback guarantee – if the borrower is late with the repayment by a specific number of days (usually 90 days, but it depends on individual loan originator), the broker will be obligated to buy back the loan and pay both outstanding principal and outstanding interest on that specific loan. Thus, delayed or defaulted loans will not have a big impact on your returns.

Your balance does not go down

However, even if you do not contribute any extra money, just your initial capital (let’s say 1,000 Euros), your principal investment will keep growing. As auto-invest feature will keep choosing and investing in various assets over time, the growth will happen naturally due to interest aggregated on each loan. In a stock market, an investor who contributes money and buys shares at lower prices each month actually loses money from re-investments as the value of his portfolio decreases, despite the fact that the average price of shares bought becomes lower. On the other hand, short-term loans backed by guarantees and driven by auto-invest feature keep on aggregating profits month by month.

You can invest in small increments

In the stock market, you may need 150 $ (Apple) or 1,000 $ (Google), or even 315,000 $ (Berkshire Hathaway) to buy a single share of a given company, while on p2p platforms such as Debitum Network, you can invest as little as 10 Euros in a single loan. So, you can distribute your 1000 Euros into a lot of loans of your choice and earn interest on each one of them under the protection of a buyback guarantee. No need to leverage your amount in order to get an investment share in a specific loan due to the large amount of it! It does not matter, whether loan size is 1,200 Euros or 50,000 Euros, you can still invest 10 Euros in a single loan.

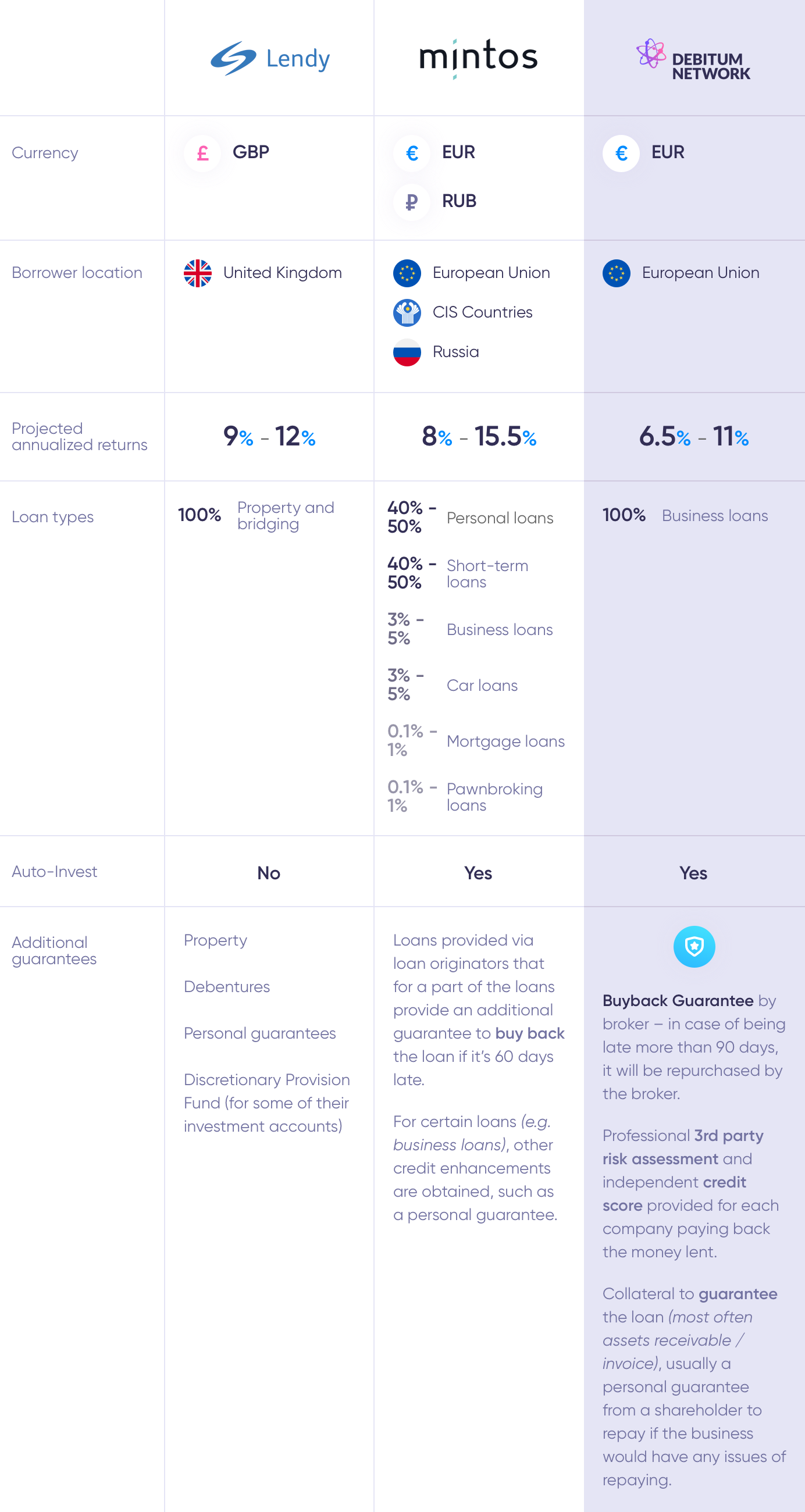

Lendy, Mintos and Debitum Network compared

Not all peer-to-peer platforms have auto-invest feature, in the same fashion as not all of them have a buyback guarantee. We decided to look at a set of data, which is closely linked to auto-invest feature and whether it enables investors to gain maximum profits or make their investments safer. The three platforms of our choice are: Lendy, Mintos and our own Debitum Network.

