Tag: P2B platforms

Current trends in P2P/P2B lending and where does Debitum Network stand

Current trends in P2P/P2B lending and where does Debitum Network stand:

P2P/P2B lending market has been growing by leaps and bounds since 2005 when the first lending and investing platform of its kind (Zopa) was launched. The growth started accelerating after the financial crisis of 2008 when Central Banks slashed interest rates close to zero (or even below it). Attractive interest rates offered by alternative investment/lending platforms attracted a lot of retail and institutional investors and the market has grown from 1.2 billion dollars in 2012 to 64 billion dollars in 2015. It is expected to reach 500 billion dollars by 2025 by some moderate estimates or even 1 trillion dollars. What are other trends in the market and where Debitum Network stands in relation to other similar platforms? Stay with us and find out.

More platforms are expected to join an alternative lending/investment market

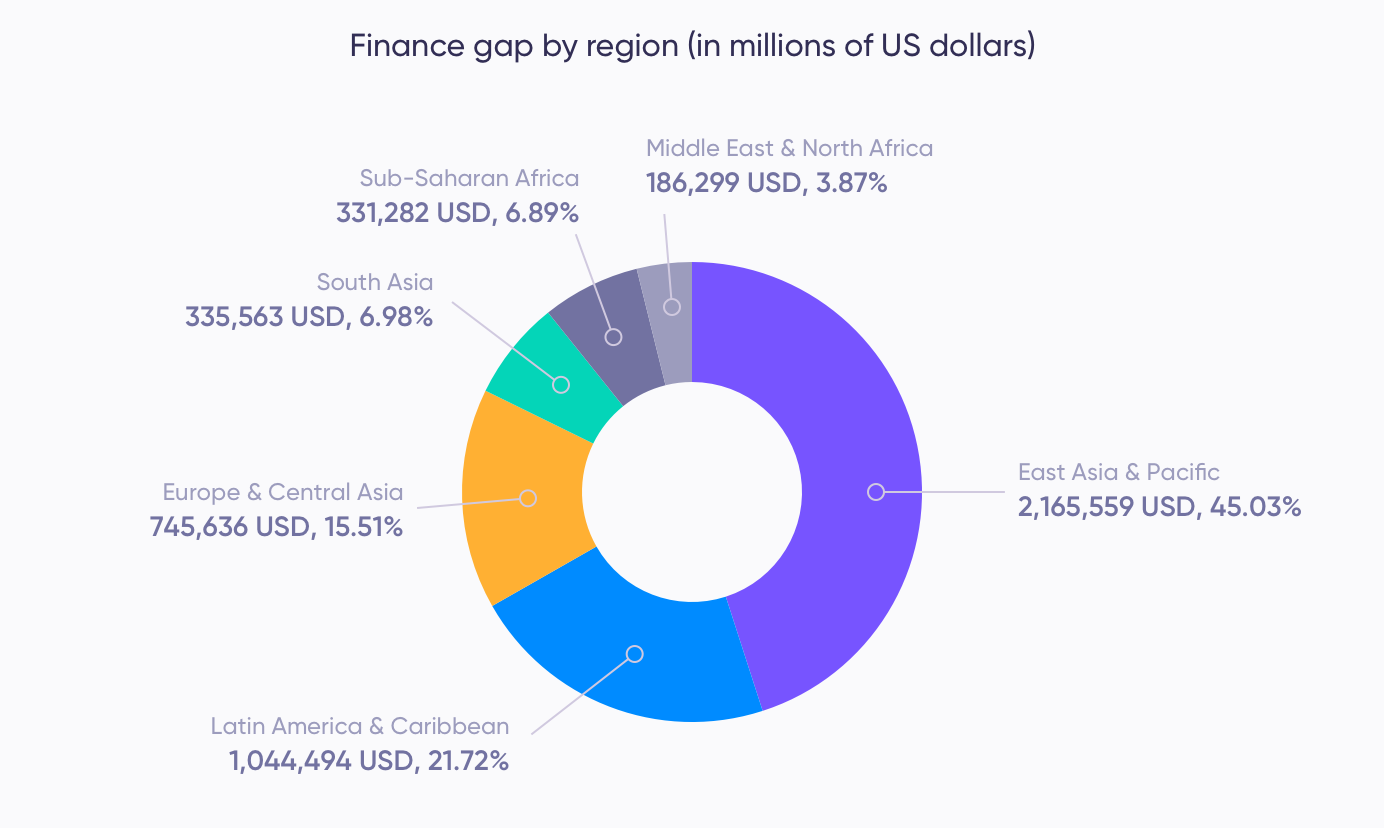

According to Reuters, P2P lending is among the fastest-growing segments in the financial lending market. Alternative investments are popular with the current generation and this means more market players will join the market. The market will continue growing as distrust in commercial banks remains huge. The interest rates offered by mainstream lenders are very low, and they still do a poor job in financing small and medium-sized businesses as well as consumers. The potential for Debitum Network (a P2B investment platform) is still great as SMEs in Europe are still underfinanced and the interest in alternative investments is on the rise. Check out the credit gap for SMEs around the world.