Auto-invest feature is a great advantage when you have investments backed by a buyback guarantee or real assets. It is also a great advantage when one invests in business loans. Personal loans that dominate Mintos market, unfortunately, have a greater chance of default. Examples speak for themselves: the loan originator Eurocent went broke and Mogo loans (that did not have buyback guarantees) went into default in Baltic countries. Meanwhile, business loans, such as the ones that are placed on Debitum Network platform, perform much better – there haven’t been any defaults on our platform. Lendy p2p platform probably does not have an auto-invest function for the better as according to investors and reviews a lot of loans for property and bridging default. Thus, loans placed on their platform need very careful analysis before investing in them manually.

Loans for businesses may have somewhat smaller interest rates than personal or property loans, but they are much safer and this is the reason why we, at Debitum Network, decided to focus on those. We believe that will help our investors to maximize their profits and keep their funds protected under additional guarantees such as a buyback guarantee or collateral from a business. There are enough loans on our platform for investors to choose from, whether one has a conservative investing style, a moderate one or likes to be more aggressive.

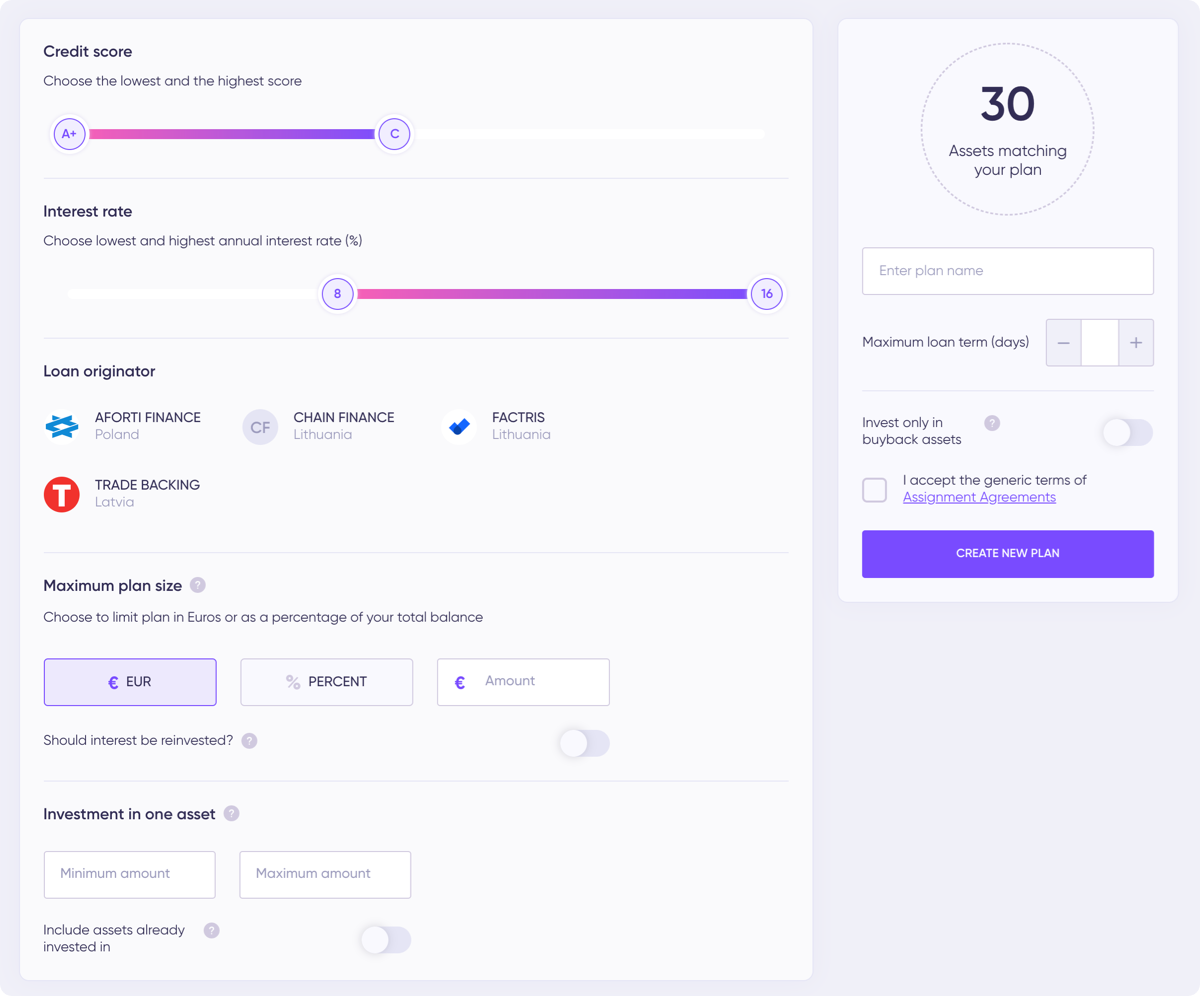

How to set up auto-invest on Debitum Network platform

Setting up an auto-invest tool with Debitum Network is quite easy. Having clicked Auto-invest in the menu bar, an investor needs to choose a template/an investment plan (Conservative, Moderate, Aggressive) to be used for purchasing loans in the future. Having chosen one of the three plans, you have to choose a credit score of a loan (available options are from A+ to F) set the range of interest rates: from 3% (minimum) to 16% (maximum) (these are live smallest and largest interest rates). Next, choose the loan originators (you can pick as many as you want). Then, define the minimum and maximum amounts you want to allocate per one asset (it can be set in the number of euros or in percentage). At this stage, you can also decide whether you want your earned interest to be reinvested or not. Then, choose the minimum and maximum amounts you want to invest in a single asset. If you want the plan to include assets you have already invested, mark ‘Include assets already invested in’. Finally, you will have to give your plan a name, maximum assets’ term in days. The last thing, decide if you want to invest only in assets that have buyback guarantee or in all of the assets available. Having accepted generic terms of Assignment Agreements and pressed the button ‘Create Plan & Activate’ you are all set. The rest is done by the auto-invest program.

Important things to remember regarding the tool

Auto-invest tool invests:

- At 23.00 IST time zone (GMT+1). After repayment is made, you have a time window to decide whether you want to invest in the same assets or not as the auto-invest tool will reinvest in the assets again at 23.00 IST time zone (GMT+1).

- When the new assets are uploaded on the platform. Any time a new asset (that fits the settings of your chosen plan) is uploaded on the platform, the auto-invest feature will automatically invest in them.

Ready to try auto-invest on Debitum Network?

Auto-invest function is available for all investors on Debitum Network to use. Investors can invest their balance and reinvest their earned returns automatically according to pre-set parameters. It saves their time, as it makes the investments automatically without supervision needed. Investors get opportunity to invest in new assets before anyone else does because of the algorithmic structure of the auto invest feature. Amounts are flexible and you may leave any time you want.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Debitum Network at LendIt event

Debitum Network at LendIt event

Every year LendIt organizes one of the biggest events for innovation in financial services and lending. This year the event took place on the 19-20th of November in London. There were more than 1000 participants and over 150 speakers from 50 countries, including our own Martins Liberts. This year’s agenda was based on new developments in marketplace lending, credit & underwriting, financial inclusion, digital banking and the adoption of blockchain solutions in finance.

This time, the event got quite a lot of fresh perspective as the speakers were comprised of 40% first-time speakers, 35% women, 30% commercial banks & investors and 50% lending & fintech thought-leaders.