Source: smefinanceforum.org

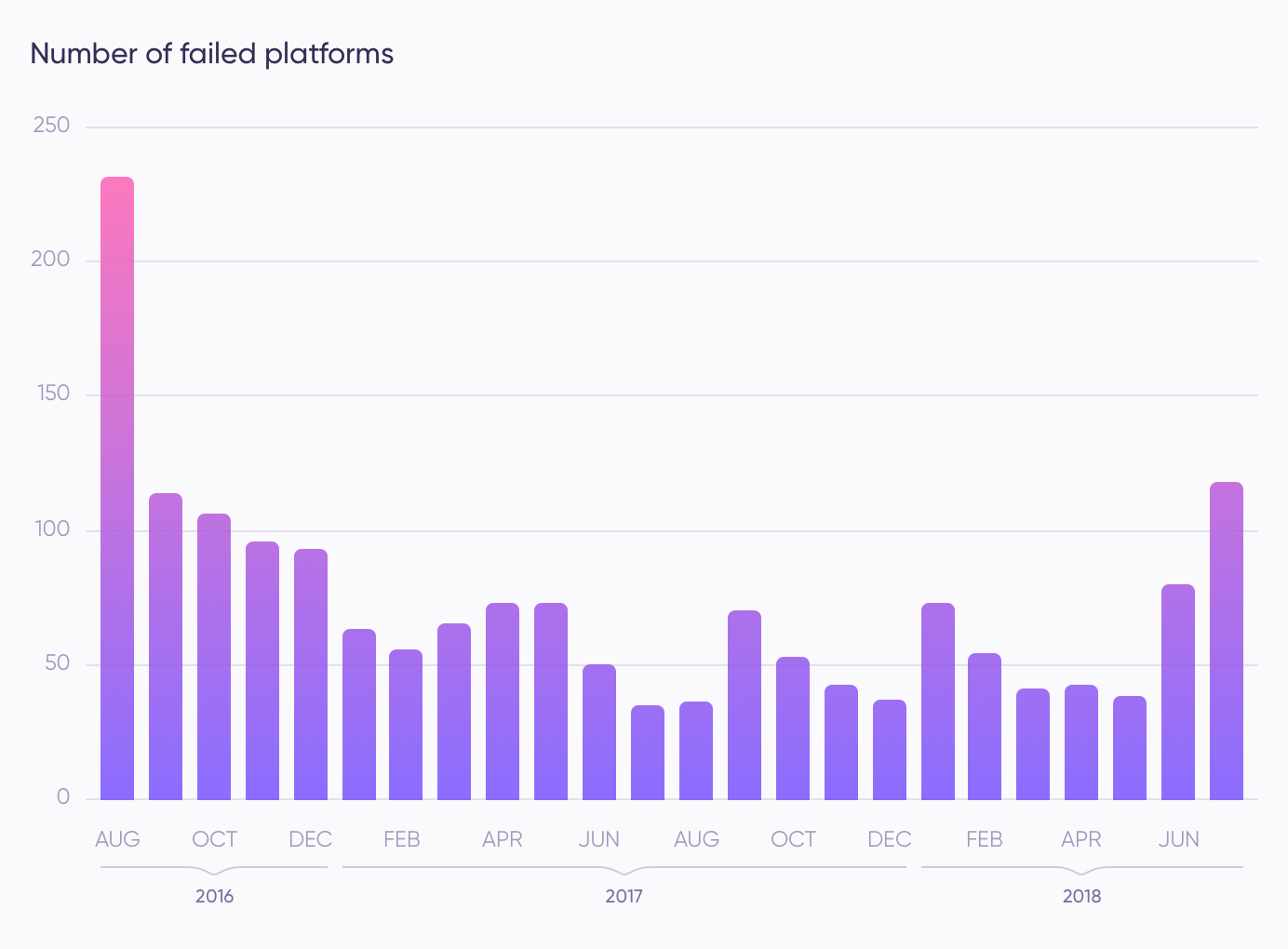

More bankruptcies of careless P2P lending platforms

Alternative lending platforms have to be careful who they lend money to or what loans they upload on their platforms for investment. Within the last year, 3 prominent alternative lending/investment platforms in the UK: Collateral, Lendy, and most recently Funding Secure went bankrupt. Tens of thousands of investors lost a lot of money, despite the fact, that Lendy and Funding Secure were regulated by the UK regulators. The UK is not an exception. A year ago, China underwent a turbulent period when thousands of P2P lending platforms went broke causing millions of investors to lose their money. The industry in China is close to $ 200 billion. Regulators have seriously cracked on online P2P lending platforms and only a few regulated ones will remain alive in the long run. The chart below says it all.

Source: bloomberg.com

Debitum Network takes seriously the safety of investors’ funds and therefore we have implemented a number of safety measures to ensure that. Firstly, we have a thorough screening process of potential loan originators to make sure they offer good loans with an excellent base of borrowing companies. Our risk management team follows up with a thorough investigation of the financial situation of a lender who is already onboard of Debitum Network and does responsible quarterly due diligence process. A case with Aforti Finance was an example of how the team’s work helped to avoid potential risks to investor’s funds and thus the assets of the mentioned loan originator were removed from our platform.

We have also implemented a buyback guarantee, which means that if the borrower is late with the repayment by more than 90 days, the broker who issued the loan will have to buy it back with the outstanding principal and interest. Most of the loans on our platform are with the buyback guarantee! Last but not least, we have independent risk assessors that do a risk assessment for the borrowing companies whose assets are uploaded on our platform. This type of risk assessment increases transparency, provides a more accurate risk scoring, and protects investors’ funds.

Acceptance by the mainstream

Governments around the world start welcoming fintech companies, including P2P/P2B lending/investment platforms. They seek alternatives to current established lenders (commercial banks) to increase options for small and medium-sized businesses to get funding. Thus, investing on these kinds of platforms becomes a part of recognized financial products just like the ones offered by traditional lending institutions. P2P lending has been authorized in all of Brazil since last year. Malaysia has a P2P scheme for first-time buyers. And in the US, P2P lending is regulated by the SEC (Securities and Exchange Commission). Thus, the importance of P2P/P2B lending is recognized by governments around the world.