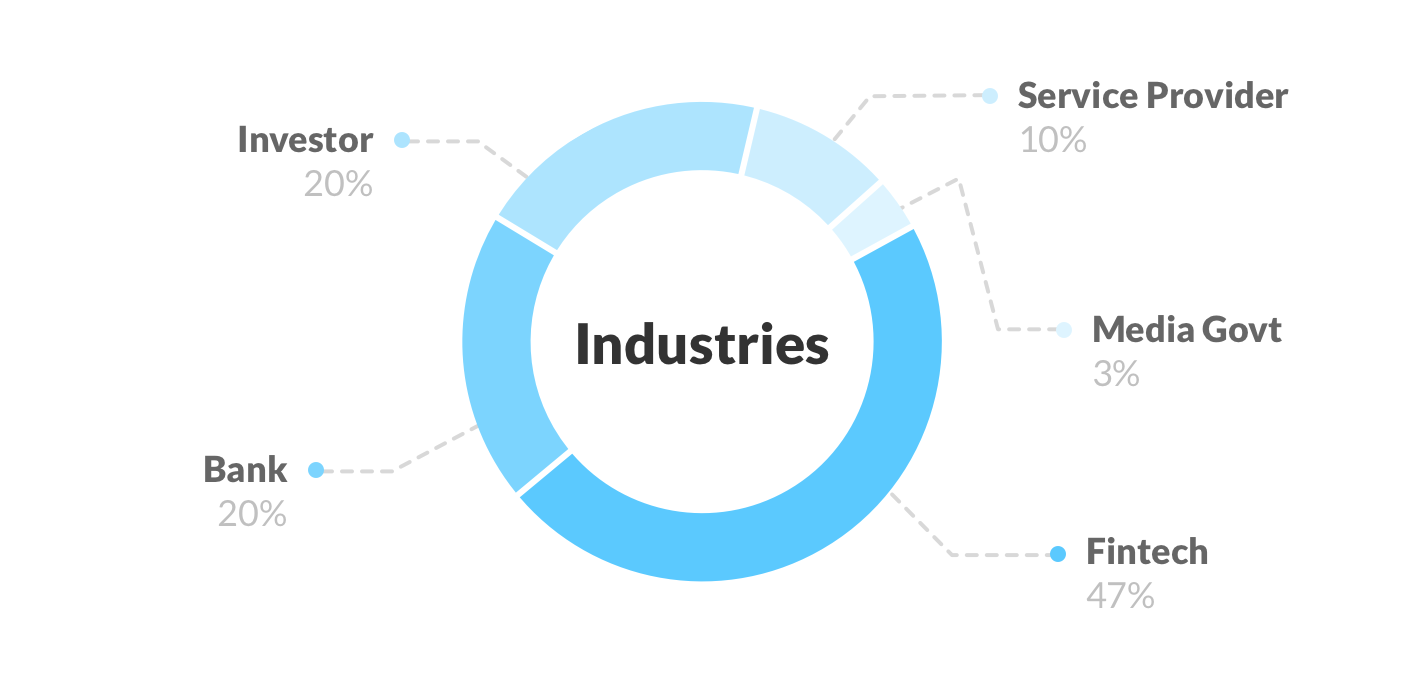

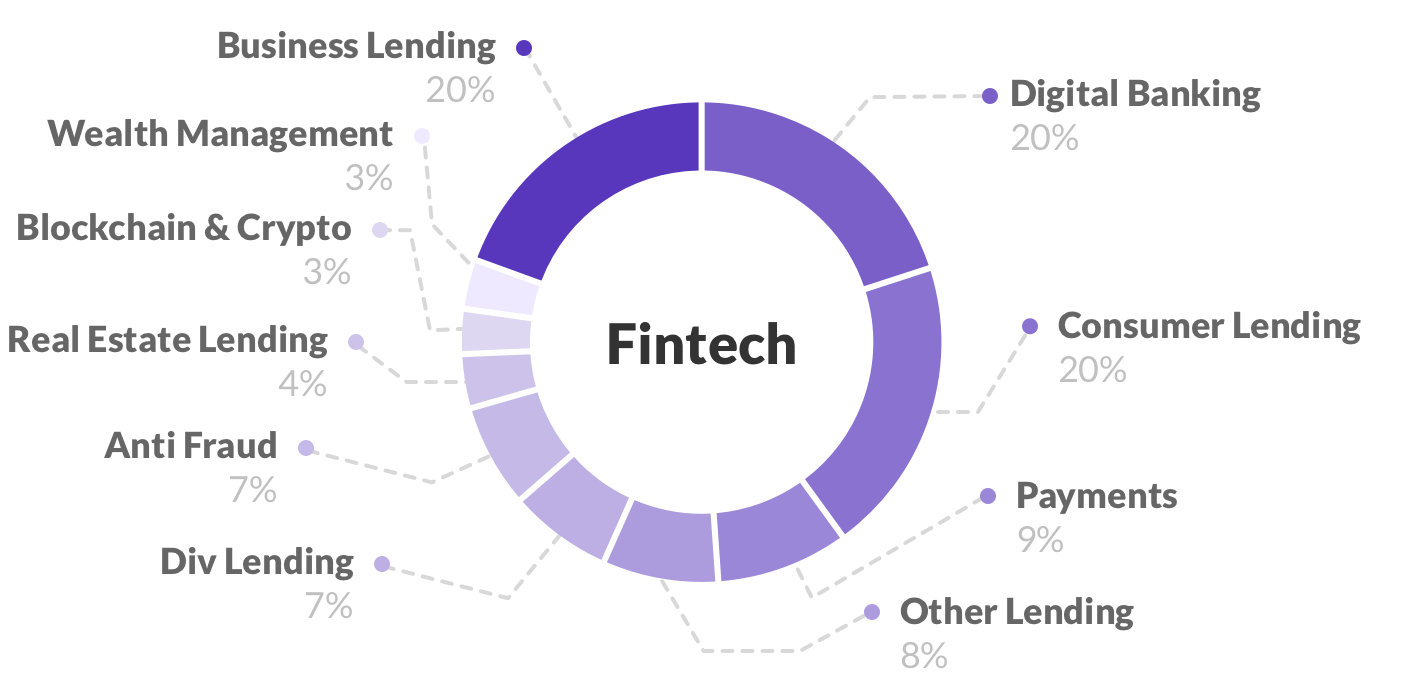

As almost half of the participants were from fintech industry, it is obvious that innovative fintech companies get stronger year by year and take a bigger market share in finance. The chart below shows share of attendees from five financial industries, Debitum Network representing Fintech. It proves the fact that interest in alternative lending is rising and platforms such as our own Debitum Network or Mintos, Twino, Funding Circle or Zopa will gain more and more traction in the future.

Data source: LendIt

The biggest industry – Fintech had also the biggest number of subsectors with a total number of 10 dominated by business lending, digital banking, and consumer lending. Debitum Network is part of Fintech specializing in providing short term loans for SMEs (Business Lending) around the world, thus among major players in the world of finance.

Data source: https://www.lendit.com/europe/2018

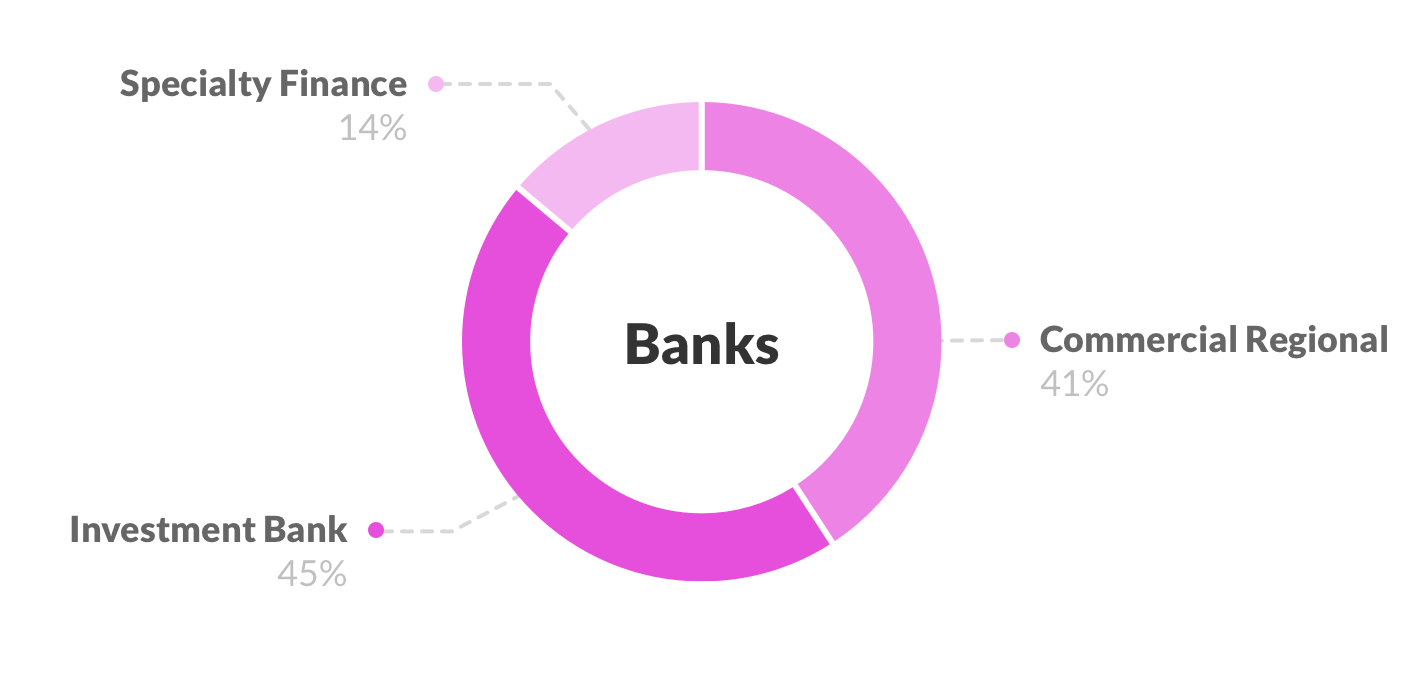

The banking sector was led by representatives from investment banking and commercial, regional banks – our main interest was to meet with institutional investors or private funds as they are investing in various assets available on platforms like Debitum Network. Our team members met quite a few members of bank associates and chatted about specifics of our loans, lending terms, interest rates, duration etc.

Data source: LendIt

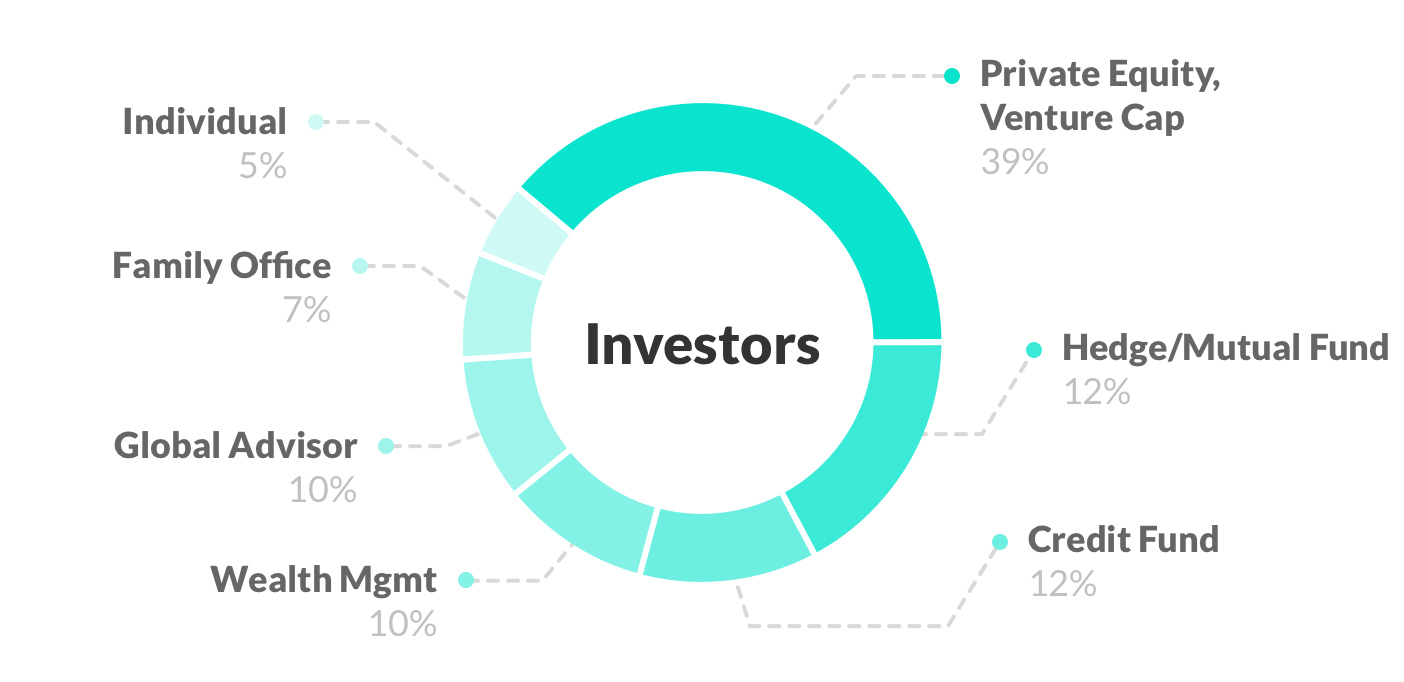

Investing sector was also quite varied this year, steered by Private Equity and Venture Cap funds. Debitum Network team was there to discuss possibilities for private and institutional investors to diversify their portfolios and invest in short term loans for small businesses. A few of them expressed interest in our business model and intention to start investing in loans right after the conference.

Data source: LendIt

Debitum Network – Gold sponsor of the event

This year, Debitum Network was a Gold sponsor of the event. On the 18th of November, 8 members of our team went there to participate, have business meetings, demonstrate to hundreds of other participants how our platform works and share more about the company. Martins Liberts, the co-founder of the company gave a demo demonstration of the platform on his real account to the attendees, he also participated in a panel discussion about usage of the blockchain technology for lending industry.

Highlights of Martins Liberts speech at demo demonstration

In the introduction of his speech, the co-founder of the company stressed the importance of entrusting lending business into the hands of professionals. This is the reason why Debitum Network introduced decentralization of the lending process by inviting third parties (risk assessment, insurance, and debt collection) to participate in lending. “Doing it all by ourselves is not a good decision as all of the things have their proprietary things and algorithms. For example, if we do business in some country, we partner with local risk assessors of the country who are doing a risk assessment for different cases on a daily basis”, stated Liberts.

“The way business functions is that our own or partner brokers put a loan on our platform and investors can participate by investing in them and get a fair interest rate from their investment”, continued the visionary of the project.

Liberts, then gave a quick overview of the platform, taking the viewers through specifics of each functionality and icon on the platform as well as stressing that an investor can get a more detailed view about the asset: who the broker is, what his score is, credit score, the loan itself, why it was given out and to what kind of business it is, when it started, the company description, under asset description, who the final payer of invoices is and etc. “In this way, you, as investor are in charge of your own decisions and if you are numbers person you can look at financial data of the company to get a better grasp of the financial situation of the company in question. You can go through the platform and cherry pick the assets that you like most and as diversification is the key, you may split your investments in each of assets, more or less equally”, elaborated Martins Liberts.

“The fun part is that investing on our platform you earn interest from day one, right away”, concluded Liberts.

The busy team at the event and their experiences

Everyone interested could visit Debitum Network booth at the premises and try demo platform for themselves. Debitum Network team members were there to answer all the questions about the platform and guide through the whole investment process. The attendees demo tested the platform, discussed future plans, and our team made a lot of new acquaintances. They shared their experiences with us and here are some of them.

Eimantas Valancius (Operations and support manager at Debitum Network)

“LendIt itself was very interesting. All the participants engaged in the process and I had tons of individual meetings that could yield promising results.