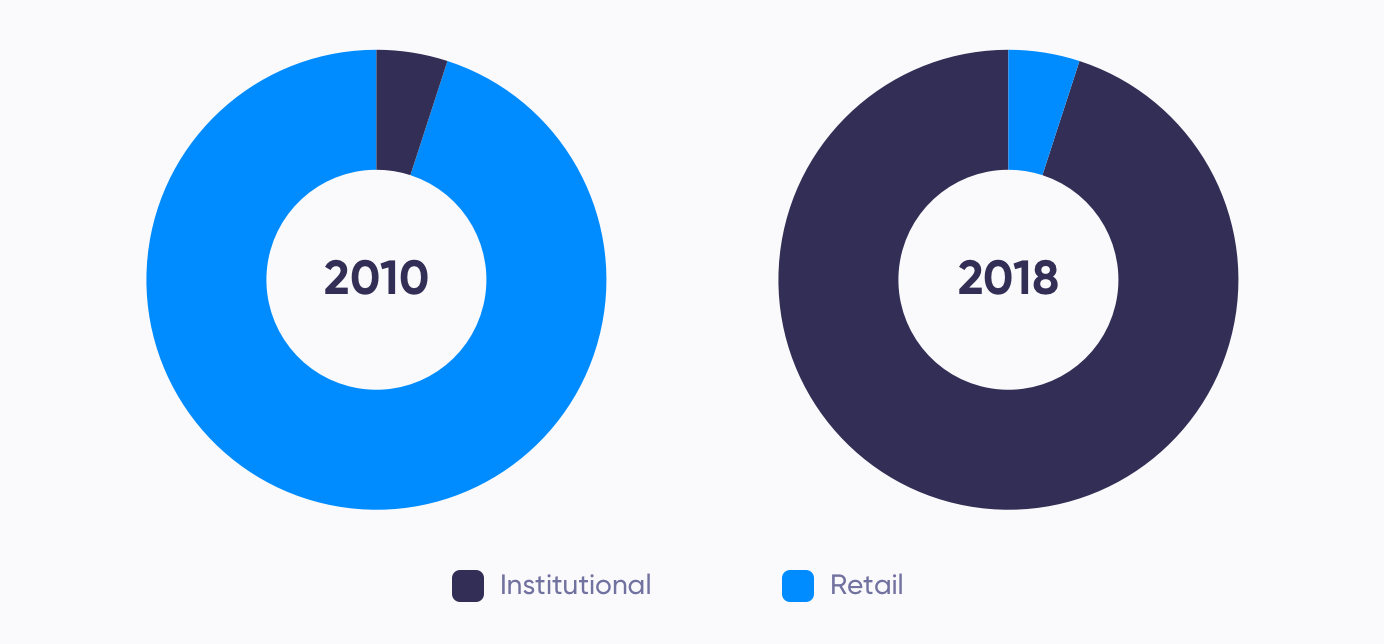

Increase in institutional investing

For quite a while, most investors on the alternative investment platforms were retail investors who would typically invest from 50 EUR to 5,000 EUR. The trend has been slowly changing across the board. Some platforms experienced it tremendously. Lending Club, the leader in consumer loans in the US shared in their blog post the following stats. The investments from institutional investors in 2010 covered less than 5% of all investments on their platform (10 institutional investors). In 2018 institutional investors comprised 95% of all investments (200 institutional investors).

Source: Lending Club

Debitum Network has been open to both retail and institutional investors since its inception. We have seen more and more institutional investors onboard our platform and expect the trend to accelerate as more loan originators onboard our platform and investors are offered a more diverse range of assets for investment.

More regulation for P2P platforms in the near future

The unregulated environment allows for more irresponsible lenders to exist and act carelessly with investors’ funds. This means that governments will not only encourage P2P lending/investing but will step up and increase regulation over the process. This will likely weed out those that compete unfairly and strengthen those that play by the rules and responsibly. Wild West for risky investment platforms that offer high returns and no security for investors’ funds might be over sooner rather than later.

Debitum Network is currently in the process of getting a license with one of the European financial regulators. We expect it to happen before the end of the year or the beginning of next year. We want to transparent, responsible and a safe environment for investors’ funds.

With that in mind, let’s proceed to our special offer for the week.

Top asset of the week

This week want to offer you an excellent asset that comes from our partner and loan originator Factris. The borrowing company is a wholesaler of hardware equipment. It has more than 25 employees, revenues of more than 4.1 million EUR, and has been in business for more than 21 years. The purchaser of the invoice is a distributor of metallurgical products, operates in Europe and has more than 270 million EUR revenues. Does it sound good enough? Check out the asset.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

What makes any investment safer?

What makes any investment safer?

Investing is always associated with risk. There are no 100% safe investments. An investor always looks to balance the acceptable level of risk with potential reward. Some are willing to bet on EUR/GBP exchange rate fluctuations in the face of Brexit with 20x leverage on some retail Forex platform, while others are so risk-averse that they choose to lend to Germany, while Germany 2-year bonds are still providing negative returns of -0.6%.