I spent most of the time communicating with attendees at our booth and at individual meetings. I participated in around 10-12 meetings, where I met with brokers, loan originators and potential service providers from all over Europe and even with one from Africa.

I demonstrated to quite a few people how the platform works and what you can do on it. In general, people were interested in the platform, they liked how it looked. The most common questions were: “How are you different?” “Is it like Mintos?” “What are you guys working on now?” I singled out our differences and advantages of our platform and people were positively impressed.”

Elze Atroskeviciute (Community & Business Operations Management)

“I’d say I had met and talked to over 100 people over the 2 days, showing our demo to them and explaining all kinds of features available. They were all kinds of finance enthusiasts: bank associates, news reporters, competitors, researchers, individuals interested in fintech, service providers interested in starting a partnership with us. They were mostly keen to find out why and how we differ from other lending platforms, what’s our value proposition, what is our roadmap for next year or years, how we deal with services (do we provide them ourselves or do we partner with different parties), how our ecosystem works in general, who our partners are at the moment, what’s our volume of loans or the number of users. A lot of people were very surprised to find out about the buyback feature and were really impressed.”

Gabriele Lipniute (Customer Experience Ambassador)

“I had a goal to raise awareness of Debitum Network platform and how investors can benefit from safe investments. Furthermore, I had to gather feedback about our platform, so I met with a couple of Venture Capitalists, who shared a positive view on Debitum Network and one agreed to invest starting from 10k, immediately, after the conference. The main feedback from all the participants was that ROI Debitum is offering really good compared to what we have in the EU market. It might be small for investors in developing countries – however, in the EU it is a pretty high figure. People who visited our booth enjoyed the experience and a variety of assets they can invest in.”

You can also join our platform and start investing

The interest in Debitum Network platform stretches beyond the LendIt event. Investors onboard and invest in short-term loans every week. You can also sign up on the platform at any time and participate by helping small businesses around the world grow. You will earn attractive interest at the same time. Furthermore, we have a new feature: buyback guarantee. This means, that if the borrower is late more than 90 days with the payments or defaults, the broker that issued the loan will buy the loan back. Thus, your investments always remain protected under the buyback guarantee.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

What makes any investment safer?

What makes any investment safer?

Investing is always associated with risk. There are no 100% safe investments. An investor always looks to balance the acceptable level of risk with potential reward. Some are willing to bet on EUR/GBP exchange rate fluctuations in the face of Brexit with 20x leverage on some retail Forex platform, while others are so risk-averse that they choose to lend to Germany, while Germany 2-year bonds are still providing negative returns of -0.6%.

The rule of thumb has not changed, though – the higher the risk, the higher the expected return. However, the returns, in case of lending would be hypothetical as riskier investments will have a higher probability of default, thus bringing the overall net return down. While Germany has its risk rating at AAA (default risk too small to understand – 0.00003% in one-year period or 0.00550% in 10-year period) or has its creditworthiness even as high as 100 out of 100 (the latest rating by Trading Economics), we expect that any amount lent to Germany will be returned as promised – no real risk for an investor.

A more riskier option is investing on Peer-2-Peer or Peer-2-Business platforms with considerably higher returns. P2P or P2B solutions offer a possibility for an investor to directly lend to an individual or business that needs funding. Such solutions offer returns somewhere in the range from 5% on Funding Circle (Conservative lending option) and Debitum Network 7.3% to around 12% on Mintos (average historical return). Then, there are platforms like Bondora that offer an average interest rate of 32.5%, while the average net return is only 10.1% with 1 out of 5 investors losing money. The latter illustrates the point of a need for safer investments perfectly; as potential returns increase, so does the risk of losing one’s investment.

Safety is one of the key values at Debitum Network. When we started creating our platform, safety of investors’ funds was at the heart of it. Therefore, we chose to concentrate on loans to businesses, which have a much higher chance of repaying the loan rather lending to individuals. That allows Debitum Network to offer investment in business loans with average annual interest of 7-8%.