The rule of thumb has not changed, though – the higher the risk, the higher the expected return. However, the returns, in case of lending would be hypothetical as riskier investments will have a higher probability of default, thus bringing the overall net return down. While Germany has its risk rating at AAA (default risk too small to understand – 0.00003% in one-year period or 0.00550% in 10-year period) or has its creditworthiness even as high as 100 out of 100 (the latest rating by Trading Economics), we expect that any amount lent to Germany will be returned as promised – no real risk for an investor.

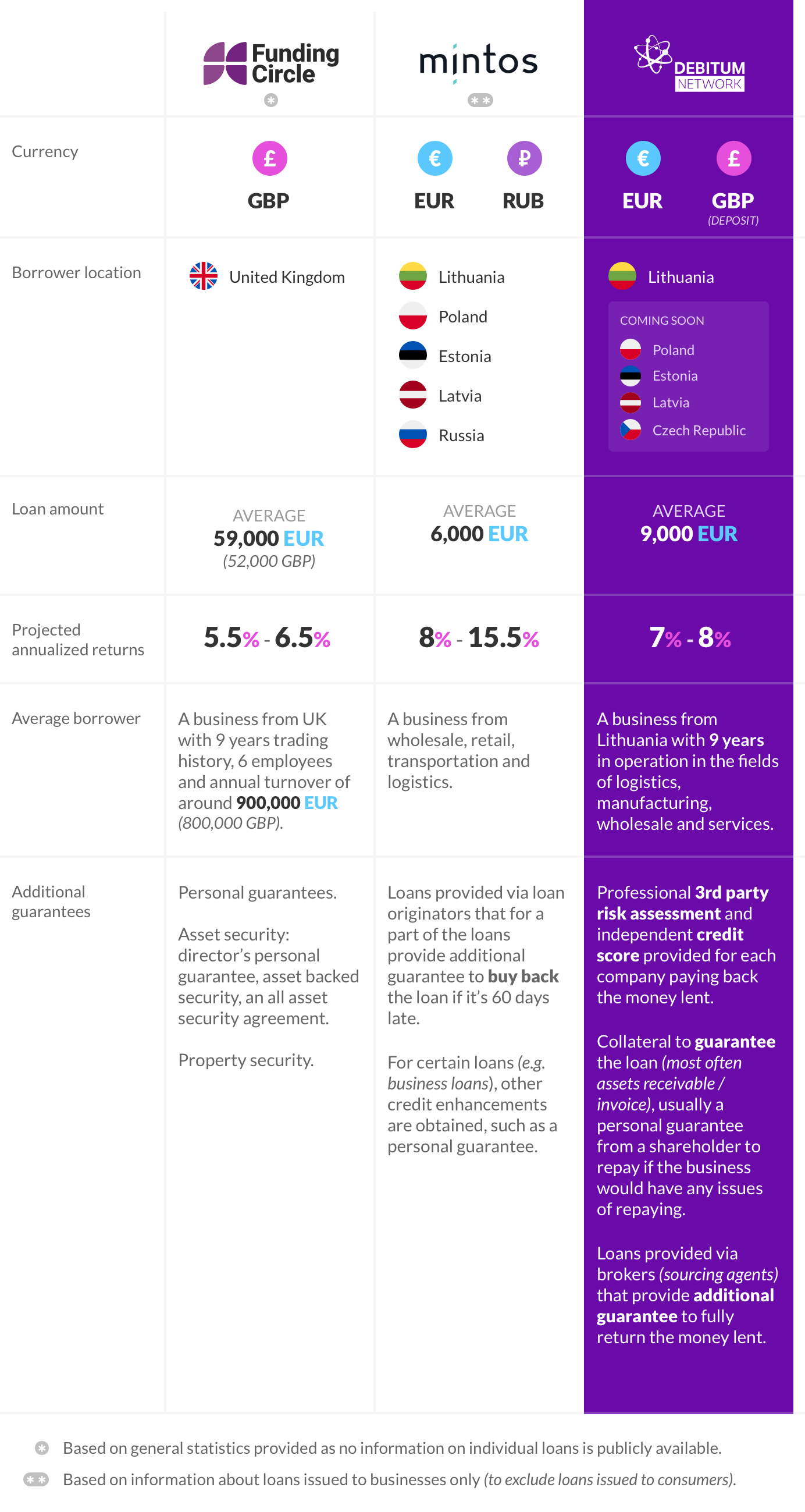

A more riskier option is investing on Peer-2-Peer or Peer-2-Business platforms with considerably higher returns. P2P or P2B solutions offer a possibility for an investor to directly lend to an individual or business that needs funding. Such solutions offer returns somewhere in the range from 5% on Funding Circle (Conservative lending option) and Debitum Network 7.3% to around 12% on Mintos (average historical return). Then, there are platforms like Bondora that offer an average interest rate of 32.5%, while the average net return is only 10.1% with 1 out of 5 investors losing money. The latter illustrates the point of a need for safer investments perfectly; as potential returns increase, so does the risk of losing one’s investment.

Safety is one of the key values at Debitum Network. When we started creating our platform, safety of investors’ funds was at the heart of it. Therefore, we chose to concentrate on loans to businesses, which have a much higher chance of repaying the loan rather lending to individuals. That allows Debitum Network to offer investment in business loans with average annual interest of 7-8%.

Let’s compare other details than interest rate for an average business loan currently available on the solutions mentioned earlier – Funding Circle, Mintos, and our own Debitum Network:

Businesses will hardly ever borrow at high interest rates that some of the Peer-2-Peer lending platforms offer. Nor will they offer extra guarantees and take risks ruining their businesses borrowing at 15-20% annually. Thus, platforms charging over 10% interest on loans will be much riskier for investors and likely attract more private individuals than businesses to borrow from. Debitum Network aims to satisfy business needs to borrow at affordable rates, as well as investors’ needs to have their invested capital safe. Which brings us to our initial position of lending exclusively to companies and at reasonable interest rates of 7-8%.

In addition to what has been said, here are a few principles, which we believe makes lending to businesses on our platform safer:

|

Professional risk assessors |

Third party services such as risk assessment single us out from other P2B platforms out there. Local professional service providers know local business specifics and therefore are better able to evaluate companies applying for a loan with much better precision than any generic risk scoring algorithm done by a single loan originator or platform itself. For Lithuanian market, Debitum Network uses Scorify, whose credit score rating system GoScore has been used to issue over 380’000 ratings. It ensures higher professional standard and more precise credit score available for a user to make a better informed investment decision.

|

Strong businesses |

Borrowers on our platform are well established SMEs and only loans handpicked by experienced loan originators such as Debifo and scored above the minimal needed credit score by independent risk assessors are placed on our platform. So far, the companies that borrow on Debitum Network platform have been in business for 9 years on average and they have borrowed and repaid the loans before. Longevity surely means better safety! Most current available assets are invoice financing loans with final payers of these invoices are mostly large companies with average revenue of 700 million EUR. They have been in business for decades and are considered key players in the economic areas of wholesale, manufacturing, logistics, and services. As the companies that actually ensure money inflow to pay back the loan are handpicked and truly strong in their respective sector and region, the risk for a loan not to be repaid and investor losing the money is reduced.

|

Guaranteed loans |

Each available loan on our platform is backed by an asset as a collateral – be it assets receivable (approved invoice for goods or services sold), variable asset (trucks, equipment and other) or fixed asset (real estate property). Often, there are also additional guarantees from company’s shareholders or another partner company’s guarantee. Moreover, our loan originators (brokers) have started offering a “buy back” of a loan being late more than 90 days. However, to make sure they can execute such an offer – we request them to put funds aside in a reserve fund as well as provide certain financial covenants towards Debitum Network.

Interested?

For many investors returns of 7-8% per annum sound really great and this is exactly what Debitum Network provides. Of course, there are ways to try earning more; however, one should always remember that in the world of investment, any type of return is associated with a certain level of risk.

As described, we, at Debitum Network work hard to ensure additional safeguards for your investment, so you can lend to businesses and earn returns with fewer worries. We believe that a loan with independent and professional 3rd party credit score and at least a few levels of payback safeguards (collateral from the business, it’s related entities and a broker that is sourcing the loan) is worth funding. Would you agree?

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.