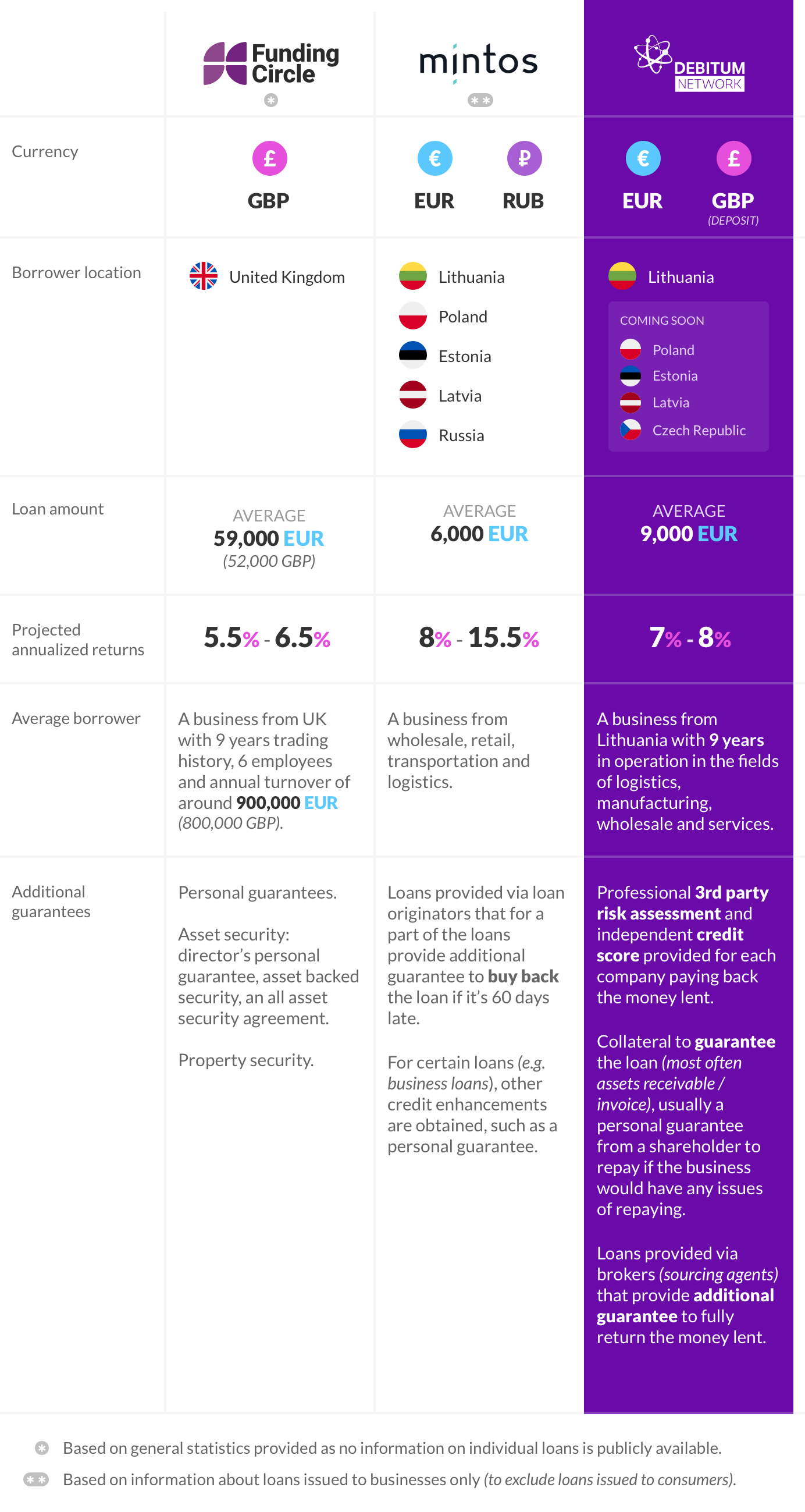

Let’s compare other details than interest rate for an average business loan currently available on the solutions mentioned earlier – Funding Circle, Mintos, and our own Debitum Network:

Businesses will hardly ever borrow at high interest rates that some of the Peer-2-Peer lending platforms offer. Nor will they offer extra guarantees and take risks ruining their businesses borrowing at 15-20% annually. Thus, platforms charging over 10% interest on loans will be much riskier for investors and likely attract more private individuals than businesses to borrow from. Debitum Network aims to satisfy business needs to borrow at affordable rates, as well as investors’ needs to have their invested capital safe. Which brings us to our initial position of lending exclusively to companies and at reasonable interest rates of 7-8%.

In addition to what has been said, here are a few principles, which we believe makes lending to businesses on our platform safer:

|

Professional risk assessors |

Third party services such as risk assessment single us out from other P2B platforms out there. Local professional service providers know local business specifics and therefore are better able to evaluate companies applying for a loan with much better precision than any generic risk scoring algorithm done by a single loan originator or platform itself. For Lithuanian market, Debitum Network uses Scorify, whose credit score rating system GoScore has been used to issue over 380’000 ratings. It ensures higher professional standard and more precise credit score available for a user to make a better informed investment decision.

|

Strong businesses |

Borrowers on our platform are well established SMEs and only loans handpicked by experienced loan originators such as Debifo and scored above the minimal needed credit score by independent risk assessors are placed on our platform. So far, the companies that borrow on Debitum Network platform have been in business for 9 years on average and they have borrowed and repaid the loans before. Longevity surely means better safety! Most current available assets are invoice financing loans with final payers of these invoices are mostly large companies with average revenue of 700 million EUR. They have been in business for decades and are considered key players in the economic areas of wholesale, manufacturing, logistics, and services. As the companies that actually ensure money inflow to pay back the loan are handpicked and truly strong in their respective sector and region, the risk for a loan not to be repaid and investor losing the money is reduced.

|

Guaranteed loans |

Each available loan on our platform is backed by an asset as a collateral – be it assets receivable (approved invoice for goods or services sold), variable asset (trucks, equipment and other) or fixed asset (real estate property). Often, there are also additional guarantees from company’s shareholders or another partner company’s guarantee. Moreover, our loan originators (brokers) have started offering a “buy back” of a loan being late more than 90 days. However, to make sure they can execute such an offer – we request them to put funds aside in a reserve fund as well as provide certain financial covenants towards Debitum Network.

Interested?

For many investors returns of 7-8% per annum sound really great and this is exactly what Debitum Network provides. Of course, there are ways to try earning more; however, one should always remember that in the world of investment, any type of return is associated with a certain level of risk.

As described, we, at Debitum Network work hard to ensure additional safeguards for your investment, so you can lend to businesses and earn returns with fewer worries. We believe that a loan with independent and professional 3rd party credit score and at least a few levels of payback safeguards (collateral from the business, it’s related entities and a broker that is sourcing the loan) is worth funding. Would you agree?

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Investment series: short term versus long term

Investment series: short term versus long term

One way to classify investing strategies is to take into account the time horizon. Long term versus short term is often discussed by financial experts, analysts and portfolio managers. One type of strategy by no means is better than the other. We may take the Oracle of Omaha Warren Buffet, who buys stocks and holds them indefinitely (and makes billions of $). On the other hand, there is speculator George Soros, who can keep his speculative position short term, just a few days and still make hundreds of millions of dollars as a result. Let us briefly cover the strategies and look at an alternative way to invest short term.

The difference of timing and expectations between the investments

A long-term investment will constitute investments, comprising stocks, bonds, real estate, and cash, that are intended to be held for more than a year. The long-term investments differ from the short-term investments in that the short-term investments will definitely be sold, sooner rather than later, whereas the long-term investments may never be sold.

Long term investments are those that have the likelihood to increase your profits over a long period of time. Those maybe index funds, stocks, long term government bonds. They tend to appreciate over the long haul and can withstand sharp and prolonged downtrends as an investor holding specific long-term instruments would not sell them when the financial markets are temporarily falling. Payout expectations are long term.

Short term investments will typically not last longer than a year and the investor holding financial instruments will look to convert them into cash any time opportunity presents itself. Payout expectations are short term. Among short term investors would often be traders or speculators that may hold their portfolio positions from a few hours to a couple of days. This is, naturally, increases risks as predicting daily or weekly fluctuations of any market is highly speculative and tremendously difficult thing to do. These types of investments may include: currencies, options, short term government bonds, stocks (for day trading) and etc.

Long term investors do not panic at short term market swings that go against them. Markets are cyclical. They go up and down, and then up again. On the other hand, those who have higher short-term expectations and take upon themselves higher risks should cut their losses quick when the market goes against them.

Investing in Short term business loans for small businesses

Short term investments may be not only securities, commodities, real estate or bonds but also loans for businesses. Alternative fintech companies such as our Debitum Network, Twino, Grupeer, Mintos, Funding Circle, Assetz Capital or Zopa not only help for SMEs to get funding for their operational costs but also gives both individual and institutional investors opportunity to participate in the financing process, invest in those loans and earn quite attractive annual interest at the same time.

Maturity terms for those loans typically last from a few weeks to 6 months. Annual interest is within the range 10-15%. Considering that a lot of investors cannot beat stock index returns, which is 8%, or even the average of mutual funds, which is 5%, 10-15% is really attractive.

Other advantages:

- Amounts are flexible. You can start with 10 Euros. The maximum is 10 million Euros.

- You may invest in an asset even if the repayment day is a few days away.

- Possibility to choose assets from various industries: Logistics, Wholesale, Manufacturing, Services to name a few.

- Portfolios should match the style of any investor: conservative, moderate and aggressive.

- All assets on the platform have a guarantee.

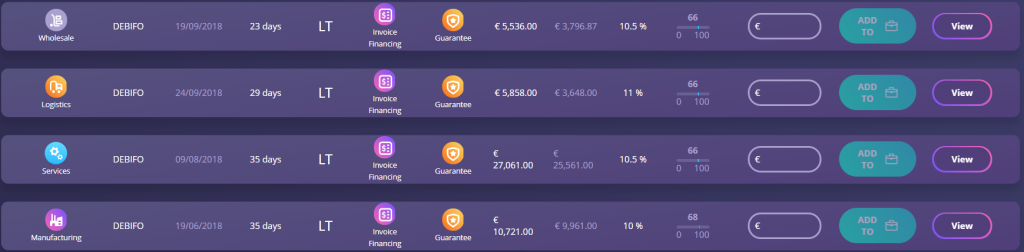

Below is the snapshot of 4 assets from our platform. You can invest in any of them. If you want to find out more what each item on the asset bar means and how to invest, you can read this blog post.

4 assets from the platform

If you got interested, try our platform

Disclaimer: It is important to point out that the approach presented here is not necessarily suitable for everyone and is presented for information purposes only. It is not intended to be investment advice. You should seek a duly licensed professional for investment advice matching your specific situation.

Investment series: Diversification

Investment series: Diversification

Diversification in investments is a method to reduce risk by distributing your funds among different financial instruments, industries, categories, and investment timeframes. Investors similarly use it to maximize returns on various investments that tend to perform differently at different market trends. It may not completely rule out risk, but surely reduce it significantly and enable you to achieve long term investment goals.

Why diversify?

If you own securities or commodities or any other financial instruments of the same kind, imagine what happens when the market turns around in that specific industry. More often than not, all of the securities in that field begin falling. Which means, all your investment portfolio is going down. Fund managers tend to mix up their portfolio with securities from different market segments: airlines, banks, high-tech, medicine, services, some commodities and etc.

A single event that may impact negatively one specific sector, will highly unlikely impact all of the sectors of the global economy. It is prudent to comprise your portfolio of instruments that do not correlate much so that when one segment of the market is affected, it would not impact the bulk part of your portfolio. Diversifying among asset classes is another way to make your investment strategy as efficient as possible. Government bonds will surely perform differently than stocks and what affects one group may not affect the other. Bonds and equities tend to move in different directions, so if your basket of equities is falling, your basket of bonds will likely rise.

A new area for your diversification – short term loans for SMEs

When it comes to investing, the first thing that would come to people minds are stocks, bonds, commodities. Some would add currencies, maybe real estate or physical methods. Few would think about investing money in loans for small businesses.

A new era of fintech and the blockchain opened new markets for investment. Regulation requirements and interest of commercial banks in big businesses left small businesses largely underfinanced. This created a new market for alternative lending. Businesses and individuals around the world can now finance SMEs globally. This has become a new stream of investments for any prospective and savvy investor to consider and an alternative way to diversify your investment portfolio. P2P lending platforms similar to Debitum Network are on the rise. Among them: Funding Circle, Mintos, Twino, Assetz Capital, Follow Finance, Ratesetter, Zopa, Upstart, Prosper Marketplace or Lending Club.

Debitum Network platform 1.0 Abra is live

On the 3rd of September an innovative alternative finance platform Debitum Network 1.0 Abra launched. It connects small businesses and funding sources around the globe. Now, anyone can participate in supporting the growth and expansion of SMEs and earn attractive interest at the same time.

Disclaimer: It is important to point out that the approach presented here is not necessarily suitable for everyone and is presented for information purposes only. It is not intended to be investment advice. You should seek a duly licensed professional for investment advice matching your specific situation.

Ways to get funding in alternative finance

Ways to get funding in alternative finance

Traditional way of getting a loan, that involves going to a bank and filling an application is probably the only way most people imagine. However, there are a lot of other ways to get funds for your small or medium-term business. Alternative finance p2p platforms such as our own Debitum Network or Mintos, Zopa, Funding Circle, Assetz Capital and others can offer you a few possibilities to choose from. This blog post aims at describing some of the most popular ways that alternative lenders provide funds to small businesses.

Equity crowdfunding